After a months-long sell-off that crunched copper prices like breakfast cereal, the metal is finally starting to bottom. You can play the next big move in this metal for a nice profit.

Why do we have this opportunity? Starting in August, trade war fears hammered copper lower. And prices are still down 15% from where they started the year — but recently started to bounce.

That’s because a funny thing happened. The trade war isn’t being reflected in actual data. In fact, spot sales of copper into China are booming.

China is the world’s biggest user of copper. While it has 19% of the world’s population and 15% of GDP, it’s responsible for an outsized 50% of global copper demand.

In fact, demand in China is up partly due to trade war fears. To stave off a cooling economy, authorities in Beijing have opened the tap on infrastructure projects and loosened credit. This one-two stimulus is lighting a fire under demand.

Here are some charts …

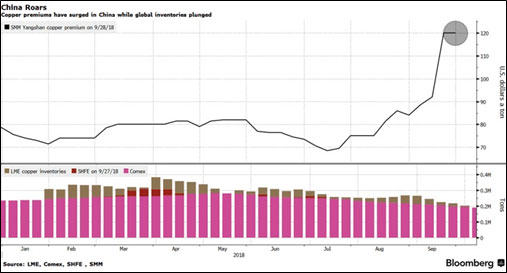

First, from Bloomberg, is a chart of the premium that copper is getting in China compared to the global benchmark price. And the bottom of the chart shows copper inventories.

You can see that the premium is skyrocketing while inventories are going down.

This is a case of the short-term trend getting back in line with longer-term forces. Longer term, due to mine closures on the one side and booming demand for copper in electric cars (and more) on the other, the world is facing a GIANT copper squeeze.

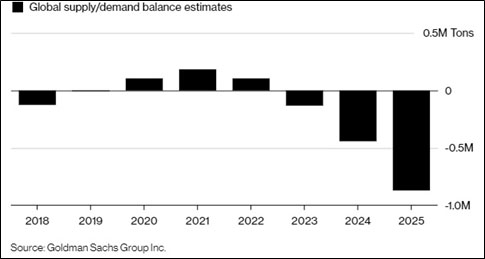

This chart from Goldman Sachs shows the forecast …

You can see that, by 2023, the world’s copper supply is projected to be in deficit. And it’s only going to get worse.

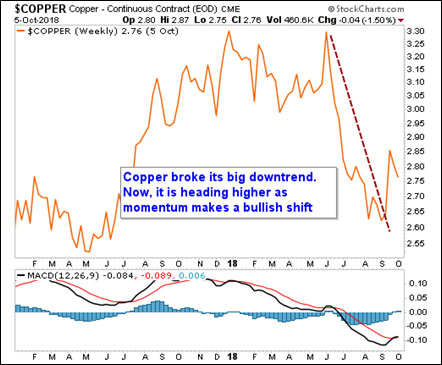

And yet, while the price of copper is up about 7% from its recent lows, it still has much more room to run …

On the bottom of the chart, I’ve put a momentum indicator called MACD. It’s good for catching big shifts in momentum. And now, MACD says copper is making a hard shift into the bull camp.

So, how can you play this?

Well, you could buy the stock of a copper producer, like Southern Copper (NYSE: SCCO) or Freeport-McMoRan (NYSE: FCX). Or, you could buy a fund that tracks copper itself. The U.S. Copper Index Fund (CPER) is one of those funds.

Here’s a year-to-date performance chart of all three …

You can see that Southern Copper, Freeport-McMoRan and the U.S. Copper Index generally track in the same direction. They haven’t rallied much yet — so you can catch the biggest part of the potential move.

So far, Southern Copper has outperformed while Freeport-McMoRan has lagged. Which one do you think will outperform going forward? I have my idea, and I’ll be sharing that with my subscribers soon enough. If you’re doing this on your own, be careful.

All the best,

Sean