The rally in the broad indices has been excellent this week.

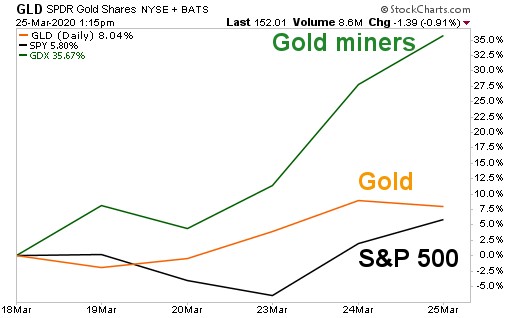

Wanna know what’s rallying even higher? Gold. And miners are outpacing both gold and the S&P 500 by 4x and 6x, respectively.

Here’s a chart of the performance of the S&P 500, gold and miners over the past five days. It shows miners’ massive outperformance …

With that said, I believe there’s even more to come. I’m not the only one who thinks so.

Goldman Sachs pointed out that gold underperformed in the 2008 financial crisis (remember that one?) until the Fed removed liquidity restraints — like it just did this past Monday.

And the Fed firing its money cannons is not the only reason why gold is going higher. Bloomberg News reports that the relationship between gold futures and physical metal has shot way out of whack. The premium has widened to its biggest gap in four decades!

People are buying up physical gold hand over fist.

What this shows us is that investors are desperate to find a safe haven amid the market tumult brought on by the virus. They want gold — the safest of hard assets.

I cover more of the reasons why gold can be a safe haven in this brutal market in my new, “Coronavirus Financial Survival Guide.” Now, you can get this premium report, absolutely free.

If you haven’t read it yet, you can download it here.

This bounce in the major averages is nice, but I believe the market is headed for a rough ride ahead. There will be islands of outperformance — including gold and select miners. Select stocks can do well as the COVID-19 virus rages across America and the world, too.

You can read about those outperforming stocks — and funds you can use to protect yourself from further market downside — in my new report.

Now isn’t the time to hide under your desk. Now is the time to get busy. Now is the time to protect your portfolio and potentially make your next, great fortune.

Be safe. Use your worry to fuel smart decisions. And God Bless.

All the best,

Sean