Solar stocks are heating up lately for a good reason. The government’s throwing mountains of money at them.

Now, my philosophy is that when the government throws cash at something, it’s time to grab a bucket and scoop some up. And that sure applies to solar right now.

So, why is solar so hot?

One force behind it is the recently-passed Inflation Reduction Act. Along with new and extended tax credits for electric vehicles and other useful clean energy measures, the Inflation Reduction Act includes $260 billion in new and extended clean-energy tax credits to incentivize energy companies and public utilities to produce more solar, wind and hydropower energy.

And it’s likely government investment in green energy is far from over. Analysts say that over the next 30 years, the U.S. needs to invest an estimated $4 trillion to cut greenhouse gas emissions and help out the environment.

And research from Energy Information Agency shows that the climate and clean energy provisions in the Inflation Reduction Act may help the U.S. cut its greenhouse gas emissions by about 40% by 2030.

That’s a good step but not nearly far enough, especially as the Biden administration’s goal is to cut U.S. carbon emissions by at least 50% by the end of the decade.

So yes, I believe the government will throw more money at the problem.

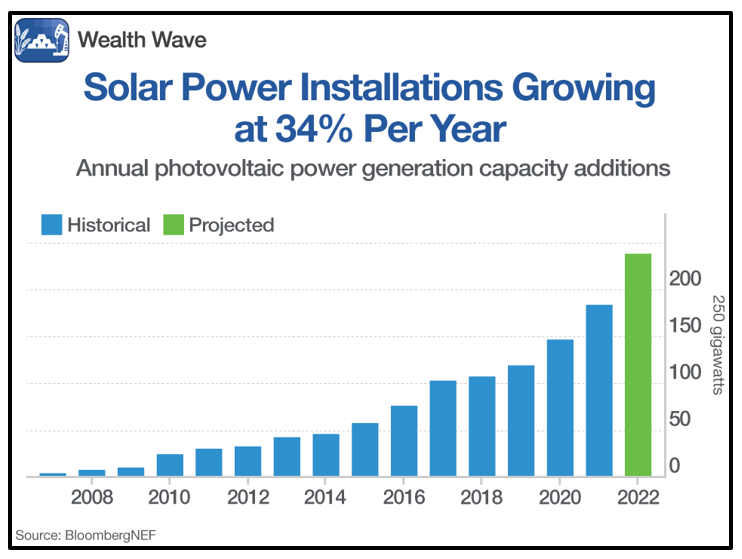

And that’s not all. The fact is, solar was growing by leaps and bounds anyway. Bloomberg New Energy Finance reports that since 2007, annual installations of photovoltaic power generation have grown from 22 gigawatts to about 240 gigawatts expected this year. That’s a compound rate of 34.5%.

That also means that it’ll take just a little for annual solar installations to double! And the pace of installations isn’t expected to slow until the middle of the century.

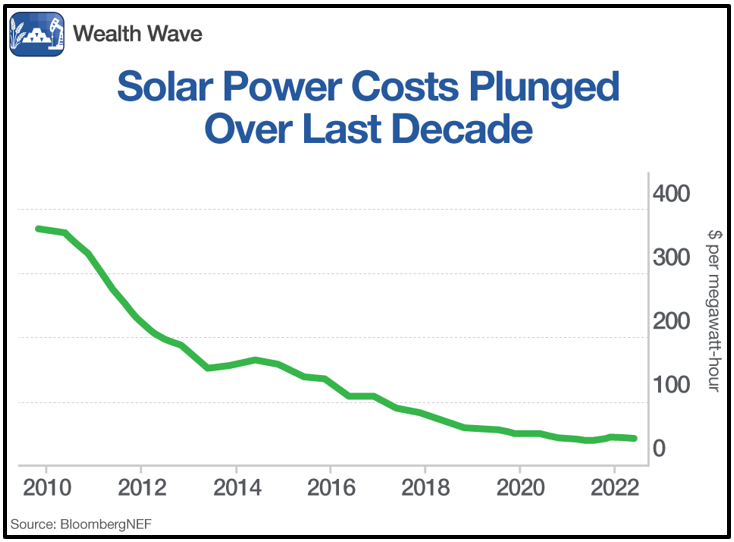

There’s a good reason solar is popular. It’s getting cheaper, and more people are getting more bang for their buck.

Solar costs less than electricity from coal or natural gas. And while the above chart shows that the price decline has flattened out, it’s not hard to imagine that the next generation of solar cells will be even more efficient.

Now, one thing that solar is missing is ample battery storage to keep the lights on at night. But I expect that to change going forward. That’s another great area of opportunity for investors.

So, how should you play the solar boom? The obvious choice is the Invesco Solar ETF (TAN). It has more than $3 billion in assets under management, trades about a million-and-a-half shares a day, so it’s very liquid and has an expense ratio of 0.66%.

Top holdings of this fund include Enphase Energy (ENPH), SolarEdge Technologies (SEDG) and First Solar (FSLR). All strong names in the photovoltaic industry.

Let’s look at a weekly chart of TAN:

This weekly chart shows that TAN bottomed in March and has zigzagged higher since then. It’s approaching overhead resistance. If it can break out, I expect it to move to $122 a share rather quickly.

As I said, I expect the government to direct more money at renewable energy. So before that happens, get your bucket and get busy. As always, remember to conduct your own due diligence beforehand.

Lastly, another way you can get more bang for your buck is by checking out my service, Wealth Megatrends. If you enjoyed reading this issue, I’m sure you’d like to join members of that service who are sitting on open gains of 21%, 18% and 16%!

All the best,

Sean