Is Gold Still a Safe Haven? Let's Talk Turkey ...

Let me start with a good news/bad news joke.

Fat Pierre goes to the doctor, complaining about tummy troubles. “I have good news and bad news for you,” the doctor says.

“Bad news first,” Fat Pierre says.

“You have stomach cancer, and it’s inoperable. You have three months to live.”

“Merde!” Fat Pierre exclaims. “Well, what can the good news be?”

“Oh, you’ll lose a lot of weight. You’ll look great — right up to the end!”

With that in mind, I have good news and bad news on gold. And I’m going to give you the bad news first.

Gold fell below $1,200 an ounce on Monday for the first time in almost 17 months. This is despite the fact that Turkey is in a currency crisis, and the “contagion,” or currency weakness, could spread to other countries.

In short, gold is not acting like a safe haven right now.

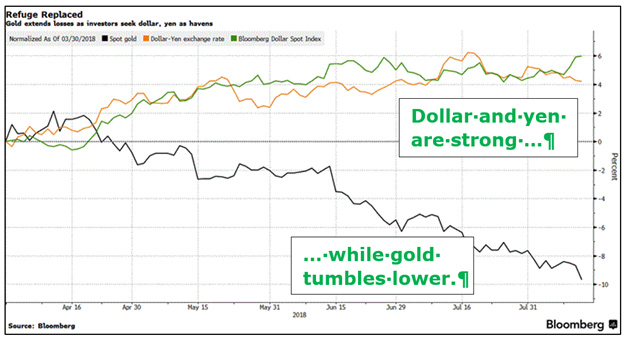

Those who do seek shelter during market storms are finding it instead in the dollar, yen and Treasuries. This chart from Bloomberg paints an ugly picture.

My subscribers will remember that, in the “Fishing Ahead of the Tsunami” report I sent last week, I talked about how gold and silver had become “a fruitless endeavor.”

OK, that’s the bad news. However, the good news is Juan Villaverde, our preeminent cycles expert, says gold and miners should bounce soon.

In the meantime, let me show you why you want to own gold.

Remember that collapse of Turkey’s currency that I told you about? The lira has dropped 47% against the U.S. dollar this year.

Well, when your currency’s value is evaporating, guess what looks really good? Guess what strengthens in value?

I’ll give you one guess. It’s in this chart I made on Bloomberg just minutes ago … a chart of gold priced in lira …

You might not be able to see it, but gold is up 55% in Turkish lira in the past two years. And most of that move came in the past month.

Boy, you can bet that people in Turkey wish they bought gold this year!

You think this can’t happen in the U.S., right? Not with the highty-mighty greenback so strong. Like Fat Pierre, the dollar is going to look great — right up until the end.

A Financial Crisis That

Could Rock the World

Now, to go back to my “Fishing Ahead of the Tsunami” report. Read the section titled “A Wall of Debt is Rushing Toward Us” again.

By the way, since I published that report, the federal government recorded a $76.9 billion deficit in July. In the first 10 months of the fiscal year, the Treasury Department reports that the deficit totaled $684 billion. That’s up 20.8% from the same period last year.

So as bad as things may have looked just a few days ago — they’re now worse.

There are only two ways to resolve that mountain of debt. Either bankruptcy or deflation.

I have a strong feeling about which way the U.S. government will go.

It won’t be soon. Indeed, as the financial and fiscal crises rocks one country after another, more money could flood into the U.S.

But when those pigeons finally come home to roost, you’ll be glad — so very, very glad — that you own gold, and companies leveraged to gold.

5 Stocks I’m Ready to

Pull the Trigger On

In the meantime, we’ll continue to fish ahead of that Tsunami. Here are five big, fat fish I have my eye on.

#1. Another company leveraged to CBD Oil, like your big winner CV Sciences (OTCQB: CVSI). CVSI, by the way, is up 69% as I write this. Wowza!

Anyway, this other pot-leveraged stock is tiny. But it is about to turn the corner in its business, and it should start a new revenue stream later this year.

#2. An oil and gas exploration and production company. Its business is in the Williston and Permian Basins, and its earnings and growth are excellent.

#3. Another energy company, this one leveraged to natural gas. And it pays a fat dividend.

#4. A tiny lithium play you never heard of that is in the sweet spot of the growing lust for this energy metal.

#5. A uranium-leveraged company that I’ve had my eye on for quite some time. This is in addition to your Energy Fuels (NYSE: UUUU) position that is up 45% in a very short period of time.

Uranium stocks as a group are pulling back now as part of their zig-zag higher. We’ll use that zag lower to load up. Because we’re going to ride the big trend in this white-hot metal.

Keep your powder dry. My next signal is coming soon.

All the best,

Sean