Last year, there was no hotter metal than cobalt. It roared higher by about 270% since the start of 2016, and it kept on running for the first part of this year, too. Whoo-hoo! Cobalt party!

But now? Well, since March, cobalt has been on a Slip ‘N’ Slide lower. The markets are abuzz with talk of potential oversupply. So, investors can be forgiven for asking: “Is cobalt doomed?”

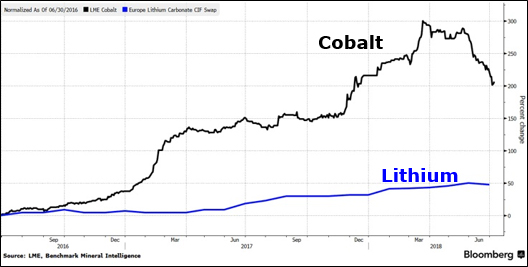

Heck, no (Though it might go lower for awhile). Let me show you a chart …

The black line is the percentage performance of cobalt since mid 2016; the blue line is lithium. Lithium is up about 50% — not too shabby. But cobalt soared nearly 300% in that time frame, then swan-dived lower, and is now up a “mere” 200%.

That’s a heck of an emotional roller-coaster. If cobalt was a person, we’d check to make sure he was taking his lithium.

What’s happening here is the anticipation game. A new report says that supply of cobalt will exceed demand by 652 metric tons this year, and that will rise to 20,842 tons next year. This rattled investors.

Ri-i-i-i-i-ight.

Cobalt prices got shoved off a cliff after mining giant Glencore inked a deal to sell 52,800 metric tons of cobalt to Chinese battery recycler GEM over the next three years.

And there’s also talk of recycling cobalt from dead batteries. That could add 25,000 metric tons of supply by 2025, if all goes well.

But it’s those words “If all goes well” that matter most!

We don’t know how much cobalt can be harvested from dead batteries. Quality is a real issue in cobalt.

Likewise, Glencore is planning to sell cobalt it produces as a byproduct from its copper and nickel mines in the Democratic Republic of Congo. That is a shady place. You can start with the human rights abuses and add a long list of misery and corruption. I’d say that raises the odds of something going wrong at a mine.

In fact, any talk of a surplus assumes a lot. It assumes that mine expansion plans will actually take place on schedule. That rarely happens. Assumptions fail to account for logistical bottlenecks and other project delays.

In fact, “if all goes well” rarely goes quite as well as the optimists believe.

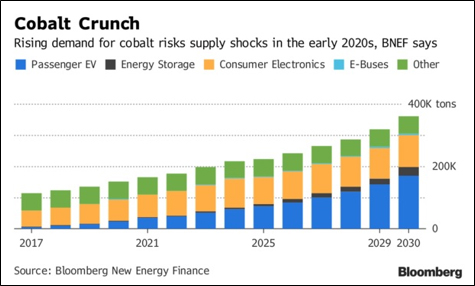

Meanwhile, the longer-term picture for cobalt looks quite bullish, as this chart from Bloomberg shows …

Bottom line: I think the short-term over-supply warnings are over-stated. And the longer-term supply/demand picture for cobalt is quite bright indeed.

Still, cobalt prices have gone lower. It reminds me of what happened in lithium stocks like Sociedad Quimica y Minera de Chile S.A. (NYSE: SQM) this year, after Morgan Stanley came out with a report predicting a lithium surplus. Lithium prices didn’t waver. But stocks like SQM got crushed.

SQM is only now scraping itself off the pavement. And funny enough, Morgan Stanley just turned bullish on the stock. Yep, they mention that SQM is a low-cost producer. To which I would add that the company is cranking up production. So, SQM could shift into higher gear in a hurry.

It’s almost as if Morgan Stanley (or somebody) wanted to buy SQM on the cheap. But that’s pure speculation.

Just as it would be pure speculation to say someone is trying to push around the cobalt market right now.

I’m not going to try and pick the exact bottom in cobalt. Wall Street has deeper pockets than I do, so this correction could go a bit further. But it sure looks like SQM is bottoming, and the way may be clear for higher prices soon.

All the best,

Sean

P.S. I’ll be speaking at the San Francisco Money Show in August. It will be a great show, with all sorts of experts sharing their insights. You can find more about that incredible conference HERE. I hope to see you there!