Did you have a good July? U.S. farmers, or at least those who export their crops, had a terrible month. A terrible, horrible, no-good, very bad month.

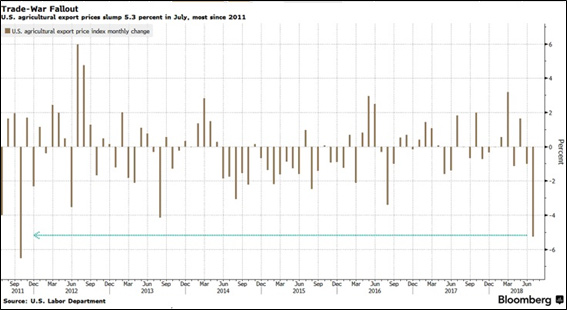

And by that, I mean prices for U.S. farm exports dropped in July. Heck, they didn’t just drop — they swan-dived by the most in six years, as you can see from the chart below.

The cause? Our trade war with China heated up in July. Washington slapped $34 billion worth of tariffs on Chinese goods. And the Chinese responded by slapping tariffs on U.S. agricultural products, including soybeans.

As a result, agricultural export prices fell 5.3% from June. And soybeans? Soybean prices plummeted 14.1%. Export prices for corn, wheat, fruits and nuts also slumped in July.

And the tariffs are having an effect on two import grain traders, two stocks you can buy and sell. I recommend that you buy one and sell the other.

The stocks I’m talking about are Archer-Daniels-Midland (NYSE: ADM) and its main rival, Bunge Ltd. (NYSE: BG).

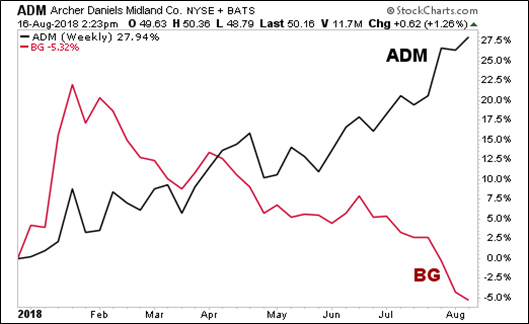

Take a look at this chart measuring both stocks’ performance for the year.

Wow! ADM is up 27.9% so far this year. BG is down more than 5%.

ADM and Bunge are the A and B of the ABCDs, the quartet of agricultural traders that also includes the privately held Cargill Inc. and Louis Dreyfus Co.

ADM reported earnings on July 31. They were excellent. Its net profit actually DOUBLED year-over-year in the second quarter.

ADM actually benefited from the tariffs. That’s because the company seized on market dislocations caused by the U.S.-China trade spat. It shipped Brazilian beans to China and crushed cheap U.S. beans into soymeal and oil.

The company had predicted it would take a $30 million hit due to China’s tariffs. But it capitalized on the spat instead.

Bunge is a different story. It made its bets on the soybean market — and bet wrongly. It bet the trade war would be averted. That cost the company $125 million in wrong-way soybean contracts, on top of a $24 million hit from hedging Brazil’s currency.

Going forward, do you think the trade dispute will smooth over soon? Or do you think it will drag on for a while?

China will send a delegation to the U.S. later this month to resume trade talks. But it’s a low-level meeting. China’s vice commerce minister will meet with the U.S. Treasury Department’s undersecretary for international affairs.

The talks will be “exploratory.” Don’t expect a lot.

Meanwhile, the U.S. plans to move ahead in coming weeks with penalties on $200 billion more in Chinese goods.

That’s not smoothing things over. That’s raising the stakes.

So, I expect trade tensions could continue. I also expect that soybean exports will remain under pressure. ADM is showing it knows how to handle this market. Bunge … not so much.

Which one you should buy and which one you should sell seems obvious to me. Do your own due diligence before you invest in anything.

There could be more terrible, horrible, no-good, very bad months ahead for U.S. farmers. And you want to be on the right side of this trend.

Of course, the trade war is doing far more than just impacting farmers and food prices. The trade war — and the global macro events at the root of it — affects everything from gold, silver, oil, tech stocks, currencies and bonds.

We could see a major shakeup in markets coming. And according to my cycles analysis, some investments that have been languishing the last couple of years could break out in a big way.

I’ve recently released a report showing my favorite overlooked profit plays for the near term. It’s free, and you can click this link to read it now.

All the best,

Sean