This Marijuana Thoroughbred is Leaving Bitcoin in the Dust

Remember how market speculators used to be so keen on Bitcoin? Many still are. We’re just between innings, they say. And that’s fine. Heck, I play big cycles. Maybe they’re right. But while they twiddle their thumbs, there is a marijuana company that is leaving Bitcoin in the dust.

This Canadian marijuana grower is doing everything right. It is building on its successes, and it is on track to be the most successful marijuana stock in the world. No, not Tilray (NYSE: TLRY). Better than Tilray.

Yet this stock is still so early in its development that it could be a 10-bagger from here …

My Supercycle Investor subscribers own it. It’s had ups and downs … and ups again. I expect more ups to come.

I’m talking about Canopy Growth Corp. (NYSE: CGC). It has a market cap of $10.3 billion, so it’s not a flash in the pan. At the same time, it’s not making money — yet. But profits are on the way, as sure as one growing season follows another.

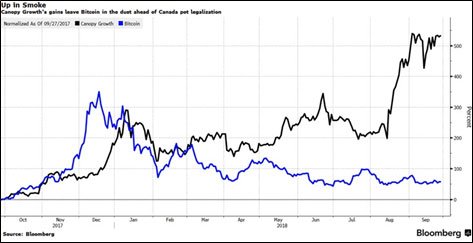

Here is a chart comparing Bitcoin and Canopy Growth. I snagged it off my Bloomberg Terminal this morning …

Canopy Growth is the top black line; Bitcoin is the bottom blue line. In the past year, Bitcoin has gone nowhere. Meanwhile, Canopy Growth is up about 484%.

And Canopy isn’t done. Far from it. Heck, Benchmark analyst Mike Hickey initiated coverage of Canopy this week with a “Buy” rating and C$100 price target. That’s $76.55 in U.S. dollars. Or about 55% higher from recent prices.

And I think he’s being too conservative.

Why would Canopy go so much higher? Well, I laid out my case for a global marijuana growth story in my recent article, “Marijuana is Bigger Than Baseball.” But let me add to that.

Let’s start with the Canadian legalization of recreational marijuana on Oct. 17.

That alone is projected to grow Canada’s marijuana market from $1.3 billion this year to $3.83 billion next year. In the next five years, the market will be 10 times as big.

But beyond that, legalization opens the floodgates of all sorts of things. Investment flows, deal activity and consolidation will all switch into overdrive as leading consumer-product companies can finally, FINALLY invest in cannabis without fear of legal retribution.

See, millennials are choosing cannabis over booze. The majority of the 55 million recreational marijuana users in the U.S. are millennials, according to a 2017 Yahoo! News poll. Most millennials use marijuana socially: Only 25% of them smoke alone.

Meanwhile, millennials drink far less alcohol than past generations. A study by the group Monitoring the Future found that alcohol use among college students fell by more than 4% from 2016 to 2017 alone.

For a beverage manufacturer, that is freaking terrifying.

So yeah, darned right, those big companies want a piece of the Canadian cannabis action. Because again, as one season follows another, they know that U.S. legalization is only a matter of time. And that’s despite the best efforts of anti-cannabis jihad warrior, U.S. attorney general — and abandoned doll who made a wish on a Monkey’s Paw — Jeff Sessions.

- Constellation Brands (NYSE: STZ) is already in. They invested in Canopy Growth.

- Molson Coors (NYSE: TAP), (Heineken (OTCQX: HEINY) and Alcanna (OTC Pink: LQSIF) have also taken the plunge.

- Even Coca-Cola (NYSE: KO) is in talks with Aurora Cannabis (OTCQX: ACBFF) about infusing drinks with CBD. That’s the non-psychoactive ingredient in marijuana that treats pain but doesn’t get users high.

I can think of a bunch more big U.S. and international companies that aren’t on this list — yet. But you know it’s coming. Those investing floodgates will open.

Next week, I’ll be telling my Supercycle Investor subscribers about more marijuana opportunities. If you’re doing this on your own, do plenty of due diligence. There are plenty of leafy turkeys out there along with the high-flyers.

But don’t wait too long. You don’t want to be sitting on your hands when this smokin’, tokin’ train — bound for profit town — leaves the station.

All the best,

Sean