Man, oh man, we have seen one Fed governor after another trot out to tell us that inflation is “transitory.”

Many Wall Street bigwigs are singing from the same hymnal. To which I can only ask, “What are these guys smoking?”

Let me show you a series of charts that show inflation isn’t just here … it’s going to stick around for a while.

It may even get worse. And you should DEFINITELY adjust your portfolio to protect against it — and even potentially profit.

First, are we having inflation? Heck, yeah! The Fed watches a version of “core” inflation, right?

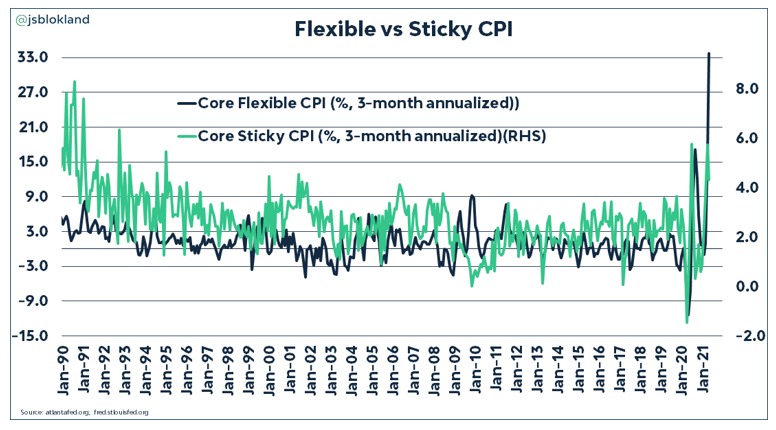

Here’s a chart showing “flexible” core Consumer Price Index (CPI) — which includes gasoline, cars, food and shoes — and “sticky” CPI, things like car insurance, alcohol, restaurant food and medical care.

This is the first problem for the Fed’s narrative. Both of these numbers are soaring. “Flexible” CPI is up a stunning 33% annualized over the last three months. And “sticky” core CPI jumped 4.3% in May — the fastest in 25 years!

So yeah, we’re having inflation. The Fed says it will calm down by the end of the year … but I’ll give you three reasons why the Fed is either fooling itself or trying to fool you.

Inflation Driver 1: Gasoline

I’m going to talk about gross domestic product (GDP), but we’re going to take a side road through gasoline to get there. The price of gasoline is red hot. How hot?

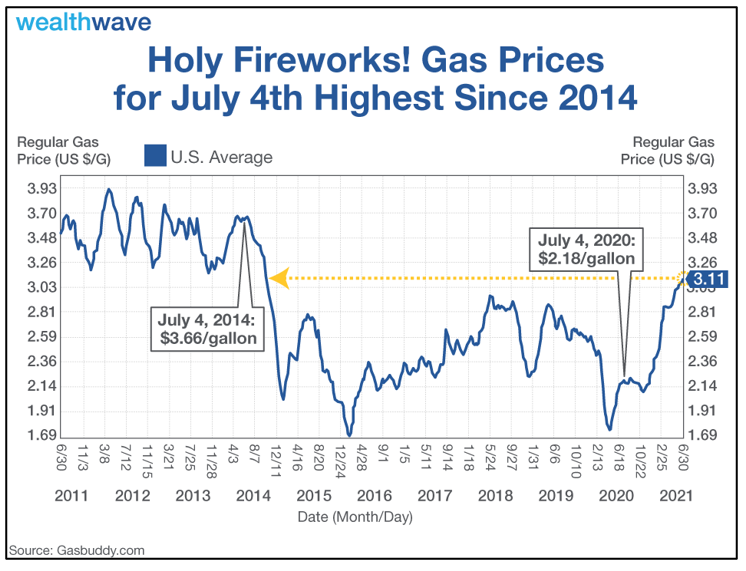

As this chart from GasBuddy.com shows, the price of gasoline is at its highest level since 2014! Ouch! Are those fireworks, or is my wallet immolating at the gas pump?

So, what does this have to do with GDP? Well, you see that dip in gas prices last year? Heck, it seemed like refineries couldn’t give fuel away! What changed between now and then? I’ll tell you what happened: The pandemic eased its death grip on America’s economy, and GDP growth blasted off. It grew 6.4% in Q1 2021.

In fact, America’s economy is projected to grow between 7.4% (according to the Congressional Budget Office) and 8% (according to The Goldman Sachs Group (NYSE: GS)) this year. That’s the fastest in decades!

So, for gasoline prices to go down, the economy has to hit the brakes. Growth will slow down. Eventually. But gasoline demand — well, it’s probably going to remain high, barring another COVID lockdown.

Bottom line: This “flexible” CPI input may prove to be a lot more sticky than the Fed is expecting.

Inflation Driver 2: Home Prices

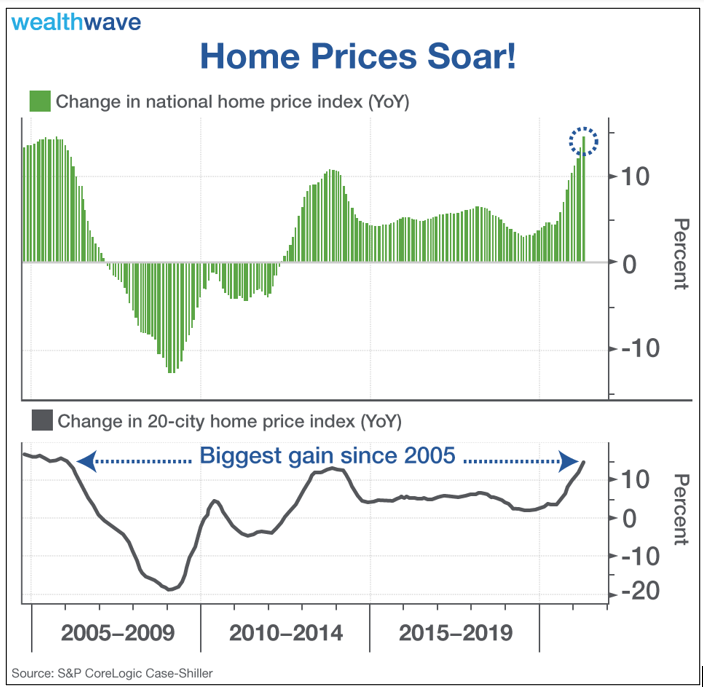

My wife and I are in the process of trying to help our daughter buy a home. But we can’t. We keep getting outbid by people with more money than sense. We’re not alone. Home prices are soaring as every Tom, Dick and Blackrock rushes into real estate. And look what that is doing to real estate prices.

It’s the biggest ramp-up since 2005. I can’t blame investors. Real estate looks like a good investment compared to overvalued stocks. That’s why home prices continue to jump, up 8% in May alone.

Home prices are one of the “sticky” CPI inputs. They don’t fall a lot unless there’s a crash. Is anyone betting on a real estate crash in the next year or two? Wall Street says this mania could last a while.

Inflation Driver 3: China!

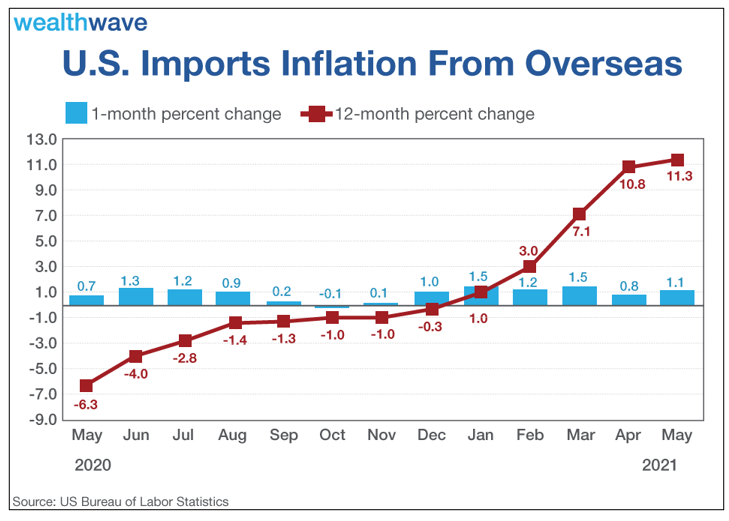

A lot of the junk we buy is imported from overseas, from China and elsewhere. And that’s a problem for anyone who wants to sell us on inflation being “transitory.” Because the prices of imported goods are soaring, too — up 11.3% year over year.

Prices for goods imported into the U.S. increased 1.1% month over month in May. But on an annual basis, that change is 11.3%!

Producers don’t want to raise prices. But at some point, they’re forced to pass along the costs of rising inputs — copper, steel, aluminum, energy and more.

So, the world is now in two cycles. One is seeing rising economic growth. The other is inflation that goes along with it. I wouldn’t expect either to hit the skids anytime soon.

That’s why the Fed is wrong. Inflation is going to stick with us — and stay hotter — for longer than the Fed admits.

How You Can Protect Yourself … and Profit

Rising commodity prices fuel inflation, and companies leveraged to those commodities can do very well in inflationary times. I’m talking about energy, but also copper … steel … gold … silver!

You should be buying companies that will do well as prices go higher. Here’s good news. Some — like gold miners — are actually in the bargain bin right now. A bunch of them are tracked in the VanEck Vectors Gold Miners ETF (NYSE: GDX).

I know, I know … the market hates gold now. It hates miners even more so. That’s why gold and miners are the contrarian play you should be picking up. Especially with inflation hot and getting hotter.

It’ll give you protection in your portfolio … and might even provide some profitable fireworks.

It’s something to think about. Stay safe this Fourth of July, and have a wonderful holiday.

All the best,

Sean