On May 12, I told you to buy oil ETFs and stocks. I hammered the point home again on May 19. And just a week and a half ago, I told you three ways to play the coming oil boom. Are you acting on any of this? Because if not, you are missing out, Big-Time!

The good news is, it’s not too late. Because oil is headed higher. This oil-soaked, smoking, and fuel-oil-devouring juggernaut of a train is sounding its warning whistle, a soul-searing shriek of the damned that only the willfully ignorant could ignore. But there is still time to get onboard. Next stop: Profit Town!

This is in direct contrast to what Wall Street is telling you. They want you to believe that oil is topping out, now that OPEC and a Russia-led consortium of other oil producers is hiking production. So, you might as well stay home, and leave it to the professionals.

Ha!

I’ll give you THREE MORE REASONS why oil is heading higher. And yeah, I’ll tell you how to play it.

Reason #1: Falling Stockpiles

Here’s a chart of U.S. crude oil stockpiles vs. the price of oil. A blind bat could see the relationship …

In fact, U.S. commercial crude inventories dropped by 9.9 million barrels in the week through June 22. That’s according to the Energy Information Administration. And that was enough to spark the latest move higher in oil.

And it’s not just the U.S. It’s world-wide. OPEC estimates commercial oil stocks in the Organization for Economic Cooperation and Development (OECD), a group of mainly western countries, are now 20 million barrels below their five-year average. That’s about 4% below where it should be.

What that means is there is much less room for error. And as I’ve said before, “Black swans breed in oil fields.”

And that brings us to …

Reason #2: Supply Disruptions

Indeed, the world is facing a triple threat of supply disruptions. Bankrupt Venezuela can’t afford to pump its own oil, and it has the biggest oil reserves in the world.

Iran is facing new sanctions from the U.S., so its buyers will have to find new supplies.

Earlier this month, the International Energy Agency said that combined production from Venezuela and Iran could plunge a further 30% — or around 1.5 million barrels a day — by the end of next year.

And in other parts of the world — from Libya to the oil sands of Canada to America’s own Permian Basin — oil infrastructure is stretched drum-tight. There is no room for error.

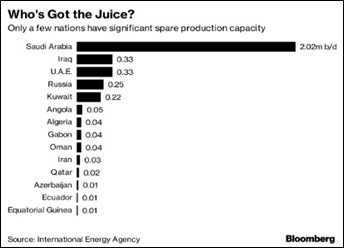

Well, other members of OPEC could always pump more, right? Nope!

In fact, very few OPEC nations have real spare capacity. That’s why the decision by OPEC and the Russia oil alliance, to raise production by 1 million barrels per day (bpd), is such a joke. Accounting for members who can’t meet their quotas now, the real rise is only about 600,000 bpd.

A disruption in any one of these areas — or Nigeria, or one of the other war-torn hell-holes that is rich in oil — could put upward pressure on prices. Again!

Reason #3: Demand Is Headed Higher

The world currently uses 98.6 million bpd of oil. That’s according to the International Energy Agency. Next year, the IEA says global demand should rise to an even 100 million bpd.

So where is that oil going to come from? Is Russia going to find it in its spare set of pants? Does Saudi Arabia have a hidden Ghawar oil field hidden under the carpet they haven’t told us about?

I’ll tell you what. This will be resolved by price action, the best oil companies in America reaps the benefits.

Bank of America Corp. forecast that Brent, the global benchmark, will advance to $90 a barrel in the second quarter of next year, while UBS Group AG predicted $80 to $85 in the second half of the year. And sure, somewhere along there, we’ll probably see demand destruction. This may be what kicks the next leg of the EV revolution into higher gear.

But all these things take time. Time enough for many companies to make a fortune.

I’ll give you the same picks I gave you back on May 12. The PowerShares S&P SmallCap Energy Portfolio (NYSE: PSCE) and the VanEck Oil Services ETF (NYSE: OIH).

The PSCE continues to lead — outperforming the large-caps in the Energy Select SPDR (NYSE: XLE), by the way.

And as America’s drilling kicks into overdrive, to feed the world’s thirst for oil, the stocks of the OIH should see a gusher of gains.

Those are two tickets on the oil-train juggernaut. It’s ready to leave the station. Are you onboard for profits?

All the best,

Sean