U.S. cannabis stocks suffered a calamitous January, down 21% for the month through Jan. 28.

Even worse, the AdvisorShares Pure U.S. Cannabis ETF (NYSE: MSOS) swooned a whopping 63% from a year ago!

Great ganja, Batman!

Then, starting late last month, cannabis stocks bounced and bounced hard. Now, they’re testing important overhead resistance at the 20-day moving average.

Is this just a dead cat bounce, or the start of something bigger? And more importantly, how can you profit? Today, I have the scoop for you.

So, what happened?

Cannabis stocks have sold off for a year because they’re seen as speculative stocks that are waiting on Federal legalization …. an effort that has become mired in the swamp that is the U.S. Senate.

All ain’t lost, though. Let me tell you about seven bullish forces for cannabis stocks right now …

Force No. 1: Cannabis Banking

Part of legalization is the Secure and Fair Enforcement (SAFE) Banking Act.

The SAFE Banking Act would provide protections to financial institutions and various other professional service firms doing business with state-legal cannabis businesses, shielding them from any associated federal liability.

The House passed SAFE five times … but it never made it through the Senate. A lot of that is due to Senate majority leader Chuck Schumer, who insists that comprehensive legalization, including his social equity measures, needs to pass first.

The good news? The SAFE backers are going to try again, and we should see a floor vote this week! And they have Republican backing. Some Republicans, sick of Schumer’s foot-dragging on the issue, have their own legalization bill.

I’d say the Federal shackles on canna-business are coming off sooner than later.

Force No. 2: Economic Boost

Everyone likes economic growth, right? As of 2021, the legal marijuana industry in the U.S. employed around 321,000 people. That’s according to the 2021 Leafly Jobs Report produced jointly with Whitney Economics.

- That’s more cannabis workers than electrical engineers, paramedics and dentists.

Cannabis means more than jobs. A recent study by Deloitte says that cannabis has boosted Canada’s gross domestic product (GDP) by $43.5 billion since it was legalized in October 2018.

That’s a lot of poutine, eh?

The report goes on to say that for every dollar in revenue or capital expenditures, the industry adds about $1.09 to Canada’s GDP.

Well, the U.S. has 8.6 times the people that Canada does … and our economy is 15 TIMES that of our northern neighbor.

I’m not saying that we’ll see 15 times the economic boost from legal cannabis that Canada does. But if the fossils in Washington want to keep America’s economy rolling along, they’ll legalize sooner than later.

Speaking of money …

Force No. 3: Marijuana Tax Revenue

Sales of cannabis are generating large amounts of badly needed tax revenue for states.

- As of December, states that have legalized cannabis have raked in more than $10 billion in “weed taxes.”

You can bet states that haven’t legalized yet are green with envy.

Force No. 4: People Power

Forget those do-nothings in Congress. Thanks mainly to people-powered ballot initiatives, nearly half of the U.S. population now lives in states where adult-use cannabis is legal (or will be legal) in 2022.

Last year, five states — Connecticut, New Jersey, New Mexico, New York and Virginia — enacted laws legalizing and regulating the market.

This year, Rhode Island, Delaware and Maryland are likely to legalize recreational use, while North and South Carolina, Kansas and Mississippi may legalize medical marijuana.

Sure, the legal cannabis industry still is thwarted by federal policy. The Feds limit everything from banking availability to multistate advertising.

Still, legal U.S. cannabis sales grew about 38% last year and “canna-biz” is poised for tremendous growth in 2022.

Force No. 5: Senior Smokers

A surprising amount of marijuana users are senior citizens. The most recent data shows the proportion of adults 65 or older who reported recent cannabis use jumped by 18%. This is possibly signaling a cultural shift.

- Why is that important? Because old people vote.

Refer back to Force No. 4 to see how that might change the game.

Force No. 6. Rip-Roaring Growth

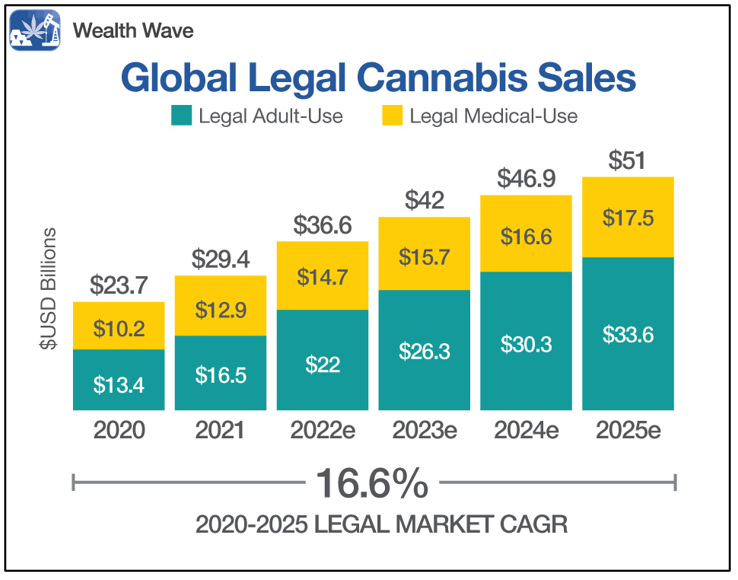

Most of the global legal cannabis use occurs in North America, and most of that in the U.S. (sorry, Canada and Mexico). So, the latest from New Frontier Data grabbed me by the eyeballs:

Investors are looking for growth, and it’s hard to find an industry growing faster than legal cannabis.

Force No. 7: Red-Hot Growth AND Earnings

New Cannabis Ventures tracks revenue growth of the top marijuana companies. And …

- It recently showed that 11 of these companies are experiencing year-over-year revenue growth of more than 100%!

Well, sales are fine, but in an age of value, it’s earnings that matter, right? Sure. Trulieve (OTCQX: TCNNF), one of the largest U.S. cannabis companies, saw earnings grow 87% last year. Terrascend (OTCQX: TRSSF) enjoyed 137% earnings growth. Jushi Holdings (OTCQX: JUSHF), another big one, saw its earnings grow an 89% last year, and analysts expect its earnings to jump another 242% this year!

- The fact is earnings are becoming more common in the better cannabis stocks.

And Trulieve trades at 24.7 times forward earnings. I’m not saying it’s cheap. But after January’s beatdown, it’s cheaper than it used to be. Some might consider it a bargain.

Sure, individual stocks can be as volatile as dynamite suppositories, but that’s why exchange-traded funds (ETFs) like MSOS exist. However you choose to play it, if you’re looking for value in an overinflated market, select cannabis investments deserve another look …

- Because cannabis stocks have gone to hell in a handcart this past month. Now, if you look around, you can find real jewels in the dustbin.

Best wishes,

Sean

P.S. If you’re interested in Cannabis bargains and their amazing upside potential, you should tune in to my next MoneyShow presentation. It’s on Tuesday, Feb. 8, at 12:55 p.m. Eastern. You can register for FREE! Be sure to sign up HERE.