I mentioned the 18-and-a-half-year real estate cycle last week in our discussion on the cycle of pandemics. And you’re probably wondering:

Where ARE we in this cycle right now?

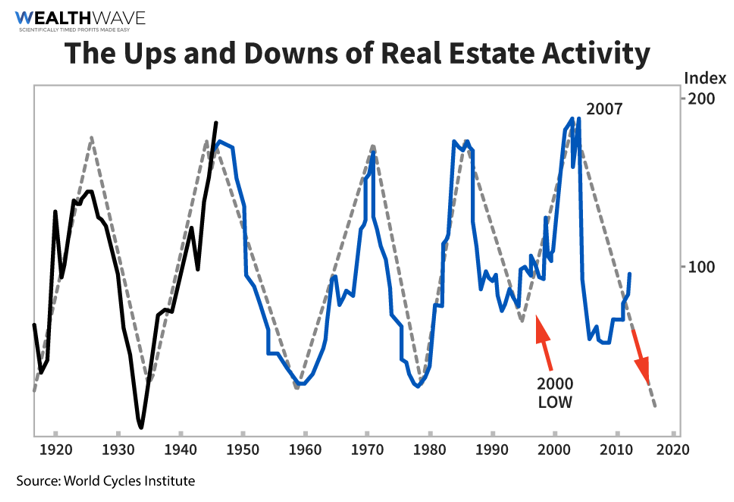

Here’s the pattern from 1920 through 2015. See how regular it is? If you’re smart, you buy a home at the bottom … but not at the top.

We had a bottom around the year 2000 and a top around 2007 … associated with the subprime crash.

The market bottomed again in 2011, and it’s been rising ever since, once again outpacing incomes.

But unlike the real estate boom that led to the Great Recession, this isn’t being fueled by a failure in lender ethics. It’s the normal battle between supply and demand.

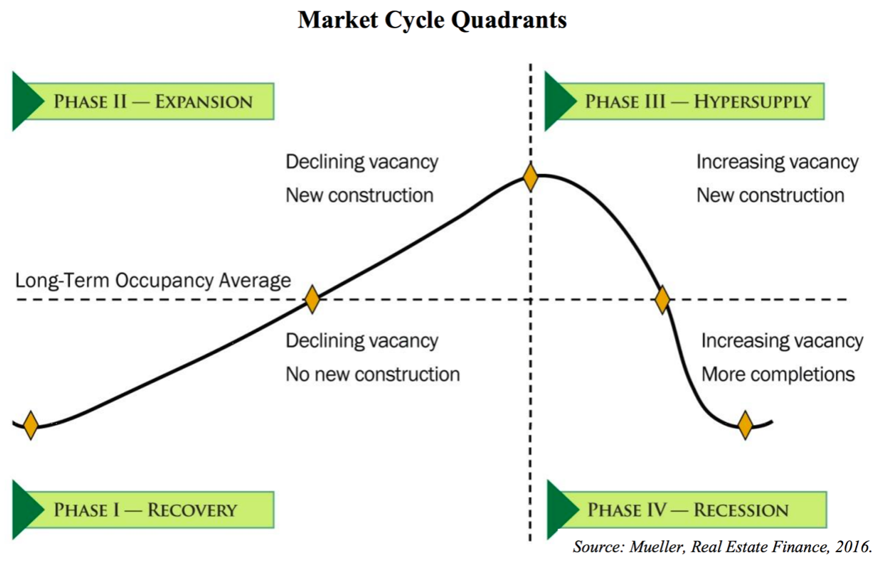

And every cycle goes through four phases …

Phase I: Recovery

In this phase, following a recession, there is a low demand for housing and high vacancy rates. This is a good time to buy properties at rock-bottom prices. The last recovery period (after the Great Recession) was roughly between 2010 and 2015.

Phase 2: Expansion

This is the environment we’re in today (in most locations). There is higher demand for housing and prices are rising rapidly. New construction begins again and there is “flipping” in the single-family market … supported by low interest rates.

This can be a great time to refinance.

Phase 3: Hypersupply

Eventually we see a tipping point. Construction slows as inventory remains high while demand lessens. Prices peak, and then start to fall. We’re actually seeing this situation unfolding in certain locations now.

Phase 4: Recession

We then enter a recession (or depression). As businesses close and unemployment rises … prices, rental demand and new construction plummet. Mortgages, loans and credit cards increasingly default. Foreclosures increase. Real estate prices bottom.

While we may see the expansion phase continuing a while longer, timing the market is extremely difficult.

And there are worrying distortions …

With the Federal Reserve and other central banks printing money like there’s no tomorrow, we have the lowest interest rates in history. That only encourages investors to keep buying … driving prices ever higher.

At some point, there won’t be enough buyers paying the higher prices … leading to a pullback, if not an outright crash.

Plus, moratoriums on evictions and foreclosures will have to be lifted eventually. If homeowners can’t sell (or refinance), we’ll again see a spike of foreclosures and homes flooding into the market.

Pay careful attention to the real estate market, the stock market and the overall economy. The central banks have created an extreme bubble and bubbles always burst eventually.

So, if you’re thinking about buying a home now … don’t wait too long.

Or consider waiting until the bubble pops and get in at the bottom.

But as the saying goes, it all depends on location … location … location!

I’ll explain more in a future article.

All the best,

Sean