Oil prices are out of control, and they’re probably going to get worse. Heck, even the White House says there are “no silver bullets” to bring them back down to Earth.

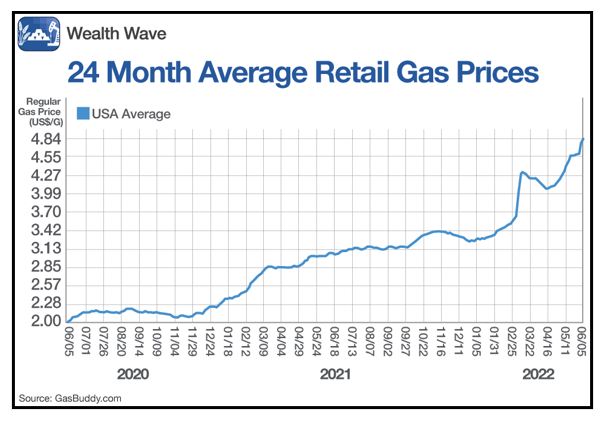

The U.S. national average for regular gas is closing in on $5 per gallon, with prices exceeding $7 in some states!

According to CNET, at least 10 states have already exceeded an average price per gallon of $5.

The following chart shows the steady climb of gas prices over the last two years, which at the time of writing stands at 142%:

Higher gas prices aren't the only strain on consumers. As I mentioned last week, consumer prices jumped 8.3% in April.

I expect inflation to be sticky.

Conflicts in Ukraine are keeping oil supply tight. Last week, European leaders committed to cutting 90% of imports from Russia. That’s a big gap to cover for the U.S. and other Western producers.

We’ve seen supply constraints make matters worse, but now demand is increasing in China.

Last week, the country lifted Shanghai’s COVID-19 lockdown. Business closures and the halt of public transportation in the city of 25 million stifled demand for two months … but now its economy should jump start again.

Experts say that could bring trouble this summer. International Energy Agency (IEA) Executive Director Fatih Birol cites a resurgence of Chinese oil demand as a key risk for the oil market this summer.

Even worse, you’ll probably feel the effects at the pump even after prices start cooling down.

Over a two-week period in March, oil pulled back from about $130 per barrel down to $93. Instead of dropping 28% as oil prices did, prices at the pump slipped single digits.

Why?

Because the gap between retail and wholesale gas prices widens as oil falls. Operators have pricing power, so it could be a while before consumers see relief at the pump, even after oil prices slide.

How Investors Can Drill Back

Higher oil prices mean greater profits for oil companies. This year, the oil and gas industries are projected to rake in $4 trillion.

That’s 167% higher than the average over the past five years!

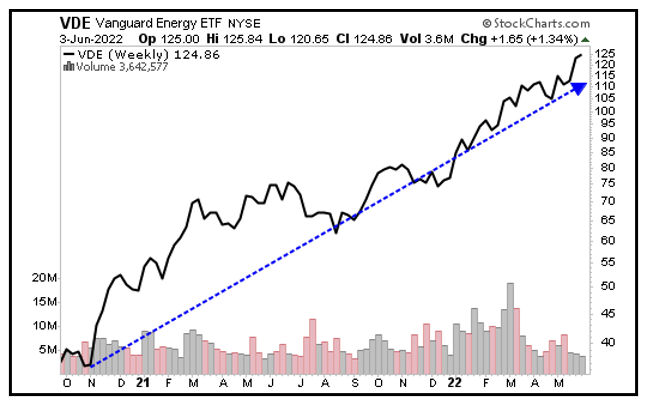

To capitalize on higher prices, I like the Vanguard Energy Index Fund ETF Shares (VDE).

It tracks the performance of an index following the investment returns of the energy sector and manages over $9.8 billion in net assets.

With an expense ratio of 0.1% — well below the 1.07% average for similar funds — the exchange-traded fund (ETF) prioritizes companies involved in:

- Integrated oil and gas,

- Production and exploration,

- Equipment and services,

- Refining and marketing, and

- Storage and transportation.

So it makes sense that VDE’s top three holdings are Exxon Mobil (XOM), Chevron (CVX) and ConocoPhillips (COP) byweightings of 20.61%, 17.19% and 7.04%, respectively. Together, those three companies make up nearly 45% of the fund.

Looking at VDE’s chart, we see that despite experiencing volatility, the fund has managed to extend its recent highs:

Year to date, VDE is up over 56%.

For my tailored company picks, consider joining my Wealth Megatrends service. Members are sitting on open gains of 114.71%, 65.09% and 34.33%.

Oil prices could be in for a wild summer if supply remains tight and demand ramps up as expected. As this plays out, the companies in VDE should do very well.

As always, conduct your own due diligence before entering a position. But as energy prices move higher, I expect this ETF to continue its excellent performance.

All the best,

Sean