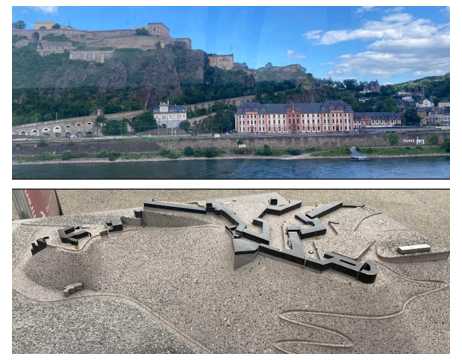

I recently cruised down the Rhine River from Switzerland to Holland, and I got to visit Ehrenbreitstein.

That’s the largest fortress in Europe. It’s set on a hill overlooking where the Moselle and Rhine Rivers meet. And it’s a great example of fighting the last war, which is exactly what the Biden administration is doing with gasoline prices right now.

I'll get back to that in second, though.

Ehrenbreitstein looms 400 feet above the left bank of the Rhine. Located on the site of a previously destroyed fort, Ehrenbreitstein was built because Napoleon Bonaparte burned nearly all the German castles along the Rhine as he rampaged through Europe. Despite Napoleon’s eventual defeat, the Germans were determined to build a fortress that Napoleon couldn’t conquer.

So, the Prussian general in charge of construction surveyed the castles and forts Napoleon destroyed. He found that, of the ones that survived, the best incorporated Roman arches in their construction. The Germans decided the arch was the key to success, so they were used everywhere in Ehrenbreitstein.

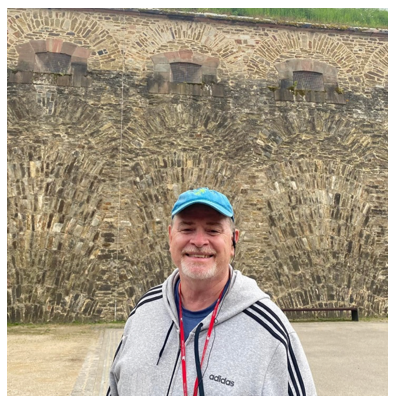

In the picture below, you can see me standing in front of a wall in Ehrenbreitstein. And that wall’s design is all arches.

Still smarting from Napoleon’s spanking, the Germans made lots of other innovations. The hundred yards directly in front of the castle’s outer walls were leveled flat and planted with brambles to slow down infantry and make it easier to shoot them.

At the time, the most devastating attacks on fortifications were carried out through tunnels. So, the Germans dug their own tunnels ahead of time, filled with explosives, so they could blow up the French underground.

There are no blind spots in Ehrenbreitstein. Every angle is sharp, every entryway bracketed by sniper slots and murder holes galore for pouring hot lead down on the enemy.

I could go on, but you get the picture. The Germans made Ehrenbreitstein impenetrable, as if to say, “We double-dog dare you to attack, you French marauders.”

History shows the French never invaded along that portion of the Rhine again. Ehrenbreitstein sat unmolested through two World Wars. It’s a museum now — an ode to wasted effort.

I have to wonder what Germany could’ve done with the money if it hadn’t built Ehrenbreitstein.

Speaking of Wasted Effort

That brings me to President Joe Biden and his plan for a gasoline tax holiday. It’s a terrible idea and, yes, a waste of effort.

For one thing, it won’t save Americans that much money.

The average savings has been estimated to be $23.85 per driver over a three-month period. On the downside, a gas tax holiday will cut money that’s used to repair roads and bridges.

But Biden’s under pressure to do something about sky-high gas prices, and his options are very limited. It’s not like the Republicans have brought any good ideas to the table, either.

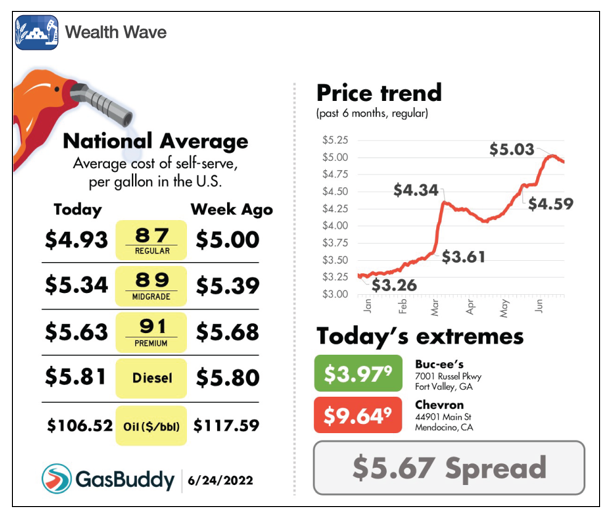

Here’s the thing: A gasoline tax holiday is fighting the last war because gasoline prices are already going down. Here’s a chart from GasBuddy.com:

Gasoline prices have already peaked. Yeah, we’re only a little off the highs, but the recent tumble in oil prices indicates lower prices to come.

So, is the problem entirely in the rearview mirror? No. The real cause of higher gasoline prices is that five refineries have shut down since the pandemic began, for various reasons. This means (1) less gasoline supply and (2) refiners get higher prices for the gasoline they do produce.

Refiners balked at the idea of building more refineries because they’re expensive and would take more than a year to construct. But again, gasoline prices are going down, so I think we can live with it.

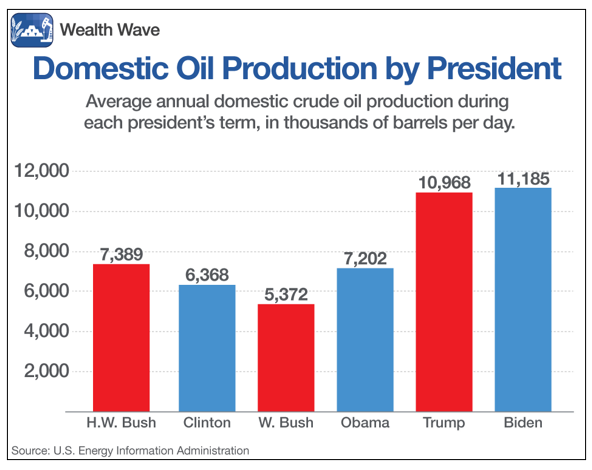

Shouldn’t Biden do what he can to boost oil production anyway?

He’s asked. The Saudis said no, and U.S. oil producers say they’re producing flat out. In fact, America is producing as much oil domestically as it ever has:

With all that in mind, let show you what you should be watching. A chart that explains not the last war, but the next war.

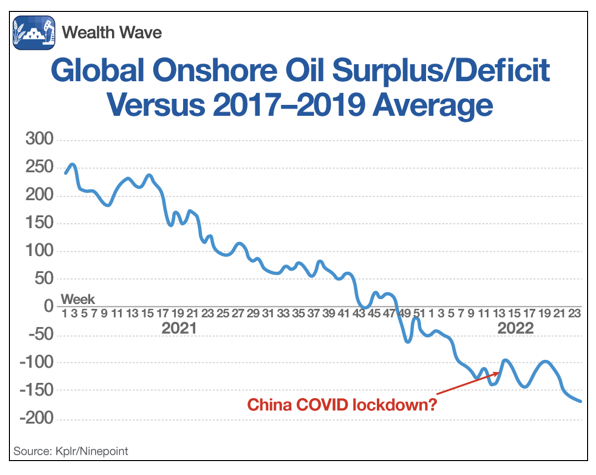

Commodity analysts at Kpler (damn your foreign names that refuse to buy a vowel!) put this chart together:

You can see that the world has a lot less oil available compared to the 2017–19 average.

A lot less.

That’s partly due to Russia’s invasion of Ukraine, OPEC+ production struggles and a lot to the fact that the world is hitting the accelerator coming out of the pandemic. The whole world wants to drive like big, fat Americans. It’s a supply-and-demand squeeze of historic proportions.

This tells me that the recent 14% drop in oil prices from their highs — and an even bigger shellacking in oil-leveraged stocks — is way overdone.

If you’d like my individual stock picks, Members of my Wealth Megatrends service are sitting on open gains of nearly 72%, 33% and 19%.

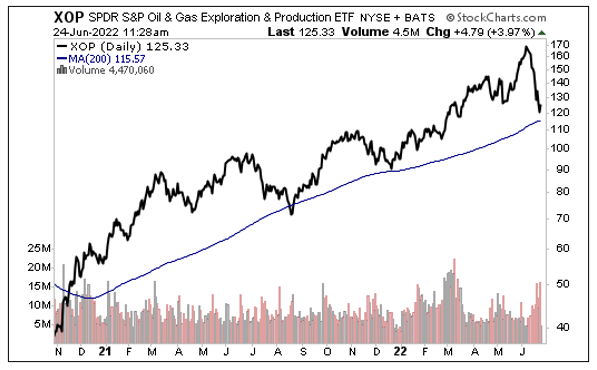

But for an exchange-traded fund, I have one in mind: the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

You can see that the XOP has pulled back very close to its 200-day moving average. The 200-day MA is often seen as the dividing line between long-term bull and bear trends. Oil, and oil stocks, are in a long-term bull trend.

This fund has a net expense ratio of 0.35%, and its top holdings include companies like Callon Petroleum (CPE), Devon Energy (DVN), SM Energy (SM) and Diamondback Energy (FANG).

In other words, a basket of stocks that will do very well as oil prices rally.

Look at that supply-and-demand squeeze chart again. I believe the smart thing to do is prepare for the next rally in oil prices and oil stocks. And investors should consider doing so now while they’re cheap.

You won’t refight the last war. And you can definitely win the next one.

As always, conduct your own due diligence before entering any trade.

Best wishes,

Sean