One sign the world economy is (gradually) recovering from the pandemic is the proxy for the global economic engine: COPPER.

And as we saw last week, it’s been lofted into the stratosphere …

… while throwing gold overboard.

$4.1 billion came out of the precious metal in just a single week in November, compared t0 $1 billion of that coming out of gold ETFs like GLD.

It’s one of the first times gold has seen outflows all year. And the magnitude of the flow shows a more risk-on approach for large investors.

Also, investors typically buy gold as a hedge against future inflation. Everyone’s worried about inflation, so this trade out of gold is even more perplexing. (And why I believe this is a VERY temporary phenomenon.)

So, where’d all that money go?

In the first three weeks of November, $10.8 billion went into (drum roll please) …

Emerging markets.

This surprising turn only shows how big money is caught between risk, reward and the unknown the pandemic has begotten.

Sure, the S&P 500 is almost 4% above the pre-COVID high, and up 16% for the year, despite that fact that U.S. economic activity and employment are still well below pre-COVID levels. But the iShares MSCI Emerging Markets ETF (NYSE: EEM) is outperforming developed markets worldwide, as seen in comparison to the iShares MSCI EAFE ETF (NYSE: EFA), which tracks developed markets around the world, excluding the U.S. and Canada.

In fact, the young whippersnappers as a whole are doing nearly “thrice” as well (in Old English-speak) as their more “mature” brethren since the beginning of the year.

But East Asian markets are the shooting stars.

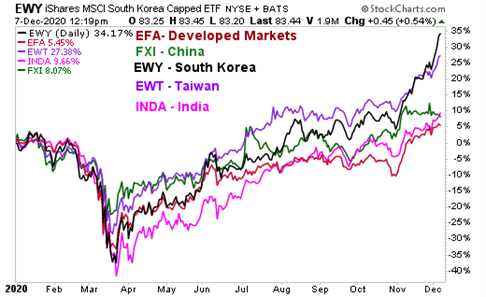

Here’s a chart of the year-to-date gains in the developed markets outside of North America that I talked about earlier charted against China, South Korea, Taiwan and India.

You can see all the emerging markets on the chart are outpacing the developed world (the red line). Taiwan and South Korea are doing especially well.

What’s the reason for this?

Well, part of the story may be the relative success at controlling the spread of the coronavirus. New cases in major East Asian markets (including Japan) are close to zero, allowing economic activity to normalize.

Peter Lampert, portfolio manager at Mawer Investment Management Ltd. in Calgary and lead manager of the Mawer Emerging Markets Equity Fund, says: “COVID has highlighted the differences [in these countries] relative to other countries, such as India, Brazil and South Africa.”

And he adds that something else changed in 2020 …

The more traditional businesses like banks, telcos and oil companies that led growth in the past in emerging markets have not kept up.

Asian consumers are addicted to their phones, and the growth of e-commerce has been staggering. The online trend has received a boost from the pandemic but is also accelerating as more powerful phones come out.

A good way to play emerging markets in general is with the Emerging Markets iShares MSCI ETF (EEM). Of the almost 1,400 securities in the index, two stocks — Alibaba Group Holding Ltd. (NYSE: BABA) and Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM) — accounted for more than 40% of the gain in the first three quarters. Chinese stocks were responsible for more than 35% of the index’s recovery from the March bottom, with Korea’s and Taiwan’s markets combined contributing another 30%.

If you want to target those national markets outperforming the broader index, consider …

1. South Korea iShares MSCI ETF (EWY). This large-cap value fund tracks the MSCI Korea Index, a broad South Korean equity market index.

2. Taiwan iShares MSCI ETF (EWT). This ETF offers exposure to Taiwanese equities and is the most liquid and popular option for achieving exposure to the quasi-developed economy of Taiwan.

3. China Large Cap iShares ETF (FXI). FXI is the most popular ETF option for achieving exposure to the Chinese market, offering unparalleled liquidity. There are, however, some drawbacks: The portfolio consists of just a handful of large cap stocks with a bias towards financials and energy, while going light on tech and consumer stocks.

For short-term traders who value liquidity, FXI is a great option. But for those seeking China exposure over the long run, better options are available. We’ll look at those next week.

All the best,

Sean

P.S. The U.S. market has been strong despite one of the highest COVID-19 case rates in the world. How come? Fed policy. But also the “safe haven” status of U.S. equity markets. And that status could become even stronger in the coming weeks. I’ll be keeping my Wealth Megatrends subscribers up to speed.