The stock market is enough to drive people crazy. Action is bullish … bearish … a mix of both! Then the president tweets, and it’s like someone kicked the chessboard in the air. It’s stressful!

The good news is, there’s a bull sneaking up on you right now. And that’s a bull you can ride to huge gains.

This bull is in a sector that is hated more than Kim Jong-un’s barber. Wall Street despises it. Says no one should own it. Why, you might as well put a gun in your mouth as buy this!

Psst! That’s just when you want to buy it.

Meanwhile, this bull keeps tippy-toeing closer and closer.

Somebody’s about to take an unpleasant ride on the bull’s horns, and it won’t be me. I’m harnessing that bull. I’m going to ride it. Sure, it’s going to be a wild ride. But it’s going to be awesome.

I’m talking about gold miners.

Now, I just talked about the bullish forces in gold a few weeks ago. And you can go back and read that. But now I want to talk specifically about gold miners. Because it’s the action in gold miners that is the latest sign the bull is creeping up on us.

You see, gold has spent the last week pulling back. That happens — it zigs and zags as it builds the base for its next big move. As I told you it would.

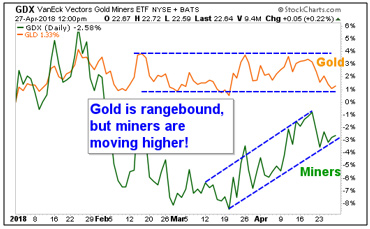

But the action in miners? Oh man, that is BULLISH! Here’s a chart showing the percentage price action in the VanEck Vectors Gold Miners ETF (NYSE: GDX) and gold.

Permalink: http://schrts.co/WScpGM

You can see that gold continues to be rangebound (for now). But miners aren’t waiting. The GDX (which tracks a basket of the biggest precious metals miners) has zig-zagged its way higher since March. It’s outperforming gold.

Miners outperforming the metal is one of the classic signs of a bull market. That particular sign has been missing until recently.

It’s a sign that big money believes gold will break out. So, that big money is taking positions in miners that are leveraged to the underlying metal.

So, let’s say gold moves to $1,650. That’s a nice 25% move from recent prices.

But let’s say a miner has an all-in sustaining cost of $1,100 per ounce. And that it recently made $220 on every ounce of gold it sold. A 20% profit margin. If gold moves to $1,650, it makes $550 on every ounce. That’s a 50% profit margin!

That’s leverage. And it’s why gold miners are so appealing in a bull market.

Gold has yet to break out. There’s still time to get onboard. But this bull is twitching with energy. It’s ready to go on a wild ride. When it busts out, you better be harnessed to the better gold miners. Or you’ll miss out, big time.

All the best

Sean