Aluminum prices are powering up again, and they could go a lot higher.

I have a trio of charts to show you why this is happening and what you should buy to ride the rally in this metal that is leveraged to inflation.

I don’t have to tell you that inflation is red-hot.

It’s at a 40-year high … and that powers up all sorts of metals: gold, silver, copper … aluminum.

Part of this is global supply and demand. Part is rising energy costs. Turning bauxite into aluminum takes a lot of energy.

On average, producing a ton of aluminum uses the same electricity as an average U.S. family consumes in a year.

- In fact, aluminum is a metal that may be described as “solid electricity.”

It’s also very in demand, for everything from cars to planes to beer cans — inflation be damned.

Demand for aluminum in cars is going much higher, because …

- The secret to making electric vehicles (EVs) with decent range is to make them as light as possible.

At the same time, in an attempt to reduce its greenhouse gas emissions, China is cutting back on aluminum manufacturing. This matters a lot because China has accounted for nearly all the new incremental aluminum smelting capacity in the world since 2005.

Last year, China’s share of aluminum production reached 58% in a market of 67 million tons ...

- Then that came to a screeching halt.

In 2021, China actually forced dozens of smelters to cut output to conserve electricity as the country faced shortages. Then it kept those smelters closed to keep the nation’s air clear for the Winter Olympics.

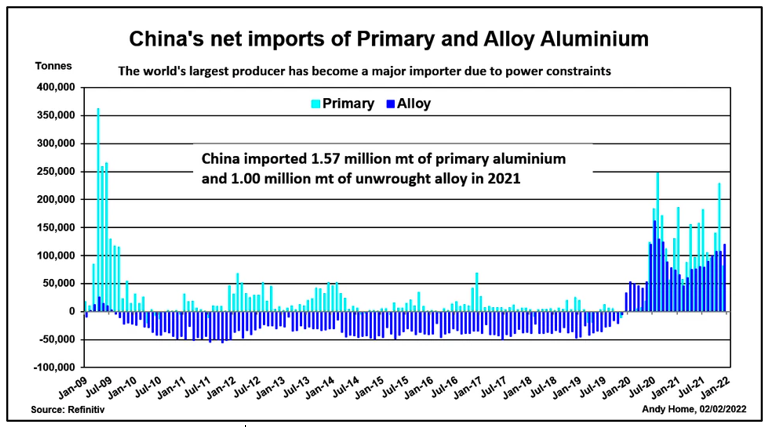

The result? China’s aluminum imports soared last year, as this chart from Refinitiv shows:

China's net imports of unwrought primary aluminum reached 1.57 million metric tons last year. At the same time, it imported 1 million metric tons of unwrought aluminum alloy.

So, we have one of the world’s largest producers import the most aluminum ever … at the same time as the metal is in higher and higher demand by industries all around the world.

This supply/demand squeeze has sent aluminum prices soaring! The last time aluminum was this pricey was 1988!

A big difference is that 1988 was more of a price spike. This is a more gradual climb … with potentially a bigger price move to come. In fact, Goldman Sachs (GS) just raised its forecast price for aluminum to $4,000 per metric ton, according to Bloomberg.

How Can Investors Play This?

The last time I wrote about aluminum was in August 2021. That article came out right as aluminum went on a 21.6% rally.

At the time, I said there were two easy ways to play it. You could buy the iPath Series B Bloomberg Aluminum Subindex Total Return ETN (JJU). But I warned you that had very low volume. Currently, JJU averages about 2,000 shares a day.

I said a better choice was to buy the Invesco DB Base Metals Fund (DBB). This fund tracks a basket of futures contracts, including aluminum, zinc and copper. I’m bullish on those metals, too … and DBB is plenty liquid, averaging more than 315,000 shares per day in volume.

I’m also bullish on Dr. Martin Weiss’ Weekend Windfalls strategy.

His breakthrough idea has one primary mission: to give investors an opportunity to acquire a steady stream of cash every weekend. If you’d like to learn more, click here now.

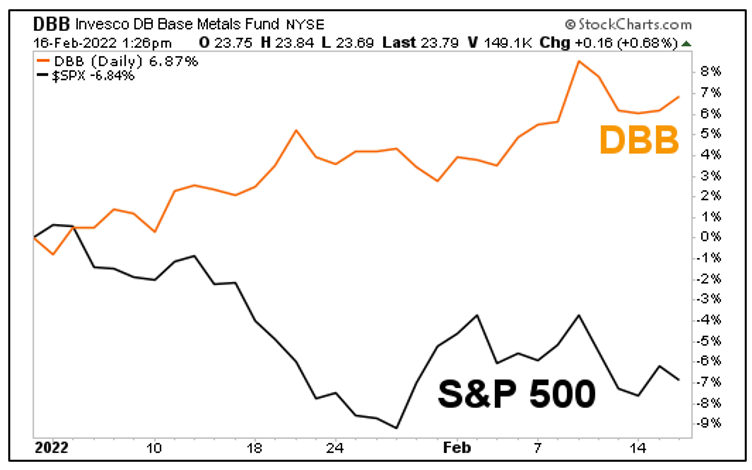

Since the beginning of this year, the DBB is already up more than 6% — much better than the S&P 500, which is down more than 6%.

The DBB remains my favorite exchange-traded fund (ETF) to play the industrial metals rally.

You could also roll up your sleeves and do the research to buy individual aluminum stocks. They’re leveraged to the metal and perform accordingly.

Aluminum will zigzag on the way up. Pullbacks can be bought.

Remember to do your own due diligence, but keep in mind … there’s a bright and shiny bucket of potential profits for those who ride this rally.

Best wishes,

Sean