The war in Ukraine isn't about Ukraine.

It's about Putin wanting to resurrect the Soviet Union and trample the West along the way. And he's getting his schoolyard bully friends to help.

The war cycles told us this was coming. Now I'm going to tell you what's coming next.

With Russia's invasion of Ukraine, I'm afraid we could be witnessing a prelude to what could be the most dangerous geopolitical crisis since World War II.

I am not an alarmist, a fearmonger or a doomsdayer.

I am merely a student of history ... of human behavior ... of markets ...

And of the cycles that drive them all.

The situation is this ...

- A new "axis" — China, Russia and Iran — would like to see America laid out flat.

And with China still buying Russia's oil, the country is funding Putin's war chest.

But right now, it's Russia that's giving the world an upset stomach.

Because Vladimir Putin's invasion of Ukraine is only the next step towards his ultimate dream to ...

Recover the Soviet Union

Even before the war in Ukraine, Russia's economy was suffering.

And now, because of accelerating U.S. sanctions, it's hanging by a thread.

But unlike, say, Germany, Russia can only extract a limited amount of money from its impoverished people.

So, it's salivating at the tax revenue it could generate by reclaiming — through intimidation or outright invasion — the peoples of the former Soviet bloc ...

Along with the natural resources and supply routes that would accrue.

Plus, Russia sold $81 billion of Treasury bonds and notes between March and May of 2018 alone. A stunning 84% of its total US debt holdings.

It's now a measly $2.4 billion. Why?

- Because there's no way Russia would tie up that much of its national wealth in the financial assets of a "hostile" power.

It's also why they've diversified their national reserves with gold bullion to record levels.

Meanwhile in Asia, the U.S. and China are squaring off (again) over the South China Sea. And the smoldering bonfire that is the Middle East threatens to ignite any day.

- I hate to say it, but one of the most bullish trends right now is war.

This is something Martin and I have discussed in detail. It's called the war cycle, and it's on an upswing right now.

While there's nothing we can do as armies prepare to wreak havoc around the globe, we can protect our portfolios.

- We can invest in defense ... to play defense.

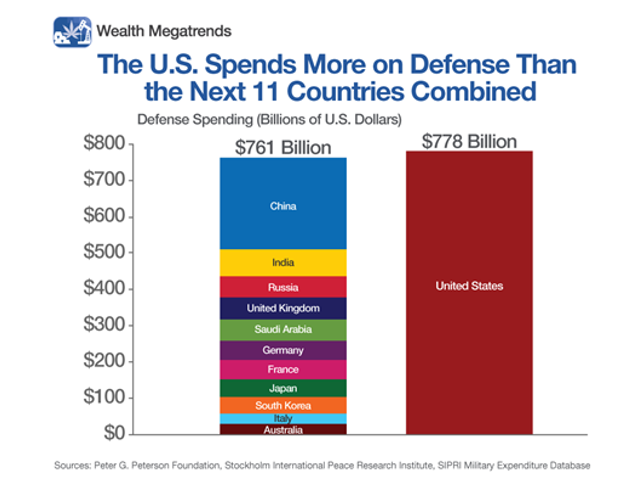

The U.S. has a vested interest in maintaining military superiority, and Uncle Sam puts his wallet to work. In 2020, the country's military spending eclipsed the next eleven countries combined.

It's not surprising that the defense industry has deep ties with the government. In fact, it bankrolls over 700 lobbyists per year — more than the total number of senators and representatives in Congress.

- Over the last 20 years, defense companies spent $285 million in political campaign donations and over $2.5 billion to influence policy decisions.

This year, President Biden's budget calls for $753 billion in military spending, or about 50% of the country's total discretionary budget. That breaks down to the Pentagon using more than $2 billion per day.

- And now that war has broken out, we should see a major boost.

My Wealth Megatrends subscribers were recently up as much as 11.7% on a major defense contractor I recommended on Feb. 18 … just before Russia's invasion of Ukraine.

With the war cycle strengthening, it stands rise much higher.

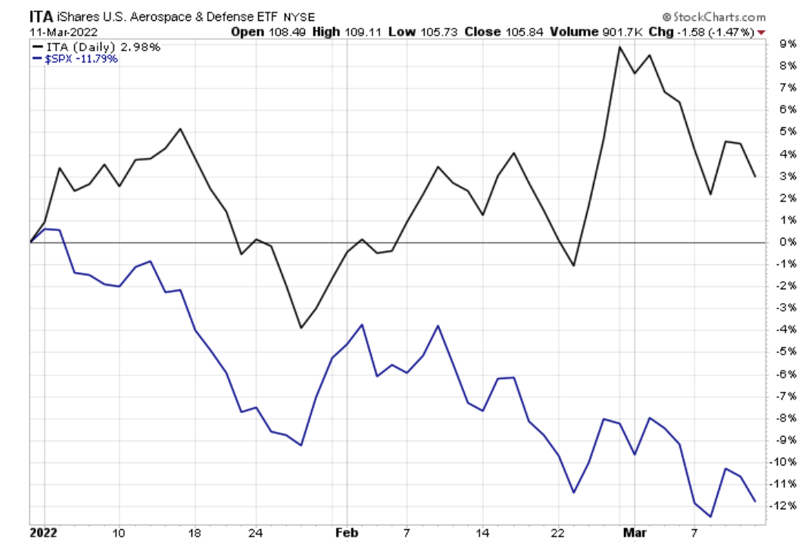

Another way to play the war cycle is with the iShares US Aerospace & Defense ETF (ITA), whichshould reward investors handsomely going forward as it already has since the start of the year.

ITA is up 11.5% since bottoming in December 2021.

Nobody wants war, but if it's inevitable, investors would be wise to look for potential profit in the wake of global unrest.

As always, be sure to do your own due diligence before entering a trade.

All the best,

Sean