You better get your padded shoulders and pantsuits out of storage because stocks are ready to party like it’s 1974. And by that, I mean an oil crisis, wild market gyrations and a major concern for many investors: inflation!

For the oil crisis, you just have to look at what happened when the Colonial Pipeline shut down last week due to Russian hacking. My home state of Florida suddenly saw gas lines like it was classic car day at Wawa.

Meanwhile, the market doesn’t know whether it wants to go up or down — sometimes seemingly trying both at the same time. And that’s basically due to the ugly parade of inflation numbers that keep rolling out on Wall Street.

Now, I warned you about this in my April 29 article, “A Thief Is Quietly Picking Your Pocket.” And the data we got yesterday confirmed the worst fears.

In case you missed it, U.S. inflation soared in April to the highest level in 13 years. The year-over-year headline inflation rate is 4.2%. That’s way, way up from 2.6% in March and way ahead of Wall Street forecasts. It’s also the highest 12-month level since the summer of 2008.

To be sure, we know the Federal Reserve hates to measure food or gas because they’re volatile. If you take those out, “core” consumer prices rose at a 3% year-over-year pace. That’s a big jump from 1.6% previously.

There are two reasons we watch inflation numbers.

First, because it affects the price of everything we buy. As I said last time, inflation quietly picks your pocket month after month as prices go higher and higher.

Second, because investors worry about how the Fed will react. If the Fed worries that inflation is too hot, it might yank its benchmark interest rates higher. And that would call a halt to the free money party that Wall Street is enjoying.

Well, we don’t need to worry just yet. The U.S. central bank is betting that the surge in inflation is “transitory” and will fade by next year toward its long-term goal of 2%.

In remarks on Wednesday, Fed Vice-Chair Richard Clarida said the Fed doesn’t think the inflation acceleration will last, and anyway, the central bank is more focused on the economy. He added that inflation should “return to — or perhaps run somewhat above — our 2% longer-run goal in 2022 and 2023.”

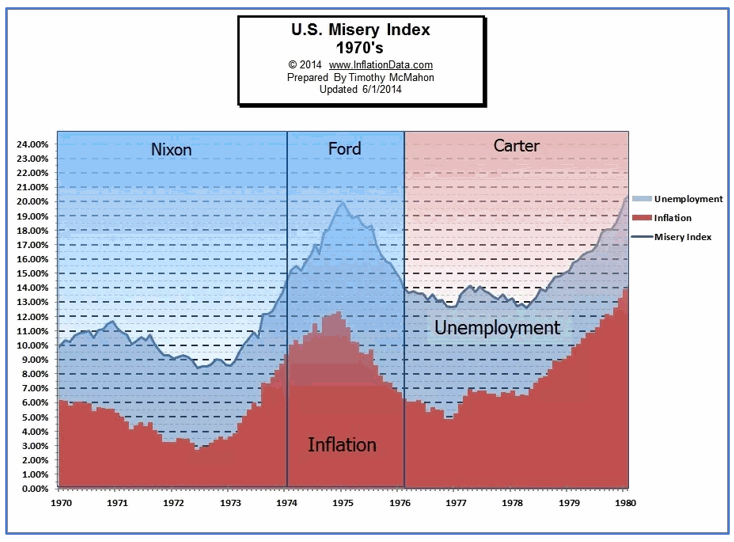

That’s a heck of a bet. Because we also have to worry about what happens if the Fed DOESN’T act. In that case, inflation might start to surge like it did in the 1970s. Remember the “Misery Index?”

Here’s a chart to spark your memory …

The Misery Index came about because the 1970s saw a peculiar combination of high inflation and high unemployment. In other words, the economy stagnated despite high inflation. Annualized inflation peaked at 11.04% in 1974.

We don’t have stagflation now, which is a good thing. The economy is booming, most recently growing at an annualized 6.4%. And there are plenty of jobs, though employment is still below the levels set before the COVID-19 pandemic.

Indeed, many businesses say they can’t find enough people to hire. Job openings reached a high in March. That could push up wages. And you know what that would be? Inflationary!

How You Can Play It

Last time, I gave you three ways to play the inflation surge — the SPDR Portfolio TIPS ETF (NYSE: SPIP), Invesco DB Commodity Index Tracking Fund (NYSE: DBC), and The SPDR Gold Shares (NYSE: GLD).

Those are all still good bets. While the rest of the market is experiencing wild dips, they keep chugging higher.

Now, I’ll give you a fourth option: stocks that increase their dividends. These kinds of stocks outperform the market in good times and bad. And the dividends should be a cushion against inflation as well.

You could research and buy individual stocks — I give a lot of them to my Wealth Megatrends subscribers. (Here’s a bit of light reading to learn more about our trading strategy and the type of picks I recommend.)

Or you could buy an exchange-traded fund (ETF) like the iShares Core Dividend Growth ETF (NYSE: DGRO). It has outperformed the S&P 500 so far this year, and there should be more where that came from. Just remember that while ETFs have less risk than individual stocks, they also tend to underperform on the upside.

The market is experiencing a blast from the past, straight out of the 1970s. Smart investors will adjust to the beat of the new music. There’s still plenty of money to be made.

And since inflation will be picking your pocket, it’s more important than ever to get out there and enjoy the profit party.

All the best,

Sean