Are you feeling nostalgic?

The reason I ask is because the S&P 500 just closed out the worst first half of the year since the Beatles disbanded … since the first Boeing 747 took to the skies ... since the Ford Torino was the car of the year!

I'm talking about 1970! Holy smokes!

The above picture shows citizens of that era grasping for answers as to why stocks plummeted. I'm guessing they blamed hippies.

But seriously, 1970 saw the S&P 500 tumble 21% in the first six months. Want to know what happened in the second half of the year? The market went up 27%.

What a wild ride …

To be sure, there's no guarantee of a rebound. But it often works that way. The problem is, we don't know when the bottom is coming. And my best reckoning is the market has more downside. I'll explain …

Flash Forward to Today

As investors nail the coffin lid shut on a horrific June, the broad market just had its worst first half in 52 years, with the S&P 500 down more than 20% year to date.

I think the market could continue lower until the Federal Reserve gives some kind of sign that it's finished hiking interest rates. Why? Because this market is addicted to free money. Many investors believe the market sell-off is due to recession fears. My view is those fears are less important than the Fed firehose of money.

The stock market became disconnected from the real economy a long time ago. Now, it's free money — and fear that the money flood will stop — that drives stocks.

Once the Fed shows the light at the end of the tunnel of rate hikes, investors can price in the limits of how much pain is to come. And then the markets can go higher again.

But how low will the market go in the meantime? Here's an idea:

That's another 16% lower. The outlook for the Nasdaq is even worse. My target there is 22% lower!

Notice I haven't even mentioned the "R" word yet — recession. I don't know if we'll have one or not. But that might have to be priced in, too.

So, here are my two ideas …

Idea No. 1: Buy Strength

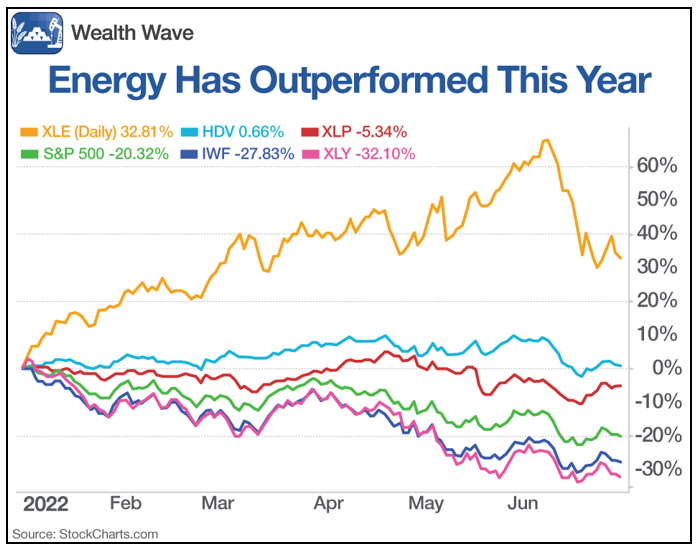

Here's a chart of year-to-date performance of some leading exchange-traded funds:

The Energy Select Sector SPDR Fund (XLE) is leading the market so far this year, up 32.81%, despite recent weakness. Little wonder about that. I've written a series of articles explaining the bullish setup for energy.

The iShares Core High Dividend ETF (HDV) is also positive for the year, barely. But strength is strength. HDV yields more than 3%, which is what investors are looking for now.

Consumer Staples Select Sector SPDR Fund (XLP) is down 5.3% so far, but showing strength compared to the S&P 500. And you can drill down into this ETF for individual stocks that are positive.

Below that I've put the S&P 500 (SPY), down 20.3%, the iShares Russell 1000 Growth ETF (IWF), which is being hammered as money rotates from growth to value, and Consumer Discretionary (XLY), which is scraping bottom down 32%. Ouch! I guess no one needs new Nikes (NKE) in a bear market.

Everyone thinks of utilities — tracked by the Utilities Select Sector SPDR Fund (XLU) — as a safe haven. They've had a good week, but they're still down (slightly) for the year, at least so far, and underperforming the XLE and HDV. At least with all three, you get nice dividends. And dividends pay you to wait for the market to turn around.

What if you want to target weakness, for the next leg down in the market?

Idea No. 2: Target Weakness

For that, let's look at inverse funds. And a jaunt in Mr. Peabody's Wayback Machine shows us the inverse fund that performed the best in the 2020 bear market was the ProShares Short Russell2000 (RWM).

The RWM tracks the inverse of the daily performance of the small-cap Russell 2000 Index. This fund has an expense ratio of 0.95%, and is up a whopping 24.7% in 2022 … so far.

It's quite likely that if the market takes another steep tumble — down 15%, 20% or more — the RWM will do very well indeed.

I've already recommended RWM and other bearish funds to Members of my service, Resource Trader. Importantly, these inverse funds are not for the long term. They are short-term speculation only. When the bottom comes, we'll see it in the rear-view mirror, and we'll need to make a swift exit.

And what should you buy when the market finally bottoms? I'll have more ideas for you then. For now, you have my bear market ideas. Just something to think about over this long weekend.

Have a happy Fourth of July!

Best wishes,

Sean