Fed ‘Sink Hole’ No. 4: The ‘Everything Bubble’

2019 was shades of 1929 all over again …

Investment bankers sipping Cristal Champagne … partying with customers’ money earned in HIGHLY-QUESTIONABLE, HIGH-RISK DEALS.

Except this time, it was cheap money peddled by the Fed that inebriated our economy like a hobo stumbling across a hidden stash of brandy.

Case in point: real estate.

Once again, high rollers piled into single-family homes, condos, apartment buildings and industrial parks with reckless abandon.

The NAHB/Wells Fargo Housing Opportunity Index shows that housing affordability for a typical family dropped to only 57% by 2018 … down from 78% in 2012.

Which means to buy or even rent a home was well beyond the reach of middle-class families who could easily afford it 10 years ago.

Heck, in certain areas even broken-down shacks were beyond the reach of everyone but Silicon Valley millionaires.

Just look at this “home” in San Jose, Calif. It sold for $938,000 … a mere 25 days after it was listed.

But 2019 didn’t just mirror 1929’s real estate price hikes. Everything from Manhattan condos to more esoteric assets like artwork … baseball cards … high-end booze … and even professional sports teams went through the roof.

Virtually ALL ASSETS became more inflated than in all U.S. history.

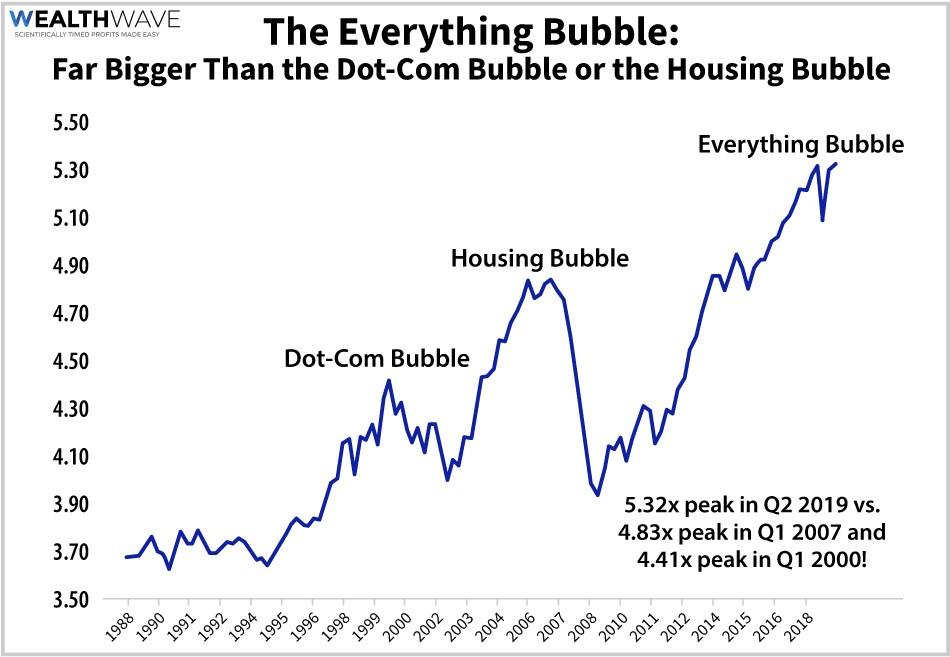

And bubble-popping has a long history in America …

In the 1980s, thousands of S&Ls and banks failed when their debt bubble popped.

In the early 2000s, the big bubble was in dot-com companies with no earnings and no money of their own. When it burst, investors lost over FIVE-TRILLION dollars.

Then, in the mid-2000s, the debt madness spread to tens of millions of American households, and there emerged a giant, high-risk bubble in mortgages.

When it came crumbling down in the Great Financial Crisis of 2008, so did the entire U.S. economy.

And now, we don’t just have a banking bubble, a dot-com bubble, or a mortgage bubble.

We have an EVERYTHING bubble!

The “Everything Bubble” was ALREADY at its breaking point before COVID-19 body-slammed our economy. Its final rupture will signal one of the greatest financial implosions EVER …

Even more stunning than the gut-wrenching “first shock” we witnessed in early 2020.

However, there is one asset that can be trusted: Gold.

Gold may be one of the few assets NOT in a bubble.

In fact, I predict gold’s bubble peak is years away.

That’s why gold bullion — especially gold mining stocks — could be the best place for your money right now.

And that’s why I’ve been recommending the VanEck Vectors Gold Miners ETF (NYSE: GDX, Rated: B-), which tracks the big boys.

Alternatively, the VanEck Vectors Junior Gold Miners ETF (NYSE: GDX, Rated B-) could have even more upside.

And let’s not forget gold’s “little brother” — SILVER.

The Global X Silver Miners ETF (NYSE: SIL, Rated C+) gives you exposure to this potentially explosive market.

But there are a few more names that I have on my shopping list. Names that could get investors potential profits of 1,000% … 3,000% … and even up to 4,000%.

And I’m going to reveal these names in my urgent briefing this Wednesday, Sept. 23 at 2 p.m. EST.

Best part? I’m giving out all the details for FREE. Just click here to save your seat on this precious metals train.

All the best,

Sean