Your Next Best Chance to Ride the Wild Commodity Bull Is Here

Commodities went on a tear in the last year — oil, gas, copper, nickel and more.

If you’re like many investors, you didn’t notice that commodities were surging until well after the surge started. Maybe you held off buying, waiting for a pullback, only to see commodities as a group keep charging higher! Rats!

Well, nothing moves in a straight line. This past week, oil prices tumbled and dragged a lot of industrial commodities lower. And now — NOW — we’re finally getting to a buy point.

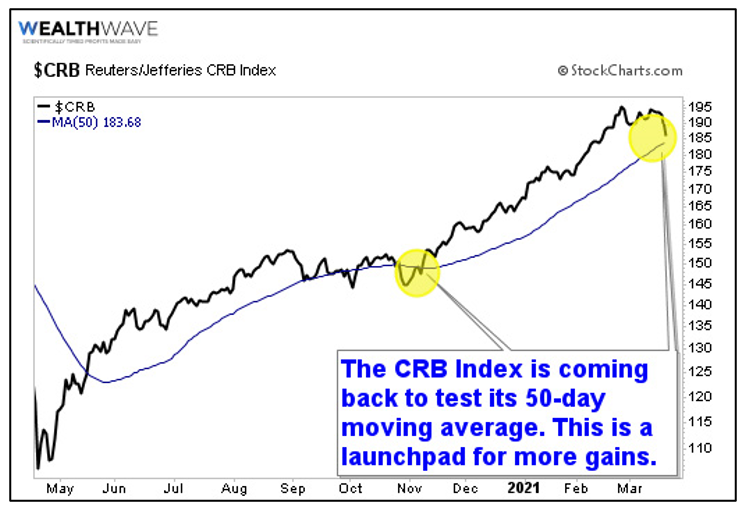

Take a look at a chart of the CRB Index. In case you don’t know, that’s a basket of 19 commodities. 39% of the CRB’s basket is allocated to energy contracts, 41% to agriculture, 7% to precious metals and 13% to industrial metals.

You can see that the CRB Index is coming back to test its 50-day moving average. The 50-day MA is important in technical analysis; it’s the dividing line between bull and bearish markets in the intermediate term.

The last time the CRB bounced off its 50-day moving average, it rallied for another 30%. Meanwhile, the stocks of companies that were leveraged to select commodities blasted off!

Sure, the CRB spent seven weeks playing slap and tickle with its 50-day moving average the last time before the blast-off. That’s a long time. There’s no telling how long it will take this time around. My guess is shorter. Maybe a lot shorter.

We need to know WHY the CRB — and commodities — are pulling back. There are two main reasons.

1. Fear of Inflation

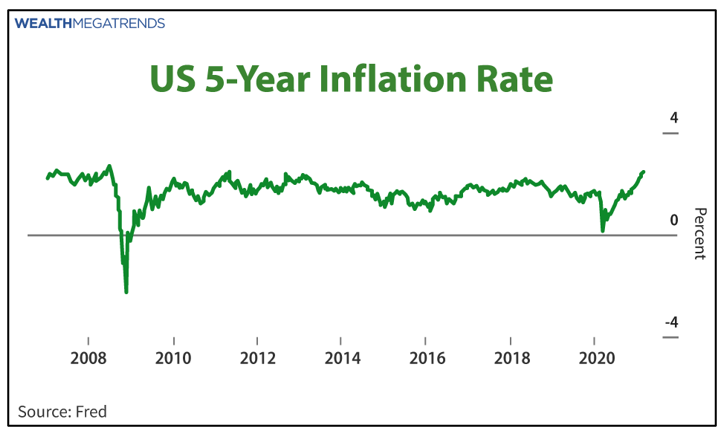

Inflation fears are running at a five-year high, as this chart I sent my Wealth Megatrends subscribers shows …

Expectations are everything in this market. Investors worry that a surge in inflation will choke economic growth … though real inflation isn’t that bad yet. The rate of inflation over the past 12 months moved up to 1.7% from 1.4%. Historically, that’s not that high. Heck, we had higher inflation at the beginning of last year.

To be clear, I strongly believe we’ll have inflation. I just don’t think it’s worth panicking about.

So, this frenzy of worry may pass rather quickly. However, inflation is stoking bond yields, and that’s part of the next problem …

2. The Rising U.S. Dollar

This week, the 10-year U.S. Bond yield went to a 13-month high above 1.7%. Again, that’s not high historically. But expectations are that yields will go higher, to about 2%.

This is due in part to the Fed’s announcement this week that they weren’t worried about inflation and wouldn’t mind if inflation ran above the Fed’s stated target of 2%. That’s because inflation has run below the Fed’s target for years.

The market takes the Fed’s easy money policy as a guarantee — as much as anything can be in this wild market — that inflation WILL go higher. This helped trigger a bond sell-off. As bond prices go lower, rates go higher.

When U.S. rates are rising, the U.S. dollar goes higher. That’s because higher yields make it more attractive compared to other currencies.

Meanwhile, there’s another force buoying the dollar. Economic growth. The Paris-based Organization for Economic Cooperation and Development (OECD) says it now expects global output to rise above pre-pandemic levels by mid-2021, and it credits the Biden stimulus for a lot of this.

The OECD raised its world-growth forecast for 2021 to 5.6% from 4.2% and more than doubled its prediction for the U.S. to 6.5%.

As the global economy picks up steam, companies and countries around the world want to do more trade. To do that, they need dollars, because the dollar is the global reserve currency.

What’s priced in dollars? Pretty much everything, but especially commodities. As the dollar goes higher, commodities tend to go lower.

This should balance itself out, and again, sooner than later. And that’s when commodities will head higher again.

How You Can Play It

You could buy individual commodities, or the stocks leveraged to them. But if wanted to ride the whole big bull, you could buy the iPath Bloomberg Commodity Index Total Return(SM) ETN (NYSE: DJP). DJP tracks the CRB Index pretty closely …

Indeed, the DJP already tested its 50-day moving average and looks poised to head higher. Is it leading the CRB Index? Come along for the ride and find out.

The next move higher in commodities could be explosive. Thanks to an economic boom coming out of a global pandemic, thanks to low prices for years that have squeezed supply and thanks to an exploding global middle class. This could be BIG. You won’t want to miss it.

All the best,

Sean