Over the past couple of days, solar stocks have shaken off the dust that’s held them in place for months.

That’s a real shift in the tide, since investors had reasons to sour on solar —including Congress’ infrastructure bill delays and supply chain bottlenecks that saw critical components stuck in ports.

Add in soaring commodity costs … and you can see why investors looked elsewhere.

But that’s changing.

One catalyst may be that 200 countries are meeting in Glasgow, Scotland, from Oct. 31 to Nov. 12 to discuss climate change and policies addressing it.

It’s called the COP26 Climate Summit — sponsored by the U.N. It’s a chance for these countries to make good on their previous pledge to deliver $100 billion PER YEAR in climate funding.

- And even before the conference begins, there are rumblings that a principal focus will be placed on solar.

Sure, $100 billion a year buys a lot of solar panels. But that’s not all solar has going for it.

Here are three reasons why I’m looking on the sunny side of solar …

Reason 1: Costs Are Falling

The cost of solar has fallen 89% since 2010, and 13.1% between 2018 and 2019 alone.

Here’s a chart of the levelized cost of energy (LCOE) of various electricity sources through 2020:

Just to show nothing goes in a straight line, the cost of solar has gone up this year. That’s due to the rising cost of inputs like silicon, which is in short supply.

As a result, costs are up an average of 2% in Q2 compared to Q1, and up 20% over a year ago.

When will the silicon shortage end? Estimates vary, but chipmaker STMicroelectronics suggests the silicon chip shortage could last well into 2023.

You know what happens when supply can’t keep up with demand – prices go up!

Nonetheless, compared to most energy sources, solar is very competitive.

Reason 2: Installations Are Booming

According to BP (NYSE: BP), total global solar installations have grown from 0.65 gigawatts (GW) in 2000 to 40.1 GW in 2010 and 708 GW in 2020. That’s enough to power 116 million U.S. homes.

Globally, new projects are being rolled out all the time …

China just announced construction on the first phase of a massive “energy park” in the desert, comprising 100 GW of wind and solar. To put that in perspective, 100 GW is more than ALL the wind and solar energy that India has installed … so far.

In the U.S., private companies including General Motors (NYSE: GM) are building expansive solar arrays to power their factories. GM just signed a power purchase agreement for a 180-MW solar project set to be constructed in Arkansas, which will send electricity to three GM plants across the Midwest.

Reason 3: The Sky’s the Limit

The plummeting cost of solar has caught utilities on the back foot because they plan their power sources many years in advance.

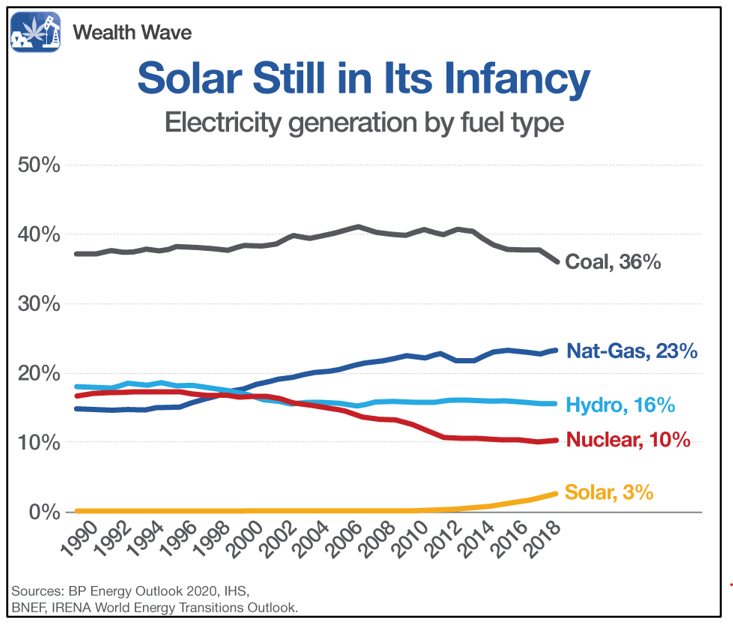

So, while solar is very cheap, it’s not widely used, as this next chart demonstrates:

That’s plenty of room for growth there.

In fact, the U.S. Department of Energy (DOE) recently said that although solar was the fastest-growing renewable energy source in the nation over the past decade … the rate of growth must accelerate to reach decarbonization goals.

The DOE said that “solar deployment would need to accelerate to three to four times faster than its current rate by 2030.”

To get there, the Biden administration proposed several financial incentives for solar last month, including extending tax credits for solar and other renewables at a projected cost of $200 billion over the next decade.

The White House also wants a $150 billion Clean Electricity Performance Program (CEPP) to subsidize electric utilities that increase the share of solar.

- The DOE says solar energy can produce up to 40% of the nation’s electricity within 15 years, representing a 10-fold increase of current solar output that would require massive changes in U.S. policy and billions of dollars in federal investment.

The DOE estimates solar could grow from its current level of 3% of generation to over 40% by 2035.

2 Ways to Play the Solar Boom

The easiest way to get in on solar before it flares again is by buying an investment that gives you broad exposure to the overall industry.

You can do that by buying an ETF like Invesco Solar ETF (NYSE: TAN).

TAN has an expense ratio of 0.69%, and like many of the solar stocks it holds, it is starting to blast off.

TAN is trading just below $90. The next stop on the way up is the high from July near $92.

But I think that level won’t be much more than a speedbump as TAN shifts into higher gear, headed toward my price target of $112. That’s about 24.4% above the current price.

The other way to play it is to find individual stocks with even more potential.

I can name two.

In fact, I just recommended a pair of power-packed solar picks to my Supercycle Investor subscribers on Wednesday.

I can’t give out the recommendations here, but if you’d like to learn more about the service, I have one more recommendation — that is, for you to join us. Call 855-278-9191 to learn more.

And, as always, if you’re doing this on your own, be very careful. It would be terrible to own a solar stock that wilts when industry leaders are soaking up the sun.

All the best,

Sean