The Federal Reserve is cranking up the pressure on stocks with higher interest rates, no matter how it affects your portfolio.

The good news is you can buy recession-resistant stocks. Heck, some stocks even thrive in a recession. And I’ve got a bargain-bin special for you today.

First, let’s talk about the Fed tightening. The central bank is walking a tightrope between trying to give the economy enough room to run and trying to yank the leash on a recession.

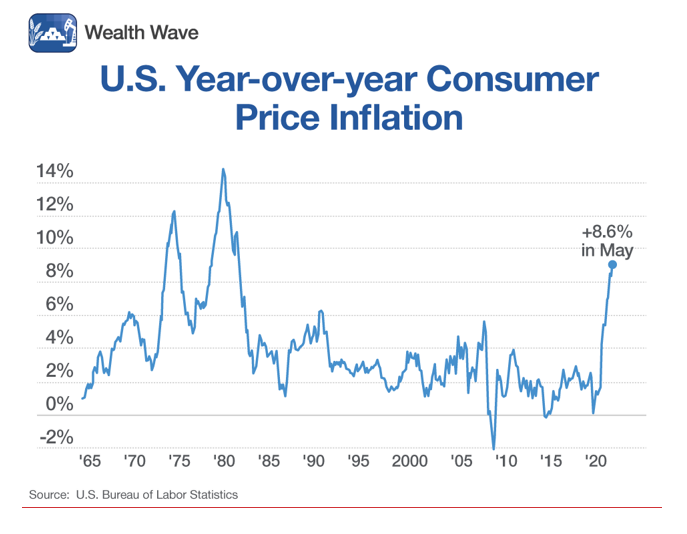

Since the Fed’s unprecedented stimulus during the pandemic, inflation has jumped out of control. The chart below shows the massive jump since the Fed took the reins.

With inflation at a 40-year high, central bankers have little choice. They waited so long to address soaring consumer prices that now they’re forced to take dramatic action.

The Fed is determined to fight high inflation regardless of its impact on the stock market. The Fed has a one-size-fits all remedy for inflation ... higher interest rates. We’ve already seen the impacts of its first rounds of tightening, but more is coming.

The saying goes: “Don’t fight the Fed.” We’d be wise to heed that warning. It worked on the upside, so it’s time to prepare with downside protection.

Wall Street has rushed to call a recession … I think the jury’s still out … But if the Fed’s keeps tightening aggressively, that could tip the economy into a downturn.

After raising rates 75 basis points last month, Fed Chair Jerome Powell didn’t rule out similar hikes moving forward. The market sees it coming, pricing in a 90% likelihood of another increase of 75 bps at the end of the month.

That’s without even mentioning the central bank’s balance sheet reduction program. The Fed announced it’s trimming $47.5 billion per month off its balance sheet, and the pace will double in less than two months. With less liquidity and no more free-money monetary policy, that’s more downward pressure on stocks.

June’s inflation report from the Bureau of Labor Statistics next week will be telling. If consumer prices roar to fresh highs, you can expect the Fed to act accordingly.

When Times Are Tough, Shoppers Want Bargains

During recessions, consumers tighten their belts and spend less on the luxuries they’re accustomed to when the economy’s booming.

Some turn to low-price retail heavyweights like Walmart (WMT) while others look to dollar stores spread across neighborhoods. Discount retailers are recession-resistant because these are the hot spots for consumers looking for the best deals when times are tougher.

In a recessionary environment, Walmart’s performance speaks for itself. During a period of the Great Recession from January 2008 to February 2009, the Dow Jones Industrial Average tumbled 53%. Walmart slipped just 10%, and that’s not even including the dividends it paid to cushion the drop.

There are no pure-play discount retailer exchange-traded funds, but one fund you can look into is the SPDR S&P Retail ETF (XRT), which holds many of these companies. XRT’s expense ratio is a reasonable 0.35%, and it manages over $370 million in assets.

Individually, you can also look to add discount retailer exposure through names like Dollar General (DG), Dollar Tree (DLTR) and Walmart, which could be useful options for recession protection.

Looking at Dollar Tree’s chart, we can see that the stock shook off panic selling in May to rebound. Now, it appears to be trying to break out of its short-term downtrend.

Dollar Tree just broke through overhead resistance, which could send it barreling higher. I believe it should easily climb to $185 and potentially higher.

It doesn’t hurt that, according to Zacks Investment Research, Dollar Tree’s expected earnings growth rate for the current year is 40.5%!

As consumers shop for bargains, I expect this and other budget retailers to perform solidly.

And speaking of hunting for deals, how about investing in Alpha Round deals? For nearly 100 years, average investors were forbidden from investing this way — in the earliest pre-IPO funding that produces the biggest returns. But new laws have opened these deals to everyone.

This month, Weiss Ratings is diving into this exciting new frontier of the market. On Tuesday, July 19, join Dr. Martin Weiss for the Alpha Round Investing Summit to seize this historic opportunity … and claim first access to a special Alpha Round deal for Weiss Ratings!

Click here to reserve your spot for free.

Always do your own due diligence before entering a position, but this looks like a great time to prepare for more market-wide volatility. And discount retailers are a great way to do it.

All the best,

Sean