There is a metal on the launchpad right now. And I’m not talking about silver or gold. Those both look good … but this metal could be even hotter.

I’m talking about copper.

Copper is said to have its “Ph.D. in economics.” We call the metal “Doctor Copper” because it takes the pulse of the global economy.

And a global economy shifting into higher gear is just ONE of the forces lining up to push copper higher.

I told you last week that the global economy grew 3.8% in 2017. That’s the fastest rate since 2011. Looking forward, global GDP growth could hit 4.1% in 2018.

Well, when it comes to demand for copper and GDP growth, there is a correlation of 0.99%. That’s so close that the skinniest of supermodels couldn’t squeeze between them. So, increasing GDP makes copper demand goes zoom!

And some economies use copper more intensively than others. Emerging markets, like China, tend to use more copper per unit of GDP than developed countries like the U.S. or those in Europe.

Well, guess what: China already accounts for half the world’s copper demand. And China’s copper use is expected to rise at the same time that country lowers its own production by clamping down on highly polluting industries.

Now, let’s add to that the fact that China is pursuing a Made in China 2025 Initiative that looks to drastically upgrade its industry. This includes smart factories, “green” manufacturing, a more advanced railway network and more.

That’s going to require even more copper.

And what about supply?

Declining grades, rising costs, water and other environmental issues have resulted in snowballing problems for copper mines. Not to mention stricter regulations. So, last year, global copper mine production went down for the first time in 12 years. The difference was made up in scrap.

This year already, there’s been so much turmoil — from mines in Chile all the way to suppliers in Africa — that any forecast is just a good guess.

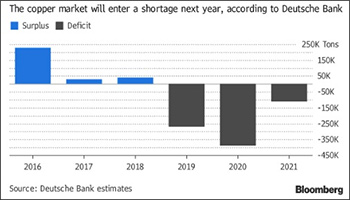

Still, most forecasts are for copper prices to rise into year’s end. And that’s before the big squeeze of reduced supply and higher demand starts next year.

A chart from Bloomberg and Deutsche Bank paints a picture of a potential squeeze …

Longer-term, the situation is only going to get worse. There’s a new long-term force on the market — the electric vehicle megatrend I keep telling you about.

An electric car can use three to four times as much copper as one with an internal combustion engine. Add in all the charging stations, and an upgraded power grid to handle it, and this can be a tremendous boost in demand.

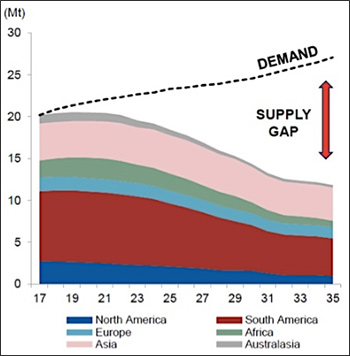

So, we’ll have higher demand. Supply is in a squeeze. And that adds up to this chart from analysts at CRU …

CRU says that more than 200 mines will run out of mineable copper ore by 2035. That will leave a huge supply gap. In fact, if this forecast is correct, demand will exceed supply by 15 million metric tons by 2035.

But let’s deal with the short term. How you can invest.

Copper had a good run in 2017, despite a few bumps in the road. It closed out the year up 39% to reach a four-year high of $7,259 per metric ton. It has dipped a bit since then. Recently, copper traded at $6,884 per metric ton.

A pullback isn’t unusual. Nothing travels in a straight line. The next surge could be a doozy. Indeed, this might just mean you have a great opportunity to get in cheap.

Indeed, Mining.com predicts copper could hit $7,800 by the end of this year and keep on climbing into 2019. Goldman Sachs is even more bullish. The big bank says copper will hit $8,000 per metric ton this year.

So, what should you be doing?

You can play this through the iPath Bloomberg Copper Subindex Total Return ETN (NYSE: JJC). It tracks the price of copper, and this ETF is liquid enough to invest in.

Or you could buy junior miners that are leveraged to the metal. When the supply/demand gap looms, big miners will come knocking on the doors of junior copper explorers. And they’ll pay top dollar for great projects.

In any case, the future looks shiny for copper. Be sure to load up BEFORE it blasts off.

All the best,

Sean