The great Green Wave is coming. By that, I mean the next big round of cannabis profits. Today, I’m going to tell you about some potential winners, some losers and one way you can play it.

First of all, you know the legal cannabis market is going to be huge, right? Canada has already legalized medical marijuana on the federal level and will legalize recreational pot this summer. Deloitte estimates that the base retail market value of recreational marijuana could be $8.7 billion. Throw in all the ancillary businesses, and it will be triple that — or more.

In the U.S., even though most marijuana is illegal, the market was estimated to be worth $6.6 billion in 2016. But it’s growing fast. And how big and how fast depends on who you listen to.

New Frontier Data estimates it will be worth $25 billion by 2025. But GreenWave Advisors puts the U.S. legal cannabis market as big as $35 billion by 2020.

That’s huge. To put that in perspective, total U.S. coffee sales run around $5.17 billion.

Maybe it’s time to wake up and smell the coffee.

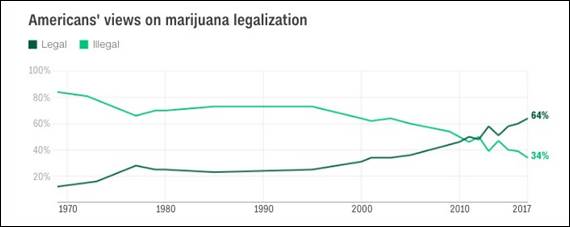

And sentiment is shifting. 64% of Americans now favor legalizing marijuana on the federal level. That’s up 14% in seven years. And for the first time, a majority of Republicans favor legalization.

And for good reason: According to another New Frontier study, legalizing marijuana would create 1 million jobs and generate $132 billion in tax revenue.

Jobs and taxes — this gives states and citizens alike massive incentive to press full speed ahead with legalization.

So, on Friday, Senate Minority Leader Chuck Schumer introduced a bill to decriminalize marijuana on a federal level. Since Schumer used to be an anti-drug warrior, that’s a big shift. But he can see how public sentiment is changing.

You know who else switched sides? Former Republican Speaker of the House John Boehner. He said his own views on marijuana have evolved, and that marijuana could help in the opioid crisis.

Marijuana remains illegal on the federal level in the U.S. But under pressure from Colorado Senator Cory Gardner, President Trump says he will support efforts to protect states that legalize marijuana on a state level.

That’s a big thumb of the nose to U.S. Attorney General — and rogue garden gnome with an inexplicable grudge against growing things — Jeff Sessions. Sessions hates marijuana. President Trump’s deal tells him, “too bad.”

Now, the door is open on the state level. This is putting a spark back in a cannabis market that had gone dormant this year.

So, who will win, and who will lose, as the marijuana business catches fire?

Big Winners

States. Colorado is leading the way in legalization. It reaped $211 million in marijuana tax revenues during the 2016-’17 fiscal year. Now California is legal, too. Gov. Jerry Brown estimates that California could see a whopping $643 million marijuana tax haul in its first full year of legalization.

Customers. Prices are plunging where pot is legal. In Washington state, the price of marijuana fell after legalization from nearly $25 per gram in July 2014 to less than $10 in July 2017. In California, the estimates are that the cost of a gram of pot could fall by half in the next six to 12 months.

Patients. Cannabis may not cure what ails you, but it sure can make you feel better. Doctors find patients are switching from pills to cannabis when possible.

And that brings us to the first of the losers …

Big Losers

Pharmaceutical companies. According to a new report, medical marijuana sales could eat into $4 billion worth of pharmaceutical sales annually. This is one reason why drug companies have fought furiously against legalization efforts. Some drug companies are getting on the bandwagon and working on drugs derived from cannabis. But many could be hurt as well.

Drug gangs. In the last year, border agents snagged roughly 1.5 million pounds of marijuana at the U.S.-Mexican border. That’s way, way down from a peak of nearly 4 million pounds in 2009. With pot being legalized, Americans want a lot less Mexican pot. You can bet the cartels are furious about this.

Private prisons. A huge amount of people are in prison on marijuana-related charges. In fact, in 2016 more people were arrested for pot than for murder, rape, aggravated assault and robbery — combined. If marijuana is legalized on the federal level, you can bet those arrests will stop — and prisons will have empty beds. I wouldn’t want to own a prison stock as this trend accelerates.

How to Play This

There are plenty of good stocks in this industry. I know, because I helped my subscribers bank gains of 107% … 144% … 193% … 216% … 309% … 468% and more during the last big run-up in cannabis stocks.

And that was just one day. There were other, richly rewarding days.

But even after a sell-off that started in February, many of these stocks are still overvalued. So you MUST be selective.

Still, if you had to pick one thing, the ETFMG Alternative Harvest ETF (NYSE: MJ) tracks a nice basket of cannabis-related stocks. It has an expense ratio of 0.79%.

And MJ holds a bunch of stocks on both sides of the Canadian border. Some 52% of its holdings are in Canada, 36% in the U.S. and the rest from around the world.

So, MJ gives you exposure to medically legal stocks now … companies that will benefit from Canada’s recreational legalization later this year … and it holds plenty of stocks that will rocket higher when and if the U.S. legalizes on a federal level.

The future is coming. It is green in more ways than one. Get ready for legalization … you could reap a rich harvest of gains.

All the best,

Sean Brodrick