Everyone likes a good sale.

And if you had a chance to get in on the sale of the century, would you do it?

What if I told you that sale was in oil … copper … gold … silver … and more?

Commodities are VERY undervalued right now.

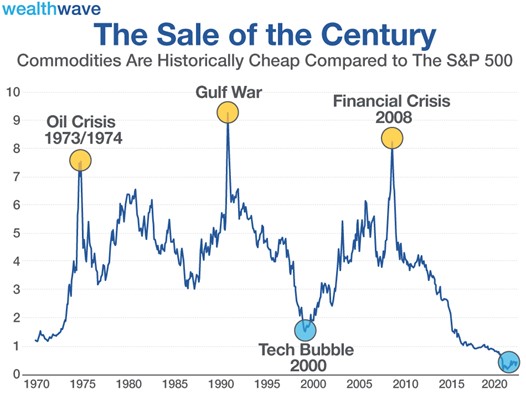

I want to show you a chart of the S&P GSCI Index divided by the S&P 500.

The S&P GSCI is a benchmark for the commodity market. It tracks a basket of 24 of them; it’s weighted by world production and comprises the physical commodities that have active, liquid futures markets.

I’m talking about the bread and butter commodities: wheat, corn and cattle in addition to crude oil, gasoline, natural gas, aluminum, copper, gold, silver and more.

This leaves out things like lithium, rare-earth metals and uranium, which are doing very well for my subscribers lately.

Nonetheless, the S&P GSCI is a snapshot of the broad tradeable commodity market. And it’s showing that commodities are on their best sale EVER!

The chart shows periods in the past when commodities experienced peaks and lows compared to the S&P 500. Recently, commodities were more out of favor than at any time in the past, including when investors were chasing the tech bubble in 2000.

According to Longtermtrends, the current gap between the price of stocks compared to the price of commodities is the widest it’s been for as long as they’ve been tracked … beginning shortly after the Civil War.

Boom Time for Commodities

Looking back at the chart, notice the blue circle at the far right. It indicates that this ratio of commodities divided by the S&P 500 just started to reverse.

So, what happens next?

Well …

- The global economy is roaring back from the pandemic. Even COVID-19’s Delta variant isn’t slowing things down.

- Consequently, energy demand is soaring even as supplies remain tight. The International Energy Agency (IEA) expects global energy demand to rise 4.6% this year, surpassing pre-COVID-19 levels.

- Meanwhile, global central bank deficit spending is approaching stratospheric levels. In the U.S. alone, the deficit will likely total $3 trillion in FY 2021. Countries like Japan are in even worse shape.

- All that money sloshing around is stoking inflation. The Federal Reserve is now predicting an annual inflation rate of 4.2% by year’s end. That’s up from the 3.4% forecast in June. And that’s the official rate; other measures of inflation are running even higher. If history is any guide, that should make gold and silver shine brighter.

- Crops are failing more often for a variety of reasons, including adverse climatic conditions and expanding human activities. In turn, this should put upward pressure on wheat, soybeans and more.

All in all, commodities have every reason to keep going higher … and should outperform the S&P 500.

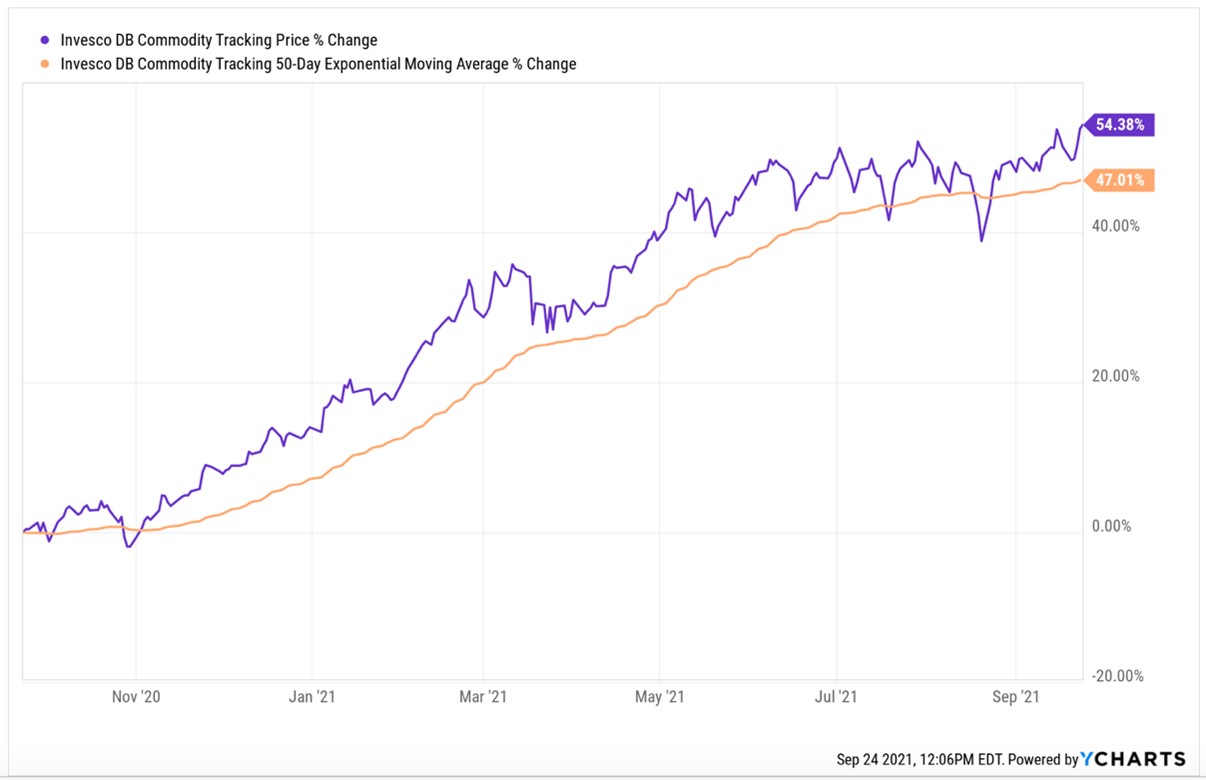

If you believe this — like I do — an easy way to play a broad commodity rally would be the Invesco DB Commodity Index Tracking Fund (NYSE: DBC). It has an expense ratio of 0.88% and tracks crude oil, corn, soybeans, sugar and much more. Not quite the same basket as the S&P GSCI Index … but close enough.

Or, you can invest in select individual commodities and the stocks leveraged to them. It’s higher risk, but there’s also the potential for enormous rewards. That’s what I’m guiding my subscribers to do. We’re already taking gains and we’re adding new positions. There will be more to come.

All the best,

Sean