It’s been quite a while since I felt so bullish on the yellow metal. The time for bull-sized profits may be coming up very soon.

Recently, gold pushed above important resistance at $1,850. It pulled back for a bit, but then buyers came in to buy that dip.

When Wall Street buys a dip, that’s a sign of strength.

Importantly, the market is worried about inflation enough that it is shrugging off the strong dollar to buy gold. I discussed why inflation is about to get a lot worse in my Saturday column of Wealth Wave.

I’ve made the big bullish case for gold many times, but red-hot inflation seems to be the current driver.

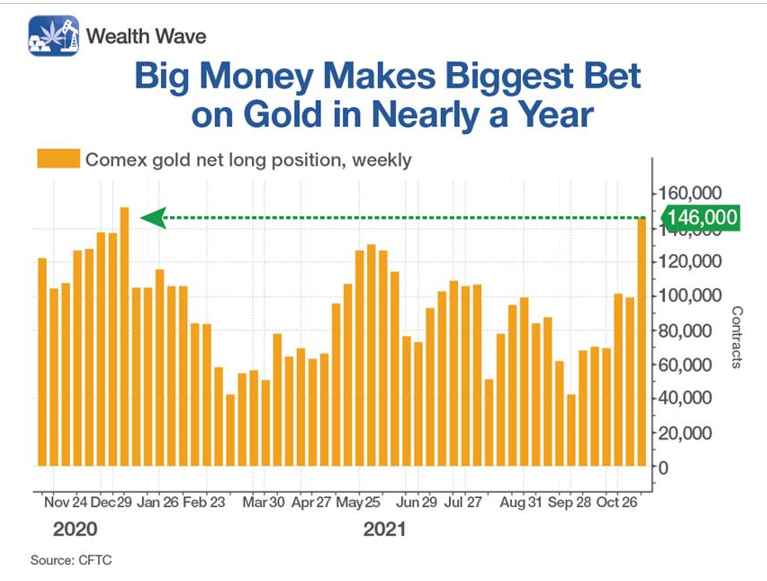

• The big money on Wall Street is so worried, they’re piling into gold.

By that, I mean the latest Commodity Futures Trading Commission (CFTC) data shows hedge funds boosted their bullish gold bets to a 10-month high as of Nov. 9.

We can tell that by looking at the long positions of gold in futures contracts trading on the COMEX:

|

Remember, this is BEFORE the latest red-hot inflation data came out.

And that article I linked to above demonstrates why and how the pace of inflation is likely to increase in the short-to-medium term.

What do you think those funds will do in that case? I’d say they’re likely to buy MORE gold.

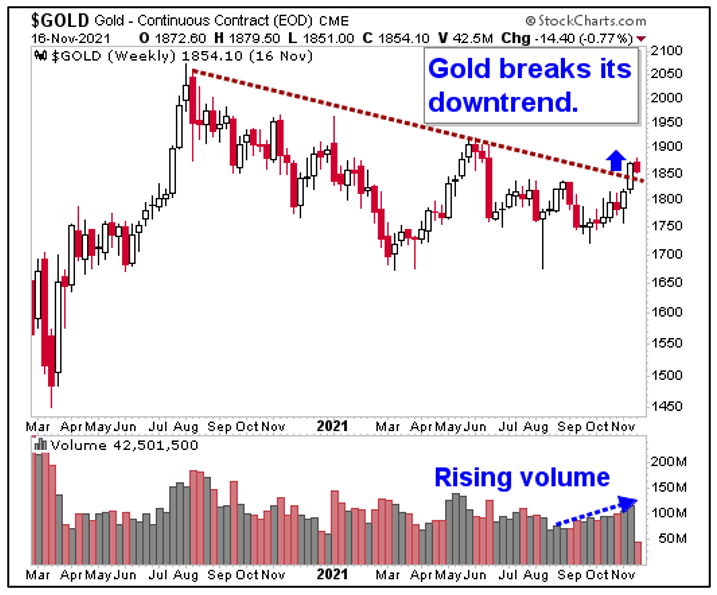

Another sign of strength can be seen in this WEEKLY chart of gold through Tuesday’s close.

|

You can see that gold pushed up through a downtrend that has gripped it by the throat since August 2020. It’s now testing that former overhead resistance as support … and volume is rising.

• Bottom line: This sure looks like a launchpad for another move higher in gold.

The easy thing to do is to buy gold, either bullion or through an exchange-traded fund (ETF) like the SPDR Gold Shares (NYSE: GLD) or the Sprott Physical Gold Trust (NYSE: PHYS).

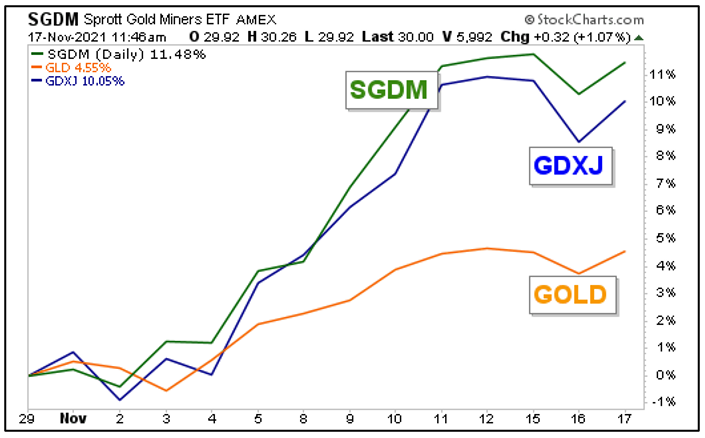

But a BETTER way is to buy gold miners. That’s because mining costs stay pretty much the same even as the price of the metal goes up, giving miners LEVERAGE to the price of gold.

A couple of ideas would be the Sprott Gold Miners ETF (NYSE: SGDM) or the VanEck Vectors Junior Gold Miners ETF (GDXJ). Since the latest rally started at the beginning of this month, they’ve both outperformed the price of gold itself.

|

SGDM holds the biggest gold producers, including Franco-Nevada (NYSE: FNV), Barrick Gold (NYSE: GOLD) and Wheaton Precious Metals (NYSE: WPM).

GDXJ holds a basket of smaller miners, including Pan American Silver (Nasdaq: PAAS), Evolution Mining (OTC Pink: CAHPF) and Yamana Gold (NYSE: AUY).

Big or small, they’re ALL leveraged to the price of gold.

All signs point to the gold bull sharpening its horns. The next charge looks like it’s coming. You should strongly consider positioning yourself ahead of that move.

All the best,

Sean