Editor’s note: Charter Enrollment in my colleague Jon Markman’s phenomenal options trading service closes tomorrow. When that happens, the $2,105 discount Jon has arranged for you will expire. Go here for all the details, and see how he’s helped his readers average 99% yearly returns.

For over a year now, we’ve seen grim faces around the table at OPEC. The oil sheiks keep cutting production to support prices. But as much as they cut, U.S. producers pump even more. It seemed like OPEC was a victim of its own success. Until an unlikely candidate stepped forward to self-immolate and save OPEC’s bacon.

Ladies and gentlemen, I’m talking about Venezuela. It is a major OPEC producer, and it is sliding into a black hole of chaos.

And this is bullish for oil prices, and for select U.S. energy stocks.

So, what do I mean when I say that Venezuela is sliding into chaos? I mean that its government is nearly non-functional. Citizens are starving or fleeing over the border. The country can’t pay its debts.

There are many reasons for this. Start with the fact that Venezuela is a socialist hell-hole. It’s actually much more complicated than that. But whatever the reasons, it’s not fixed easily.

And that means Venezuela’s oil production is going like this …

Wow! The latest OPEC figures put Venezuela’s oil production at 1.52 million barrels per day (bpd). That’s down from 2.4 million bpd recently, and way, way down from 3.3 million bpd in 2001.

So how does this help OPEC? Well, Venezuela’s oil production has fallen so far, so fast, that it’s exceeding the big cuts that Saudi Arabia agreed to in the cartel’s 2016 agreement limiting output.

OPEC is addicted to selling oil — they can’t live without it. But they need high enough prices to pay for all their goodies. This means they often cheat on agreements. This time around, Saudi Arabia, with help from Russia, made those production agreements stick. But it wasn’t enough — until Venezuela’s production fell off a cliff.

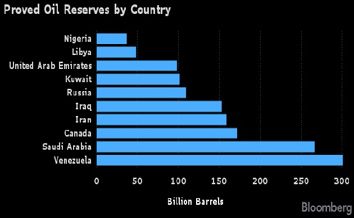

This should be embarrassing for Venezuela. After all, it has the biggest oil reserves on Earth.

But a lot of those reserves are very heavy crude oil. To export that heavy crude, Venezuela must cut it with lighter oil. But with Venezuela’s economy in shambles, it’s harder and harder for that country to import light oil.

This means even LESS exports of Venezuelan oil. And that means the financial crisis spirals deeper and deeper.

I don’t know if Venezuela has a way out. It may get a new government that can work out a deal with foreign creditors and get the U.S. to lift economic sanctions.

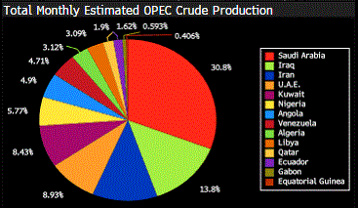

Or, Venezuela may plunge into a black hole of economic collapse. In that case, its entire oil exports are threatened. And despite its recent fall, it still accounts for 4.7% of OPEC’s total supply.

At last count, OPEC still exported 32 million barrels per day. If 1.5 million bpd of that suddenly disappeared, well … prices are made on the margins. You’d see oil prices go much higher before finding their next level of equilibrium.

OPEC will likely cry crocodile tears if Venezuela’s production is cut off. Because that boost in oil prices will save the bacon of high-living oil sheiks who want top dollar for every barrel of oil they sell.

Winners and Losers

One loser in this might be Valero (NYSE: VLO). It imports more than 200,000 barrels per day of Venezuelan oil for its refineries. But if it can source that from elsewhere, it will do okay.

Potential winners are select U.S. oil producers, as well as drillers. Both are doing well … and should do even better if oil prices climb higher.

You can find plenty of good candidates in the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) and the SPDR S&P Oil & Gas Equipment & Services ETF (NYSE: XES).

Sure, this market will zig and zag. You shouldn’t chase anything. But after the next drop should come an even bigger pop. Be ready for that.

And if you’re looking to take some calculated risks to go for big gains as the market zigs and zags, my colleague Jon Markman is one of the best options traders I know. He’s averaged 99% yearly returns for his readers since 2012.

Enrollment in his Markman’s Strategic Options service is open right now, but closes tomorrow. Go here for all the details and save $2,105 on your membership.

All the best,

Sean