Today’s story is about oil, gasoline and perspective. Let me explain that with a joke.

Jean-Claude goes to his doctor for his annual checkup. A week later, his doctor calls with the results.

“I’ve got good news and bad news,” the doctor says.

“Hoo boy,” Jean-Claude replies. “OK, give me the bad news first.”

“You’ve only got a week to live.”

“Merde!” Jean-Claude is left reeling by his bad luck. “OK, what’s the good news?”

“Well, it’s going to be a very expensive week. I’ll be able to afford a new car,” the doctor says happily.

So that’s my introduction to the good news/bad perspective of this story. The good news is that consumers, including probably you, will be paying less at the gas pump.

The bad news? Oil investors, reaching for profits, are about to get whacked across the knuckles.

Not all oil stocks are in trouble. I’ll tell you about some areas that could prosper. And I’ll also tell you how to profit on the bear side.

Now, why do I think oil prices are going lower? In the short term, anyway.

A picture is worth a thousand words. I’ll let three charts do most of the talking for me.

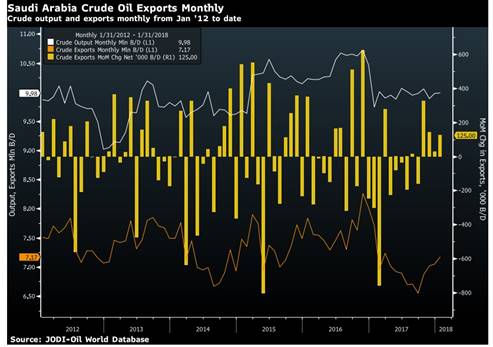

You know that the Saudis, the rest of OPEC, and a group led by Russia all cooperated to reduce the world’s oil production. That, in turn, supports oil prices.

And sure, Saudi oil production is down year-over-year. But month-to-month is a different story.

Since late 2017, Saudi oil exports are higher month-to-month.

This shows the Saudis are starting to cheat on their own directive.

Sure, the Saudis are only one side of the equation. There’s a new “oil kingdom” that is pouring oil into the global market.

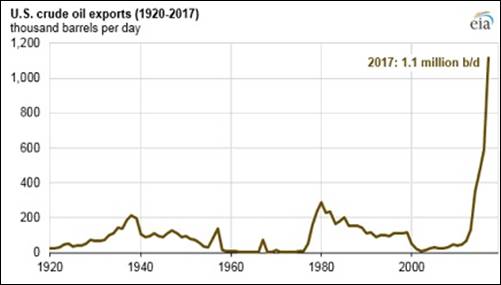

As this chart from the Energy Information Administration shows, U.S. crude oil exports are soaring. Soaring! This is upending the power structure of the global oil market.

U.S. exports are driven by rising production. America’s crude oil production is up more than a fifth since mid-2016, to 10.38 million barrels per day.

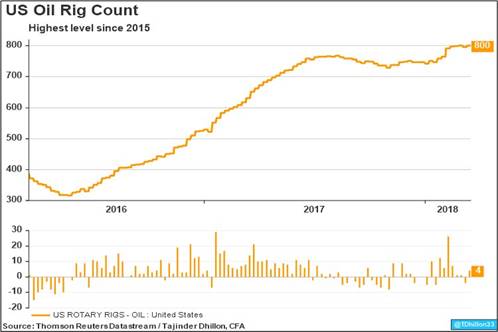

Is U.S. production going to top out anytime soon? No. Not with oil rig counts at the highest level since early 2015.

The number of U.S. rigs drilling for oil increased to 800 last week. And the combined oil and gas rig count is also at a multiyear record of 990.

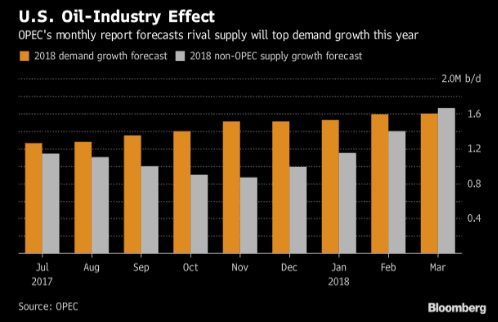

With the U.S. as the new swing producer, supply is growing faster than demand. At least for now.

This chart is from data in OPEC’s monthly market report. The cartel raised its expectation for supply growth from the U.S. and other producers for a fourth consecutive month, to 1.66 million barrels a day. Meanwhile, demand should rise 1.6 million barrels a day.

Eventually, we’ll see demand catch up. But in the nearer term, this is a bearish picture.

Here’s what I expect to happen: I think we’ll see global oil prices correct here in the shorter term. If the correction is sharp enough, it will light a fire under the butts of the Saudis and Russians to re-commit to their production caps. That, in turn, could put in the next bottom for oil.

But in the meantime, it will be tough on higher-cost oil producers, explorers and drillers. Oil companies with heavy debt loads should especially be avoided.

Winners will include low-cost oil producers, refiners and other companies that use oil as an input. Also, oil companies that don’t carry a lot of debt. Because they will be able to pick up bargains when others are under stress.

If you want to play this potentially fast move down, consider the ProShares UltraShort Oil & Gas ETF (NYSE: DUG). It tracks twice the inverse of a basket of oil companies, who themselves are leveraged to the price of oil. So, DUG could go higher in a hurry.

Be sure to do your own due diligence before buying anything. And only experienced investors, or those with professional guidance, should buy leveraged funds.

If you’re a long-term investor, don’t worry too much. After all, the big trend in global oil demand is still higher. But if you’re a short-term investor, prepare yourself.

Otherwise, the joke will be on you.

All the best

Sean