Natural gas has pulled back sharply, down about 20% from a seven-year high it hit on Oct. 5.

So many folks are ready to stick a fork in the nat-gas rally and call it done.

• But if you walk away now, you’re leaving a lot of potential profits on the table. And if you haven’t played the energy rally yet, now is a good time to start.

Despite its recent slip in price, natural gas moved higher on Wednesday, using its 50-day moving average as support and bouncing.

|

| Source: FX Empire |

But why did natural gas go so high in the first place?

Several reasons:

• Last winter was fairly cold, which reduced stockpiles.

• Summer heat waves in Europe and America lit a fire under electricity (and natural gas) demand.

• At the same time, droughts reduced hydropower in the American West, and nat-gas was the substitute of choice.

• Gas production in Europe has dropped hard in recent years, leaving Europe more dependent on fuel from Russia, Norway and the United States.

• And back-to-back hurricanes disrupted production and distribution in the Gulf of Mexico.

Add in the fact that China is set to overtake Japan as the world’s top liquified natural gas (LNG) importer for the first time this year. China is stockpiling supplies of nat-gas to help shift away from dirtier fossil fuels (e.g., coal).

Throw in more electrical demand from a resurgent global economy, and you can see why natural gas prices soared in the past year.

Weather Troubles

Then, prices slumped earlier this month.

That was mainly due to the weather: October 2021 may turn out to be the second-warmest October since 1950, which lowered heating and electricity usage.

And the forecast is for more of the same.

La Niña is developing in the Pacific Ocean. The climate pattern brings more cold water to the West Coast, pushing the jet stream northward. This tends to lead to warming in late fall and early winter.

• However, I’d point out that a weak La Niña can mean a cold winter. And it turns out, that’s precisely what the Energy Information Administration (EIA) is worried about.

The EIA says that nearly half of U.S. households that use natural gas to heat their homes can expect to pay an average of 30% more on their bills this winter compared to last year.

What’s more, those bills can be 50% higher if the winter is 10% colder than usual and 22% higher even if the winter is 10% warmer.

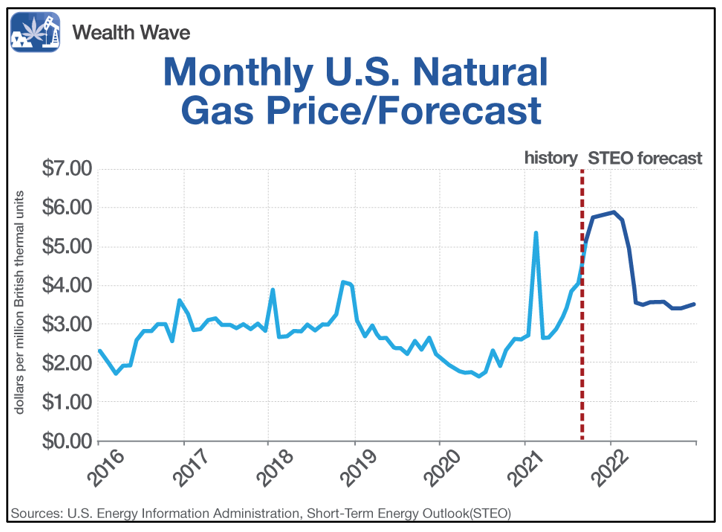

• As a result, the EIA expects U.S. nat-gas prices to keep marching higher into early 2022.

Then, the EIA expects the normal, seasonal price drop.

|

And maybe that will happen.

I’ll just point out that after peaking in February 2021, nat-gas prices pulled back a bit and bottomed in April … then bolted much higher!

Foreign Competition

Meanwhile, U.S. consumers have foreign competition for America’s natural gas.

Along with China buying all the nat-gas it can ship, Europe was counting on more nat-gas from Russia, the source of more than one-third of Europe’s total gas supplies.

Vladimir Putin recently said Russia’s Gazprom (OTC Pink: OGZPY) could ship more gas to Europe. But it turns out, Gazprom is actually preparing to ship LESS gas than in previous years.

How does Europe make up for that?

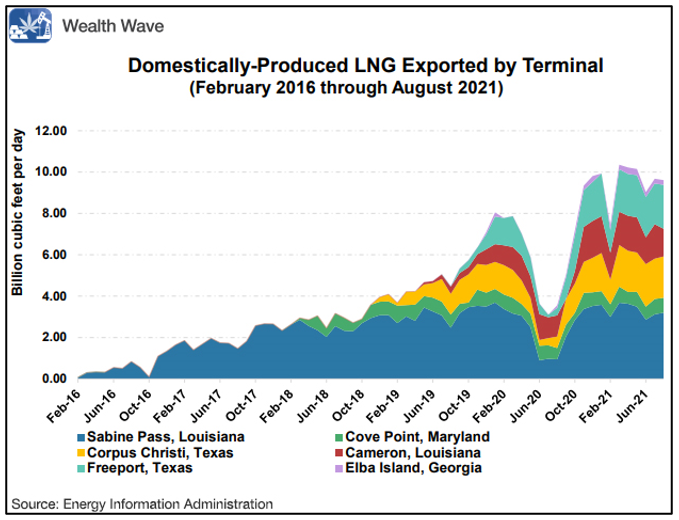

By purchasing nat-gas from the U.S. and other exporters. Look at this chart of U.S. nat-gas exports through August (the most recent data available):

|

Look at that surge from last year!

The EIA says that U.S. nat-gas exports averaged 9.6 billion cubic feet per day (bcf/d) in the first six months of the year, up 42% from the same period a year ago.

• And September saw the most U.S. LNG exported since exports began in February 2016!

Mind you, September was when two hurricanes stomped through the Gulf of Mexico, interrupting shipping.

I wonder what October export numbers will look like? I’d bet pretty high!

Less Supply = Higher Prices

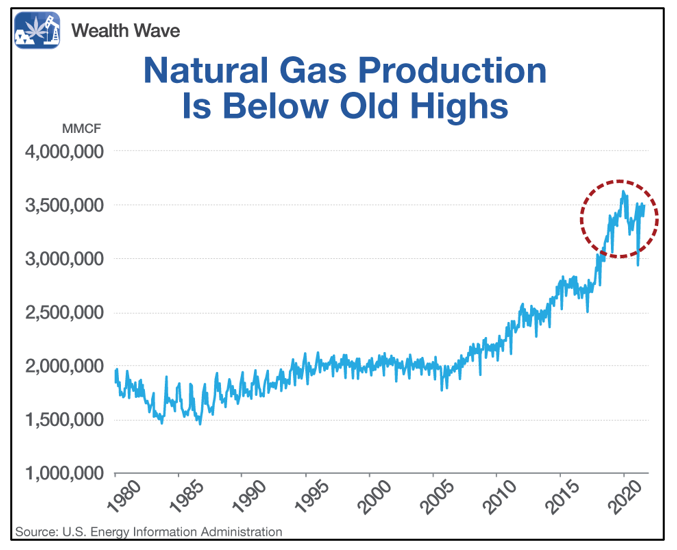

We can always just pump more nat-gas right? Nope. Even as prices have soared, U.S. domestic nat-gas production has stalled.

|

So if prices are still near a seven-year high, why isn’t production going up?

It turns out that U.S. shale producers, who are responsible for the boom in oil and gas output over the past decade, got their hides handed to them during the pandemic price crash.

That capped years of weak performance.

Now, they’re much less willing to drill for more oil, instead focusing on cutting spending to boost returns for investors.

Here’s a quote I passed along to my Gold & Silver Trader subscribers earlier this month, as I gave them fresh oil and gas recommendations. It’s from Scott Sheffield of Pioneer Natural Resources (NYSE: PXD). He told the Financial Times that “All the shareholders that I’ve talked to said that if anybody goes back to growth, they will punish those companies.”

• Well, you want to keep your shareholders happy. So that means oil and gas production may remain flat for quite some time to come.

Add it all up, and this points to higher prices.

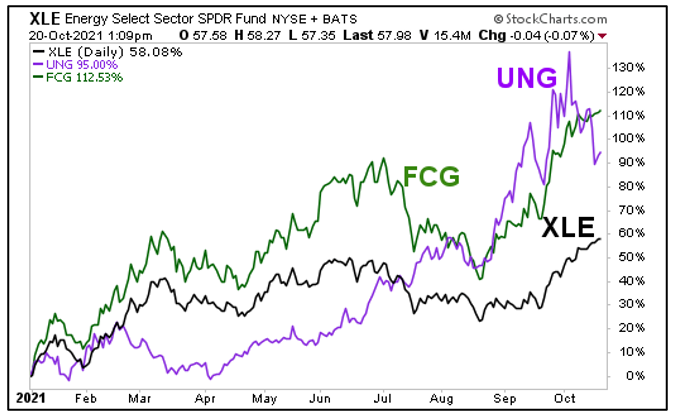

An easy way to play a longer nat-gas rally is the United States Natural Gas Fund (NYSE: UNG), which holds a basket of futures contracts. A better way might be the First Trust Natural Gas ETF (NYSE: FCG), a basket of natural gas producers.

|

You can see that both UNG and FCG have outperformed the Energy Select Sector SPDR (NYSE: XLE) this year. But while UNG is way off its recent highs, FCG is holding onto its highs nicely.

I believe this is because companies leveraged to natural gas are raking in cash hand over fist with recent prices.

And even if prices go lower, they’re still the best prices in seven years. These companies are poised for earning excellence.

You can drill down to individual companies, too. Just do your own research before buying anything. The long hot summer for nat-gas is over. The very profitable winter is about to begin.