Governments and central banks will do everything they can to keep their economies sputtering along. The primary way is to keep printing money.

Of course, that only adds to the debt …

Which becomes so large, even the interest on the debt becomes unmanageable.

So, what do central banks do?

They keep interest rates near zero as long as they can.

But that only kicks the can further down the road.

What ELSE can they do?

Deliberately create inflation.

Why?

Because inflation is a sneaky way to reduce the deficit.

When you inflate the dollar, you wind up paying off your debt with money that’s worth less than it was when you incurred it.

Suppose you bought a car for $20,000 today and promised to pay for it next year. If you could deliberately trigger 50% inflation, you’ll wind up paying only $15,000.

Clever, isn’t it?

That’s why Federal Reserve Chair Jerome Powell is following a policy that could be summed up like this:

“Inflate or die!”

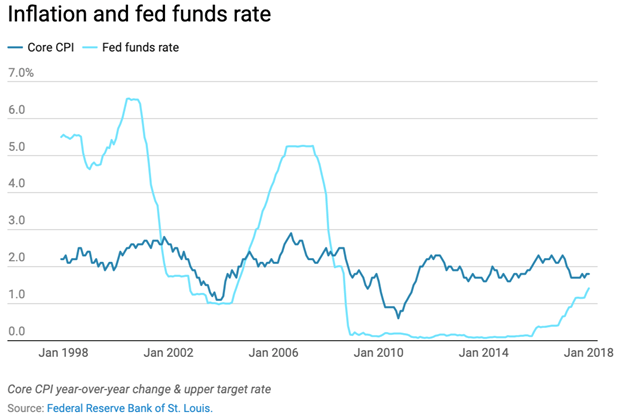

To trigger inflation, Powell has promised not to raise interest rates — via the “federal funds rate” — for at least two years.

Here’s how this “works” …

When interest rates are low, people and businesses demand more loans.

Each bank loan increases the money supply in a fractional reserve banking system.

A growing money supply increases inflation, as measured by the Consumer Price Index (CPI). Thus, low interest rates tend to cause more inflation.

Powell’s goal used to be 2% inflation.

But now he’s willing to allow even higher rates of inflation before he taps the brakes by raising interest rates.

But rising inflation — especially when the overall economy is turning up — is like opening Pandora’s Box.

Once you crack the lid open, you could suddenly get much more than you wanted.

A campfire of inflation quickly becomes a forest fire of economic destruction.

And when inflation gets out of hand, the government will do everything they can to stop it.

Everything wrong.

But as I’ve shown …

The inflation cat is already out of the bag.

A conflagration of runaway inflation is coming. And it’s going to be worse than anything we’ve ever seen! What will the elites do then? I’ll tell you right here next week, so keep an eye on your inbox.

I’ll also be watching this situation like a hawk — and giving timely insight — in my monthly letter, Wealth Megatrends.

Whatever ultimately happens, it’s up to you to fight back.

All the best,

Sean