Often times, the best opportunities to outperform are when others are panicking.

Warren Buffett famously gets “fearful when others are greedy, and greedy when others are fearful.” Recently, we’ve seen plenty of fear among investors.

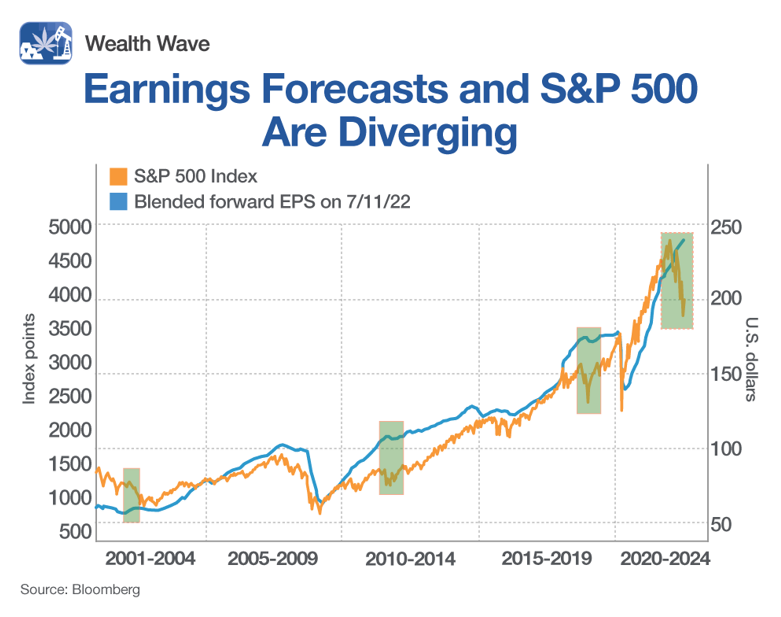

One of the major drivers of investor worries is the reduction in corporate earnings. When profits are smaller, it impacts valuations because prices must drop to keep the same multiples.

However, the market doesn’t seem to mind lower corporate earnings this time around, considering the near-3% increase in the S&P 500 index on Tuesday.

That’s because lower earnings were priced in, and corporations have been more resilient than expected so far. After all, companies are still beating analyst estimates.

Stocks have trended lower since the beginning of the year as investors weighed the Fed’s economic tightening and its impact on corporate profits, but the pendulum looks to be swinging back in favor of investors.

Deutsche Bank (DB) says the worst could be over for now, with additional selloffs unlikely because the market already priced in the disruptions.

History is on the side of the bulls. In the past, selloffs heading into earnings season usually led to rallies when the data comes in.

As you can see in the chart below, divergence between the S&P 500 index and forward earnings estimates usually leads to broader market gains.

Deutsche Bank strategists point to this history when calling for a relief rally for equities, and analysts at Citigroup (C) and Sanford C. Bernstein agree that stocks are oversold.

Deutsche Bank’s analysts claim, “The market has usually rallied during earnings season, especially following a selloff and when investor positioning is very low going into the earnings season, as is the case presently.”

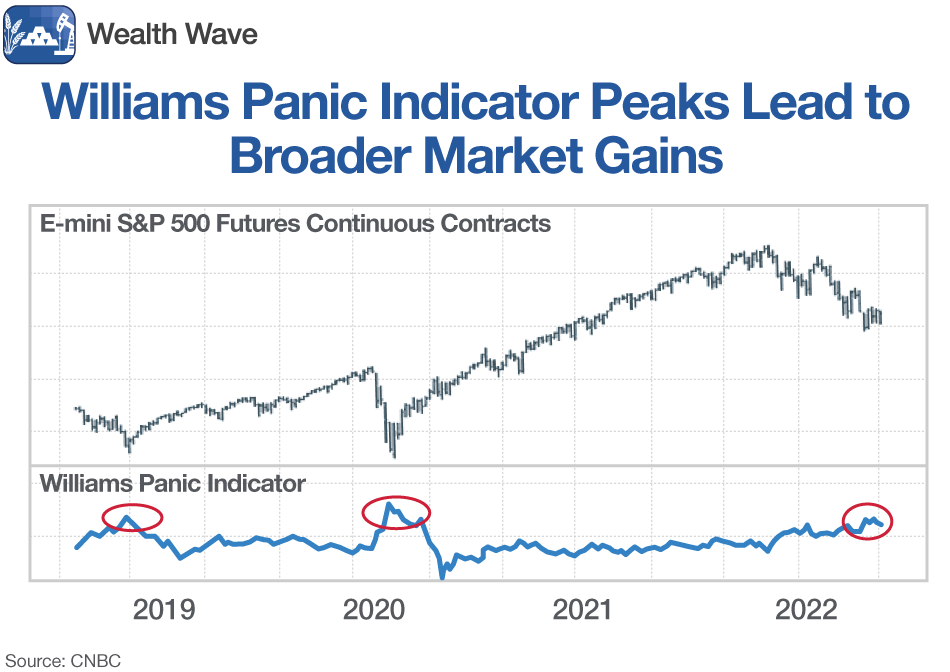

As positive earnings surprises build momentum, another key indicator is flashing the buy signal. The Williams Panic Indicator, pioneered by Larry Williams, is calling for a continuation of the recent stock rally.

Historically, the indicator has only flashed 18 times in the last 90 years and it usually leads to broader market rallies. Since 2018, its peaks have corresponded with strong growth. After peaking again last month, we could be seeing it play out again.

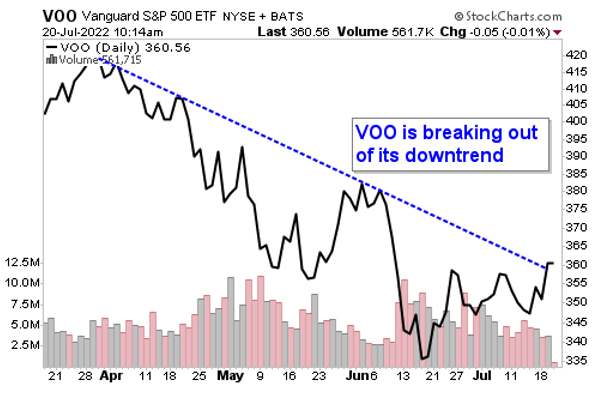

For a broader-market relief rally, you may want broad market exposure. The Vanguard S&P 500 ETF (VOO) tracks the S&P 500 index, which includes 500 of the largest qualifying U.S. companies.

To make the index, companies must satisfy several strict conditions. Some of these include generating positive yearly earnings, having at least 10% of their float available for public trading, exceeding $14.6 billion in market capitalization and surpassing their market capitalization in yearly trade volume.

The index is weighted by market capitalization, so the largest companies make up the biggest positions in the fund. VOO’s top three holdings are Apple (AAPL), Microsoft (MSFT) and Amazon.com (AMZN). Together, the make up about 15% of its total assets.

VOO trades with a liquid average daily volume of 6 million shares and manages about $710 billion in assets. The fund’s expense ratio is a minimal 0.03%, meaning it charges just $3 for every $10,000 invested.

Looking at VOO’s daily chart, we see that the fund just broke through its downtrend.

As the broader relief rally extends, I expect this index to capture the market’s gains. For now, you get the chance to enter at a steep discount from the beginning of the year.

Always make sure to do your own research before entering a position, but now could be the time to get greedy when others are fearful.

Speaking of which, for the first time in our 51-year history, Weiss Ratings is diving headfirst into the world of Alpha Round deals — the earliest pre-IPO funding that produces the biggest returns.

Our newest expert, Chris Graebe, has been educating individuals about early stage investing for the past few years. He’s played a key role in helping raise over $12 million in this growing industry.

He wants to help Weiss Ratings readers like you claim returns that are hundreds or even thousands of times higher than waiting until the IPO. I urge you to check out all the details here.

All the best,

Sean