Oil Prices Go Higher, But Don’t Buy Producers. Consider Buying This Instead

As America and the world accelerate out of the pandemic recession, oil prices are heating up bigtime. The U.S. crude oil benchmark recently peaked at just under $68 and looks primed to take another run at new highs sooner than later.

Things seem to be playing out just as I forecasted in my Feb. 5 article, “How High Can Oil’s Stealth Rally Go?” If you bought my recommendation in that article, the Alerian MLP ETF (NYSE: AMLP), you’d be up 17.65%, compared to 1.48% for the S&P 500. Not too shabby.

You might think now is a great time to buy select oil producers. And you’re right. But there is an even better way to ride the surge in prices.

I’m talking about oil refiners.

As high as oil prices are going, gasoline prices are going higher, faster. U.S. gasoline inventories recently dropped to more than 6% behind the five-year average. As a result, the price of gasoline has risen an average of 35 cents a gallon over the past month, according to the American Automobile Association. The motor club forecasts that the average price could hit $4 a gallon in some states this summer.

There’s a good reason that inventories went lower and prices went higher: Severe winter storms in Texas ravaged refinery complexes. Even though some refineries have come back online, at least six facilities are still operating at below full capacity.

What’s more, at least four refineries — with a combined 800,000 barrels per day of capacity — have no estimated full restart date.

But wait … how does producing LESS of a product help refiners’ profits? Prices are made on the margins. And with less gasoline being produced, ALL refiners are receiving higher prices for their products.

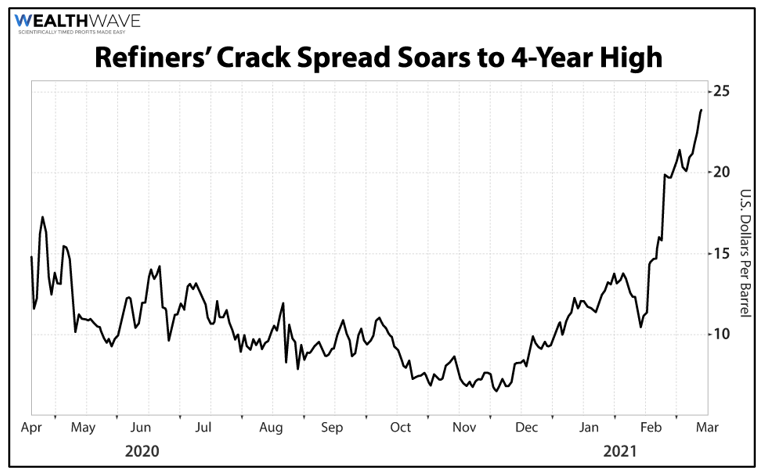

This widens the crack spread, which is the difference between wholesale petroleum product prices and crude oil prices. In fact, the crack spread has now widened to levels last seen in 2017!

Is this going to continue? It could for a while. Total refinery output is about 2% below pre-storm levels. And as I said, some refiners still have no full restart date.

What’s more, even pre-storm gasoline production was running around 7% behind year-ago levels.

To be sure, Americans are driving less due the pandemic. But that’s changing fast.

Covid vaccinations are going full-blast, businesses are reopening and people will be going out to spend their $1,400 stimulus checks. So, if anything, gasoline DEMAND is likely to accelerate.

To me, that says the real opportunity is in refiners. How can you play that? You could roll up your hard sleeves and do the hard work of finding the best individual refiners. As a bonus, some of them pay excellent dividends.

Or, you could lower your risk and buy the VanEck Vectors Oil Refiners ETF (NYSE: CRAK). This fund holds 25 refinery stocks — big names including Phillips 66 (NYSE: PSX), Marathon Petroleum Corp. (NYSE: MPC), Valero Energy Corp. (NYSE: VLO) and more. CRAK has an expense ratio of 0.6% and a decent yield o 2.31%.

Let’s take a look at the weekly chart of CRAK:

You can see that CRAK has already rallied and is up against overhead resistance. I believe it’s going to push through that and rise to $36.50 fairly quickly.

So, consider adding CRAK to your portfolio. Oil prices aren’t going down anytime soon. Gasoline prices are probably going higher. And oil refiners are the best way to play it.

All the best,

Sean