I’ve been disappointed by the action in gold for nearly a year. However, some things are happening right now that could send the yellow metal — and the stocks leveraged to it — rocketing higher.

So now the question now is: Has gold’s hour come round at last?

Mind you, this is the opposite of what Wall Street is saying.

Most analysts forecast a weak year for gold as the Fed raises interest rates. I’ll show you why they’re wrong, why I’m right … and how you can profit from this.

Price Action

Let’s start with the fact that gold is dancing around a two-month high despite the fact that the Fed is telegraphing three and potentially four interest rate hikes this year. And some Wall Street fortune-tellers are saying there could be as many as seven.

Anyone saying the Fed is going to hike rates seven times is a bear talking their book. There’s no way in H-E-double-toothpicks that the Fed is going to raise rates seven times. I can give you 30 trillion reasons why.

- The more the Fed raises rates, the more interest it has to pay on new debt it borrows.

On Wednesday, the central bank announced that it was keeping its funds rate target range the same for now, but it “expects it will soon be appropriate to raise the target range for the federal funds rate.”

- That’s much more dovish than the market expected.

Bottom line: Gold prices are shrugging off the seven-hike forecast of doom. So, I’m probably right on that.

Bullish ETF Action

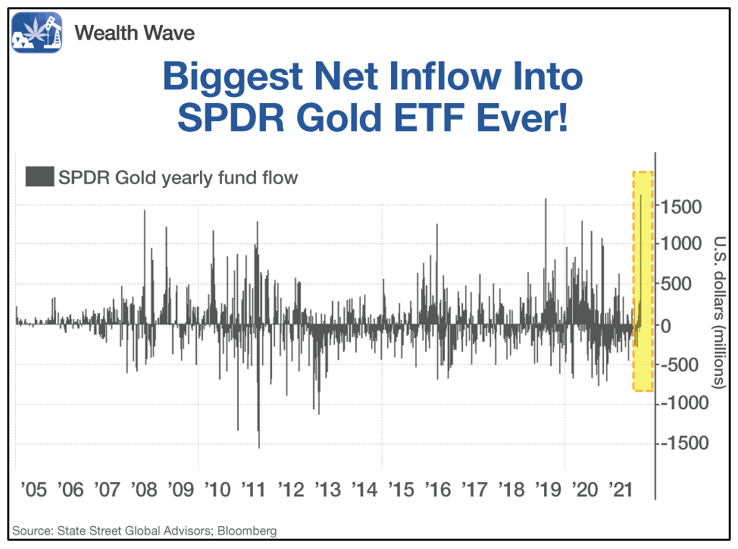

Recently, in just one day, the largest physical gold exchange-traded fund (ETF), SPDR Gold Shares (NYSE: GLD), reported its largest-ever net inflow in dollar terms! And by that, I mean since the fund started trading in 2004.

- In one day, $1.63 billion poured into the fund. That bought 27.6 tons of gold.

If gold ETFs buy gold, that’s a short-term positive for the yellow metal. More important, this may show a shift in investor sentiment — one that could drive gold prices much higher.

Real Rates Are the Real Deal

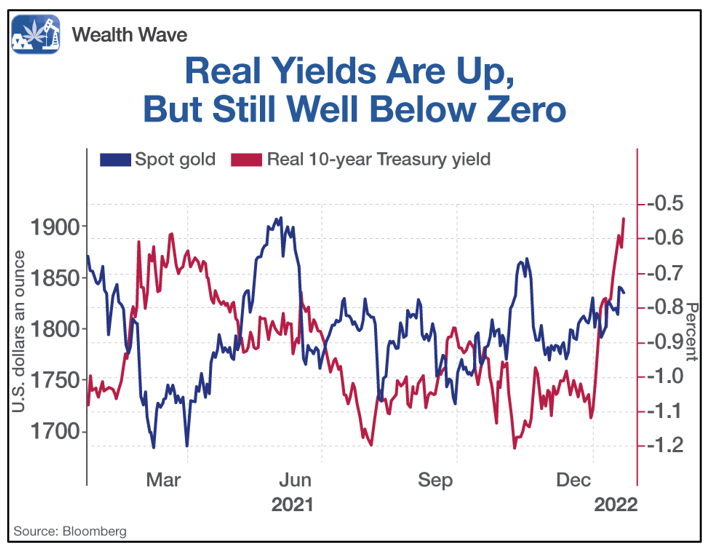

The real interest rate is the nominal interest rate MINUS the inflation rate. The current federal funds rate is 0.25%. I probably don’t have to tell you that U.S. inflation reached 7% in December. This made the real interest rate sharply negative.

A negative real rate destroys one of the arguments against holding gold: that gold doesn’t pay interest. Well, in a negative real-rate world, many issues dependent on the federal funds rate — yields on Treasurys, for example — don’t pay interest either.

- The real 10-year Treasury yield is 1.375%. Not nearly enough to make up for inflation.

So, a negative real interest rate is a boost for gold. And sure, real interest rates and real Treasury yields are going up. But they’re still negative.

If anything, in the short term, the price of gold seems to be rising with real yields.

How to Play It

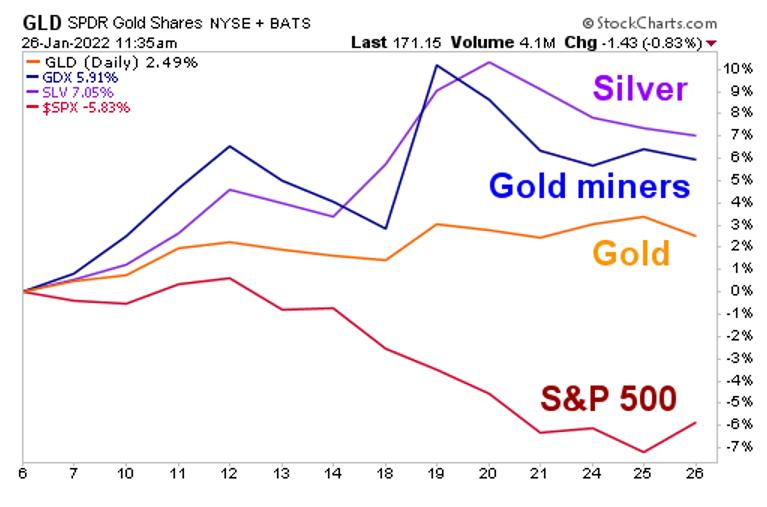

Gold’s most recent bottom came on Jan. 6, even as stocks melted down. This makes gold shine by comparison. You know what shines even more?

Gold miners and silver!

If you’ve been around these markets as long as I have, you know that when gold bottoms, the miners — which are leveraged to the metal —lead the way higher.

Silver is also leveraged to gold (although silver bugs will tell you otherwise).

- And silver is behaving exactly as you’d think if we’re in a new bull market for precious metals.

We still need price action to confirm a new gold bull. That won’t come until gold closes above $1,862 or $1,908, depending on how conservative your standards are.

And there’s nothing wrong with waiting … though you will give up the potentially enormous gains that gold miners will make between now and then.

- Because that’s how I would play this potential rally — with gold and silver miners.

They are leveraged to the underlying metals. Their moves could be explosive.

The VanEck Vectors Gold Miners ETF (NYSE: GDX) owns the biggest gold miners. That’s a good place to start.

Or you can drill down into its top holdings, including Newmont (NYSE: NEM), Barrick Gold (NYSE: GOLD), Franco-Nevada (NYSE: FNV) and more.

The choice is yours.

If you’d like more customized picks, check out my Wealth Megatrends service.

With gold’s hour coming around at long last, I suggest you set your watch now.

Best wishes,

Sean