I’m getting ready for my trip to the New Orleans Investment Conference, so I’ll keep this brief. Gold, and gold miners, are turning a corner. And I’ll prove it to you in two charts.

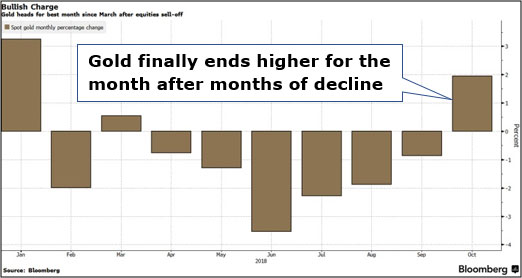

First, a look at a monthly chart of gold. Most analysts don’t look at this precious metal on a time frame this long-term. They’re missing out. Because something very interesting is happening, as this chart I made on my Bloomberg terminal shows …

October was more treats than tricks for gold. You can see that the price of the yellow metal ended October with the first monthly gain in seven months.

Why is this happening? The major stock indices had a horrible October. Basically, they gave back their gains for the year. And as I keep saying, gold is the ultimate safe harbor.

Now, add in renewed and massive buying by central banks, more gold buying by India and tightness of global supply — well, darned tootin’ that gold is rallying.

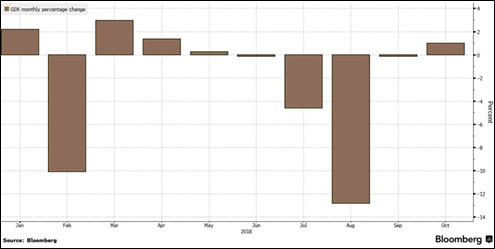

And this is reflected in gold miners. Here’s the monthly chart of the VanEck Vectors Gold Miners ETF (NYSE: GDX).

You can see that gold miners are finally turning higher, too. They ended up 0.9% for the month of October. After four months of declines — and a downtrend for seven months — that small gain looks good.

The miners suffered more than the metal on the way down. That’s because they’re leveraged to the metal. No one believes the gold rally yet, so miners are underperforming. Once Wall Street wakes up to gold’s next surge, what do you think miners will do?

I think they could go ballistic.

To be sure, stocks started rallying on Oct. 30, and that took the wind out of gold’s sails. I guess your outlook depends on whether you think the big October sell-off in stocks was just a dip in the road. If, on the other hand, you think the S&P 500 and other major indices could face trouble ahead, you know what you want to buy while it’s still cheap.

Good luck. And if you’re at the New Orleans Investment Conference this weekend, please say “hi.” I like to meet and talk to subscribers. And look for my presentations about gold, uranium and more. It’s going to be great!

All the best,

Sean