Hydropower is expected to remain the world’s largest source of renewable power through 2024, according to the International Energy Agency (IEA).

If you’ve ever stood atop Hoover Dam, you know how mind-blowing hydroelectric power plants can be. The biggest ones are some of the largest man-made structures on Earth.

At the time of its completion in 1935, Hoover Dam was the largest in the world. Today, it’s not even in the top 60 … despite having a total power capacity of about 2,080 megawatts (MW), or enough electricity to power 1.3 million homes.

America’s largest hydroelectric project — Washington’s Grand Coulee Dam — comes in at No. 7 at 6,809 MW installed capacity.

The top spot goes to China’s Three Gorges.

Straddling Asia’s longest river — the Yangtze — the dam has an installed capacity of 22,500 MW and an average annual production of 103.1 terawatt hours (TWh), or 1 trillion watt hours.

The silver medal goes to the Itaipu Dam, one of the Seven Wonders of the Modern World, which straddles the Paraná River between Brazil and Paraguay.

At 14,000 MW, it generates 90% of Paraguay’s energy needs.

But it’s China that’s leading the way, with four of the largest 10 hydroelectric projects on Earth.

In fact, China plans to build the biggest hydroelectric project ever …

The dam will be on the Yarlung Tsangpo River in the Tibetan Autonomous Region (TAR) across a gorge more than twice as deep as the Grand Canyon. Once complete, it’s estimated to produce three times the power of Three Gorges.

So, where does the U.S. rank?

Third — after Brazil. But you might be surprised to know that hydropower accounts for around 52% of America’s total generated power.

• And the market for hydroelectric stocks is expected to reach a whopping $11 trillion by 2050.

To grab your piece of the pie, here’s a pair of stocks with considerable potential for appreciation …

Hydro Pick No. 1: Brookfield Renewable Partners (NYSE: BEP) generates over 62% of its total energy production from hydropower plants on 81 river systems in Canada, the U.S., Brazil and Colombia.

That makes Brookfield a global leader in this renewable energy subsector. Moreover, the company’s generation capacity will more than double … with 31.4 GW in its development pipeline.

• The company sports a 3.11% dividend yield, and it’s projected to grow that dividend 6.32% per year for the next three years.

At the recent $38 share price, this stock looks very reasonable.

Hydro Pick No. 2: Duke Energy (NYSE: DUK) actually started as a hydroelectric company in 1904 before expanding to other forms of energy.

That’s when James B. Duke led a group to begin constructing a system of lakes and dams along the Catawba River in North Carolina. The goal was to generate electricity that would drive the economic growth of the Carolina Piedmont.

Currently, the firm operates a portfolio of 25 hydroelectric assets in the Carolinas and Tennessee, providing electricity to 7.7 million customers in six states.

The company expects earnings growth of 4% to 6% per year through 2024.

• Duke has a dividend yield of 3.84%, and that payout is projected to grow 3.32% per year for the next three years.

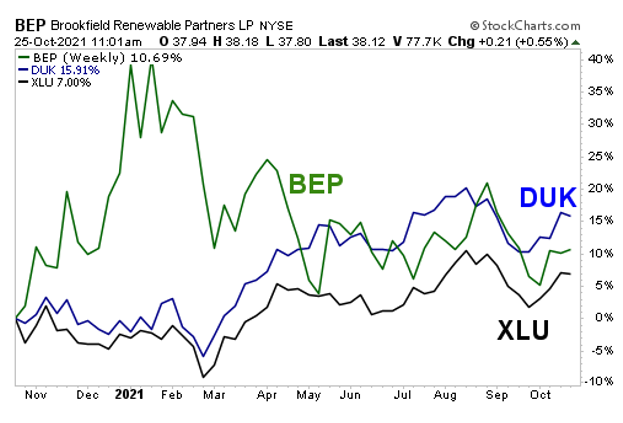

Let’s compare these two hydro-leveraged plays to their benchmark, the Utilities Select Sector SPDR (NYSE: XLU). The XLU has a 3.15% dividend yield, and that’s growing 5.47% per year.

|

Over the past year, Duke has more than doubled the performance of the XLU. Brookfield has outperformed as well, but it’s much more volatile. And those fat dividends pay you to wait.

The big risk for any hydropower play is drought. But again, sizeable and rising dividends are a nice cushion for unpredictable events.

A splash of hydro may be just what your portfolio needs. As always, remember to do your own due diligence before buying anything.