The Next Oil Crisis Looms — What You Need to Know in One Chart

There is a crisis moving toward the oil markets now, like a crocodile hunting a bunch of swimmers at the beach.

It barely makes ripple on the surface of the water. But man, can it bite.

I’ll explain. You know that President Trump and Iranian President Hassan Rouhani are in a war of words.

First, Rouhani warned Trump that war with Iran would be “the mother of all wars”.

Then, President Trump tweeted (of course it’s a tweet) in all caps that if Iran continued to threaten the U.S., “YOU WILL SUFFER CONSEQUENCES THE LIKES OF WHICH FEW THROUGHOUT HISTORY HAVE EVER SUFFERED BEFORE.”

Then, Rouhani fired back via his foreign minister (and by tweet, because this is how geopolitics are handled now): “COLOR US UNIMPRESSED” before going on an extended rant of his own. You can read his whole tweetstorm here.

But we’re not done. Top brass in Iran’s military warned that U.S. threats against Iran will draw a “strong, unimaginable and regrettable” response.

What do you think that response might be?

First, let’s establish that Iran feels backed into a corner by new U.S. sanctions. There are already widespread protests in Iran against the bad performance of the economy in general and the devaluation of its national currency (the rial) in particular. Sanctions WILL make it worse.

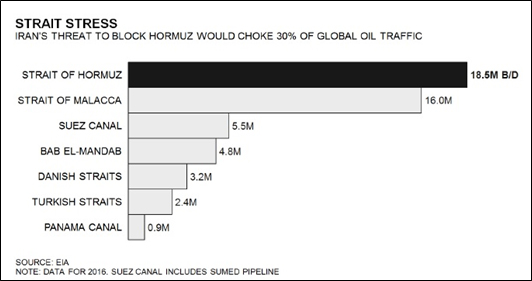

What might a desperate nation do? I’ll tell you what Iran CAN do. And it’s all in this chart …

Iran controls the Strait of Hormuz. What’s that? Oh, just the conduit for 30% of the world’s seaborne crude oil.

If Iran gets desperate enough, it can shut down the strait.

What do you think would happen to global oil prices if that happened? I’d say, brace for $150-per-barrel oil!

The good news is about 4 million barrels per day of that oil could be put through pipes (to the other side of Saud Arabia, for example) and shipped alternately. But still, that’s a huge bite out of global supply.

Now, do you think the U.S. and Iran will come to some peaceable agreement, or do you think we’ll continue to twist the crocodile’s tail?

Well, if the Middle East suffers a supply cramp, the U.S. can always pick up the slack, right?

Let me throw in a bonus chart for free …

The rising black line is the price of crude oil. The falling blue line is U.S. crude oil inventories.

As you can see, our stockpiles are running low. The Energy Information Administration just reported that U.S. crude oil inventories fell by 6.1 million barrels in the most recent week. That’s nearly the triple expectations of a 2.3-million-barrel drop.

Right now, global leaders are feeding this crocodile with their rhetoric. If we keep on this path — if the crocodile gets closer to the beach — we are going to feel that bite.

And I can tell you that global oil markets haven’t priced this in. Not by a long shot.

If you want to prepare, I recommend buying high-quality oil stocks and ETFs.

But don’t wait too long.

This crocodile is smiling, and growing hungrier by the day.

All the best,

Sean

P.S. I’ll be speaking at the San Francisco Money Show in August. It will be a great show, with all sorts of experts sharing their insights. You can find more about that incredible conference HERE. I hope to see you there!