When I say you can make a lot of money on weeds, you probably think I’m talking about marijuana.

While pot can be profitable, the weed I’m talking about here is cotton.

Futures traders have an old saying: “Cotton is a weed.”

By that, they mean this agricultural crop can grow big and grow fast.

And that can send cotton futures on wild swings that can make fortunes … or break a bank.

- The good news is you don’t have to trade risky futures to profit from cotton.

I’ll show you a couple of ways you can profit on it today.

First, I want to touch on some fascinating history.

Cotton — which is a member of the hibiscus family — has long been one of the most useful plants.

Cotton has been grown, spun and woven into cloth as early as 3,000 B.C. in Egypt’s Nile valley and the Indus River Valley of present-day Pakistan.

Arab merchants brought cotton cloth to Europe around 800 A.D. And boy, did it catch on.

It made the trip to the New World, and by 1616, colonists were growing cotton along Virginia’s James River.

We all learned in school that Eli Whitney invented the cotton gin in 1793. Whitney’s cotton gin employed a rotating wooden drum studded with hooks that grabbed the raw cotton fibers and pulled them through a mesh screen, leaving the seeds on the other side. The gin, short for engine, could de-seed cotton 10 times faster than was previously done by hand.

That made it possible to generate enormous amounts of cotton fiber for the fast-growing textile industry. The invention was revolutionary.

Within 10 years, the value of America’s cotton crop rose from $150,000 to more than $8 million.

But that was only the start of the commodity’s investment story.

Futures trading on cotton began in New York in 1870. It helped alleviate the price risk inherent in a physical contract during its six weeks shipment across the Atlantic. Option on cotton futures weren’t introduced until 1984.

Fast forward to today …

- Annual revenue stimulated by cotton in the U.S. now exceeds $120 billion!

Much of the world’s cotton is grown in the southern U.S., as well as in Missouri and California …

China, India, Uzbekistan, Brazil, Pakistan and Turkey are also major producers.

Some 20 million tons of cotton fiber is harvested and traded each year. That comes to the amount of 20 t-shirts for each human being on the planet!

You can buy or sell an interest in cotton through a variety of investment vehicles besides futures.

Two exchange-traded notes (ETNs) come to mind.

1. The iPath Series B Bloomberg Cotton Subindex Total Return ETN (BAL) tracks an index of cotton futures contracts anywhere from one to five months from maturity.

This strategy considers the life cycle of the cotton plant — further-out contracts during incubation and nearer expirations during harvest.

It also allows the index to select the most liquid contracts available.

The expense ratio is 0.45% and average volume is 6,500 shares a day, which is pretty light.

2. The ELEMENTS Linked to the Rogers International Commodity Index - Agriculture Total Return (RJA) is a broad-based index of 20 agricultural commodities (via front-month futures contracts where expiring contracts are rolled into the next-nearest month). Along with cotton, RJA holds wheat, corn, soybeans, coffee, cattle, hogs and more.

• And RJA was recently upgraded, now holding a strong “A-” Weiss Rating.

RJA is a consumption-weighted portfolio that includes livestock and pumped-up exposure to cotton.

Its expense ratio 0.75%, and its average volume is 178,000 shares per day. That makes RJA more liquid and easier to trade than BAL.

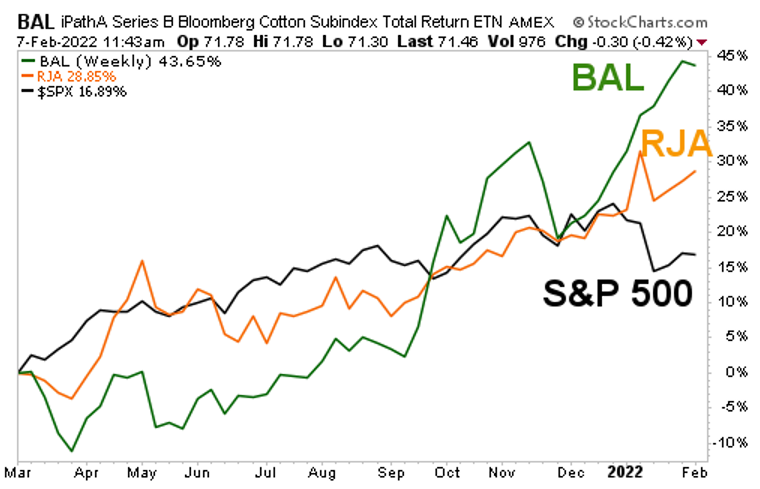

However, as you’ll see on the weekly chart, since the bottom last March, the more-focused BAL is leaving RJA behind … and the S&P 500 in the dust.

The S&P 500 has racked up a 16.89% gain since last March’s low, though it has given back some gains recently. But …

- RJA is up 28.85%, and still going strong.

- And BAL is up a whopping 43.65%.

This shows the big bull market that we’re seeing in agricultural commodities. And cotton, in particular, is leaving stocks sputtering in its wake.

It’s a massive industry and will continue to be so as long as we continue to like wearing clothes.

I’m not saying you should chase anything.

But consider taking advantage of pullbacks and get yourself in high cotton.

Remember to always due your own due diligence before buying anything.

All the best,

Sean

P.S. Speaking of weeds, if you’re interested in cannabis bargains and their amazing upside potential, you should tune in to my next MoneyShow presentation. It’s taking place TODAY, Feb. 8, at 12:55 p.m. Eastern. You can register for FREE! Be sure to sign up HERE.