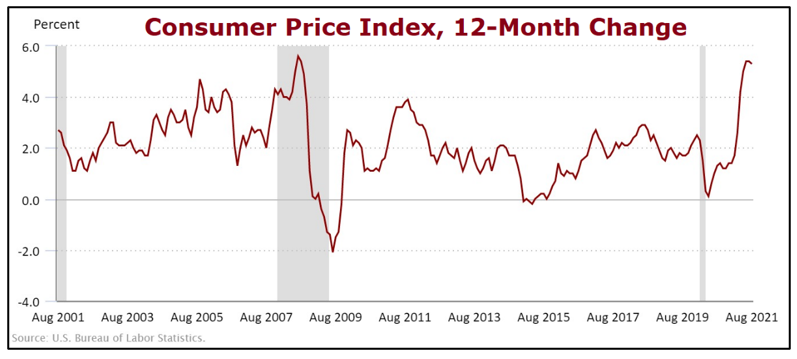

In July, I wrote a column explaining why inflation would be hotter and last longer than the “transitory” malarkey Fed Chair Jerome Powell and President Biden were selling. Let’s see how that went:

As you can see, consumer inflation is running at 5.3%, just off a 13-year high that was set the previous month!

So what happens next?

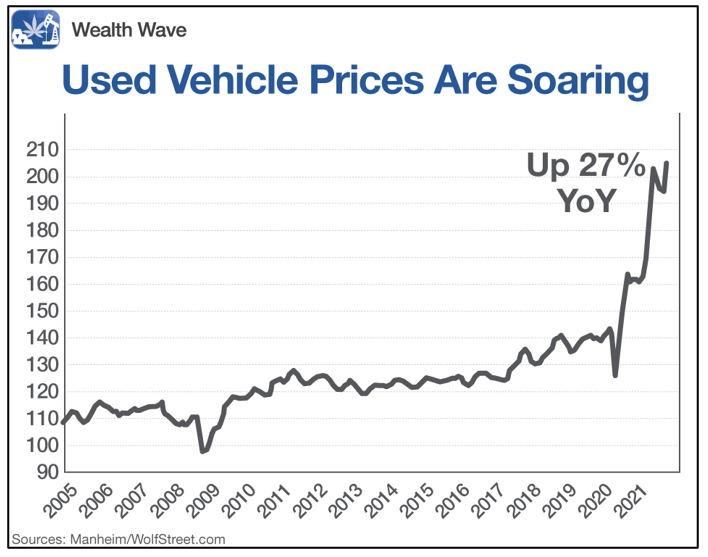

Well, a bellwether for inflation has been used car prices. Let’s look at a chart of those:

Holy Hot Wheels, Batman!

According to vehicle wholesaler Manheim, the largest auto auction operator in America:

• Used vehicle wholesale prices spiked 5.3% in from August to September — a new record.

This spike more than wiped out a couple months of declines that gave some people false hope that the escalation in used car prices was over.

In hard numbers:

• Over the first nine months of the year, the average resale value of a one-year-old vehicle jumped by 25%, or by $7,759.

• Manheim’s index is now up 27% from September a year ago.

• And as prices went up, sales fell 10% year over year.

Yet demand remains strong, and Manheim believes wholesale demand will likely stay high through October.

And it’s not just car prices.

Lumber prices are rising again … agricultural prices from coffee to oats are rising … and no wonder, because fertilizer prices are soaring as natural gas, a fertilizer input, hit a multi-year high.

This past week, oil prices hit a seven-year high. Computer chips are in short supply … one manufacturer after another is talking about tight supplies squeezing profit margins.

Eventually, those higher prices will be passed along, meaning more inflation is coming … and it’s coming for your wallet.

But there could be a reprieve for investors.

One way to beat inflation is to invest in things that are going up faster than inflation. For example, energy stocks are rising, but still cheap as I explained in another recent column.

There are many good energy industry funds. But you can’t go wrong with the good ol’ Energy Select Sector SPDR (NYSE: XLE), the largest energy exchange-traded fund (ETF) in the world.

Let’s look at a performance chart comparing the XLE to the S&P 500 over the last three months:

As you can see, volatile energy stocks are on a bit more of a wild ride than the S&P 500. And we’ll probably see more volatility going forward.

• But you can’t argue with the fact that over the past three months, the XLE is up 10.3%, FIVE TIMES BETTER than the 1.85% gain in the S&P 500.

You can drill down inside the XLE to find individual stocks. My paying subscribers are already riding this big trend, and we’ll be adding more names, too.

To protect your own pocket against inflation, consider shifting into high gear and buying stocks in the inflation passing lane.

There’s a lot more coming, and it’s coming on fast.

All the best,

Sean