Advanced artificial intelligence (AI), otherwise known as machine learning, and its next level, deep learning, are the future of AI.

I’ll explain how investors can embrace them, but first, let me explain exactly what they are.

Imagine a farmer riding an automated smart tractor through his field spraying targeted bursts of pesticides precisely where they’re needed.

Or robots helping surgeons avoid critical mistakes as they perform delicate invasive procedures.

Or doctors providing personalized medicine based on a patient’s unique genetic makeup.

- That’s just the beginning of the picture.

The thing is ... you don’t have to imagine this stuff.

It’s happening right now.

|

| (Source: Medium) |

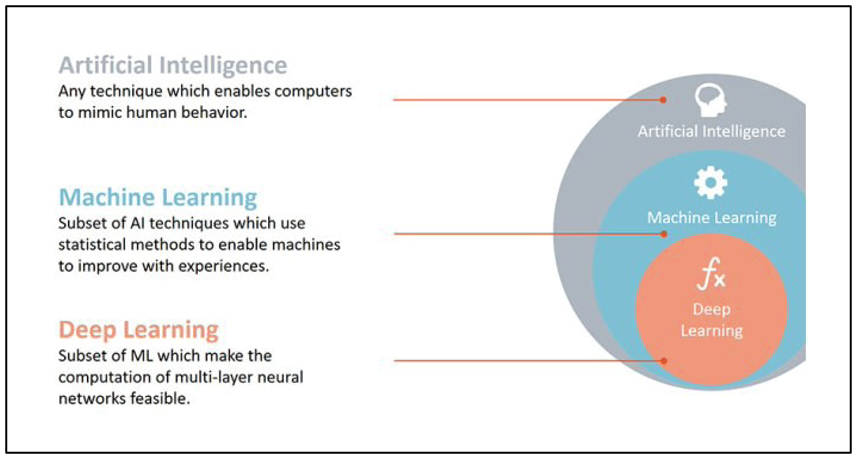

So what are the differences between AI, machine learning and deep learning?

AI: anything with the ability to perform a human-like skill on its own. Examples include Google Maps suggesting faster routes, mobile check depositing, speech-to-text, spam filters and Meta Platforms’ (Nasdaq: FB) Facebook ability to tag faces.

Machine learning: relies on known features. Examples include image and speech recognition. If you’ve seen a suggested item after making an e-commerce purchase, that’s “learning association.” Netflix (Nasdaq: NFLX), YouTube, Spotify (NYSE: SPOT) and Amazon.com (Nasdaq: AMZN) all use this class of machine learning.

Deep learning: Inspired by the structure and function of the human brain, deep learning can discover features on its own. According to Intel:

An artificial neuron “fires” if the inputs exceed some threshold. And just like neurons in the brain, artificial neurons are arranged in many layers as a “deep” neural network (DNN).

This technology is the main force behind virtual assistants, facial recognition software and self-driving cars.

And it’s just recently become possible due to the following:

- Bigger datasets that provide enough input to develop accurate models.

- Better hardware that can perform at 10 exaflops (1018 or one quintillion floating-point operations).

- Smarter algorithms that are constantly being published.

Alphabet (Nasdaq: GOOGL) and Amazon, for instance, are heavily investing in fundamental research.

- So much so that deep learning now demonstrates BETTER than human-level accuracy!

It’s why Facebook is so good at recognizing who is in that photo you uploaded ... and why Alexa generally gets it right when you ask her to play your favorite tune.

Heck, systems using deep learning are practically self-aware.

- And that’s why every industry is scrambling to get their hands on it.

In fact, advanced AI is projected to grow by as much as 42% from 2020 through 2025, adding $15.7 trillion to the global economy by 2030.

2 Potential AI Plays for Investors

This growth is creating a brand-new arena for investors to cash in on … and the gains could be substantial.

- ai (NYSE: AI) could be the purest play on advanced AI. Its algorithms can help streamline supply chains, cut costs, detect fraud and make other decisions.

It expects revenue to increase up to 35% as new partnerships with Alphabet and Snowflake (NYSE: SNOW) come online. But the company also expects operating losses in the near term as it ramps up investments. - For less risk, I recommend the Global X Robotics & Artificial Intelligence ETF (Nasdaq: BOTZ). It has $2.73 billion in net assets, a total expense ratio of 0.68% and average volume of more than 633,000 shares per day.

The top three holdings of BOTZ, totaling almost 30% of the fund's assets, are: Nvidia (Nasdaq: NVDA), which makes graphics processing units (GPUs) for video games and data centers; Keyence (OTC: KYCCF), a Japanese company that makes factory automation products such as sensors and scanners; and Intuitive Surgical (Nasdaq: ISRG), a maker of the da Vinci robotic surgical system, which allows for minimally invasive surgeries with precise control.

BOTZ has pulled back about 10% from 52-week highs it hit in November, if you were looking for an entry point.

We probably won’t see flying cars like in the Jetsons or Terminator-like robots walking among us tomorrow … but advanced AI is here, and there are ways investors can take advantage.

All the best,

Sean