Is there a metal too cheap to mine? Yes!

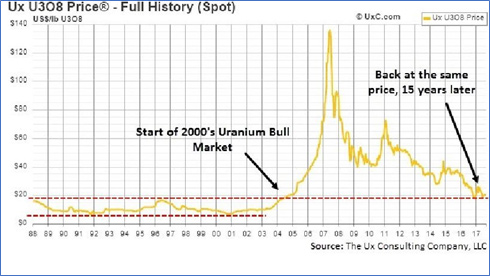

I’m talking about uranium. The price of uranium is up 28% this year. On Wednesday, it closed at $26.05 per pound. That’s the good news.

The bad news? The average production cost of uranium in the U.S. was $33.79 per pound. That’s the Energy Information Administration’s number for 2016, the most recent year available.

That’s cash costs, not all-in mining costs. The estimate for global all-in costs is between $40 and $50 per pound, depending on the deposit and how it is mined.

So, despite a 28% rally, uranium is dirt-cheap!

Too darned cheap, actually …

How cheap is it? The “Saudi Arabia of Uranium” recently shut down its biggest mine. I’m talking about Cameco (NYSE: CCJ), which closed its MacArthur River mine. A mine that provided about 9% of the world’s uranium, and was a low-cost leader.

Why would Cameco do that? Because the company lost money on every ounce it mined. And no, it couldn’t make it up on volume.

Instead, Cameco is now buying uranium out of the spot market — and turning a tidy profit. It’s buying from the huge overhang of uranium built up in the last bull market.

But here’s where things really get interesting. Cameco needs to purchase 11 million to 15 million pounds of uranium to meet its 2018 and 2019 commitments. And the average annual volume on the spot market is just 50 million pounds.

Man, that’s going to be tight. What do you think that’s going to do to the price of uranium?

I’d say the price of the white-hot metal is going to be squeezed higher.

There are a lot of changes going on in uranium. Mines shut down or curtailed, one after another. New atomic power plants coming back online. Japan switching its nuclear plants back on again, after learning the hard lessons of Fukushima. And more.

So why is this a crisis? Because 20% of America’s power plants are nuclear. We can’t afford to have this market disrupted. And yet, we’re barreling straight for a major disruption.

The fact is, we are at a cyclical low in uranium prices.

If we see a move this time that’s even a shadow of the last big bull run in uranium, we could see prices of select stocks rise 10 times … 20 times … or more.

Heck, my Supercycle Investor subscribers already own one uranium stock that ran up nearly 60% in just a few weeks … and there’s a lot more where that came from.

And that’s just scratching the surface. I could fire off a new uranium-leveraged pick at any time.

If you’re doing this on your own, you MUST be careful. Some uranium companies are great …. Others are glorified real estate companies that will throw your money down a black hole.

If you just want to buy an ETF, and there’s nothing wrong with that, the Global X Uranium ETF (NYSE: URA) tracks a basket of stocks that cover uranium throughout its business cycle, from miners, to processing, to utilities.

It should do OK. But select uranium stocks are going to do outstanding.

All the best,

Sean