Yesterday’s quarter-point Fed rate hike was expected, and it was followed by the Fed’s statement and Chairman Powell’s Q&A session.

Those last two left traders reading the tea leaves. The general feeling is that the Fed is closing in on the end of its hiking cycle. There was lots of uncertainty. But you know what wasn’t uncertain? Gold!

Gold sold off before the meeting, pushed lower by stubbornly strong employment data, and closed lower in the COMEX trading session. But after the Fed statement — in which the Fed referred to the “extent” of future increases instead of the “pace,” a hint that it’s not far from its goal — gold in electronic trading blasted off.

Why? Because neither the Fed’s printed statement or Powell’s words can remove the pall of fear hanging over the market ... fear that drives gold higher!

Combined with a potential supply squeeze and cyclical forces that were already in play, we’re looking at gold on the launch pad.

But let’s start with the world’s central banks.

Central Banks & the Fear Trade

Central banks are worried about something.

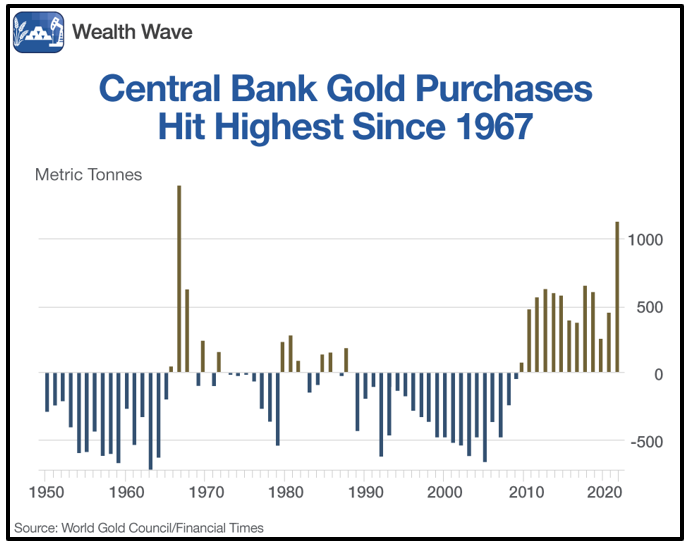

That’s the only conclusion I can reach when I see that central banks around the globe purchased more gold last year than any time since 1967.

Just take a look at this data from the World Gold Council:

Click here to view full-sized image.

The group adds that 2022’s gold buying — 1,136 metric tonnes — was a 150% increase year over year.

What’s more, central bank gold purchases in Q4 — 417 tonnes — followed a whopping 445 tonnes in Q3. Why are the central banks buying so much gold?

Inflation, sure, because gold is traditionally seen as a hedge against inflation. I’m pretty sure geopolitical uncertainty is also on the list, as the war in Ukraine not only continues to drag on, but threatens to engulf the rest of Europe.

But looming over all of this are fears about the global financial system. Governments around the world have piled up so much debt that they’re bursting at the seams with it. For instance, Japan’s debt-to-GDP ratio is a titanic 262.5%!

There is only one way out, and that’s by printing fiat currency. You can do many things with gold, but you can’t print it.

The WGC opines that it would be hard to match last year's demand in 2023, given the historical size of last year’s purchases.

Oh, yeah? Put that on my list of “predictions likely to be proven false.”

Uncertainty and sovereign debts are increasing and that’s a one-two recipe for more gold buying.

Then There’s China

The biggest news in central bank gold purchases was that China came back to the market and started buying with both hands.

The People's Bank of China scooped up gold for the first time since 2019 by adding 62 tonnes in November and December, lifting its total gold reserves to over 2,000 tonnes for the first time.

But it doesn’t just stop with the government. The Chinese culture has a historical affinity for gold. Combine that with the country’s re-emergence from its three-year-long COVID-19 lockdown and the result is major gold-buying frenzy. The Chinese can finally shop till they drop and they have the savings to do it.

Last year alone, Chinese consumers saved $2.6 trillion, or a third of their income. Before the pandemic, consumers in China saved, on average, just 17% of their income.

And over the last three years, excess savings in China reached 5.6 trillion yuan — or $827 billion. That’s according to JPMorgan Chase (JPM) estimates. So, what are they going to spend all this money on?

We know that China’s population of 1.4 billion spent $64 billion on luxury goods at home last year. That was actually a slump of 13%, as COVID-19 lockdowns toward the end of the year weighed on shopping.

Now that the Chinese can leave their homes and go to markets, what do you think they’ll buy? I’m not saying they’ll spend all that stored-up money on gold, but they’ll be buying all sorts of luxuries.

Even if they spend just some of that money buying more gold, that’s going to send global gold demand through the roof.

Where Is Gold Headed?

Since Nov. 3, gold prices have rallied roughly $300 per ounce, a gain of more than 18%. Many might think this rally is done. But the fact is, gold is still trading in the same range it has been in since April 2020.

I call this kind of sideways motion an “energy band.” When something trades like this, it’s building up energy for its next big move up or down. In gold’s case, I believe that’s up … way up.

Click here to view full-sized image.

This chart shows a two-year cycle in gold. We saw two years of a massive, 71% rally, then the yellow metal consolidated for two years, and now I believe it is headed higher to break out.

I’ve put a momentum indicator I trust on the bottom of the chart. It turned bullish at the bottom of the cycle and is getting stronger; yet another indicator of a potential breakout from this range.

My target is $2,931 sometime over the next year and a half.

To be sure, there are other cycles that push gold around. $2,931 may be a peak or it may be a signpost on the way to higher prices.

But whatever it is, you’ll want to use pullbacks to add to positions in gold and gold miners. The future for this shiny metal is very bright indeed.

Speaking of the Future

This will be my last issue of Wealth Wave. It’s been a lot of fun, and thank you for reading my scribbles. And don’t worry! Starting immediately, you will be able to find my columns in Weiss Ratings Daily each and every Wednesday morning.

All the best,

Sean