They call copper “Doctor Copper” because it measures the temperature of the global economy.

When global growth cools off, copper, that most useful of metals, usually goes lower.

When economic activity heats up, copper prices go higher.

But economic prescriptions aren’t all copper is good for … because it’s also a great bellwether for inflation!

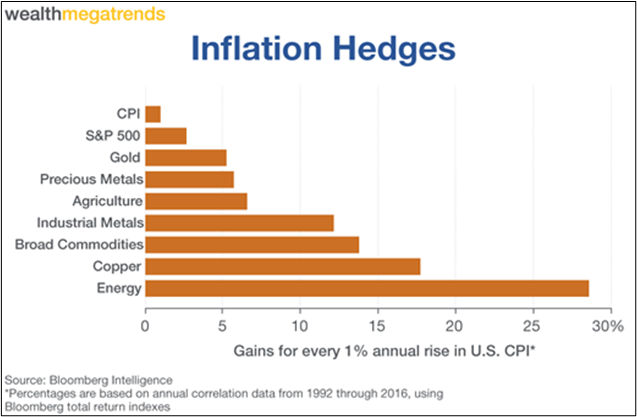

- Energy is the greatest inflation hedge ... but COPPER isn’t far behind at number two, as this chart shows …

Given the current environment of soaring inflation, that’s something to take note of.

Copper is very cyclical — and affected by the big cycles that Dr. Martin Weiss and I will be talking about in our upcoming emergency video conference.

In fact, we’re going to make some forecasts that will shock you! You can find a countdown to this conference by clicking here.

And there’s ANOTHER good reason to invest in copper, and the stocks of companies leveraged to the metal.

Thinking Green With Copper

Goldman Sachs (GS) calls copper “the new oil,” as it’s so important to green technologies.

You see, the average internal combustion engine (ICE) uses just 20 to 48 pounds of copper.

On the other hand, the average hybrid electric vehicle (HEV) contains 85 pounds ... while plug-in hybrid electric vehicles (PHEVs) use 132 pounds.

And battery electric vehicles (BEVs) ... a whopping 183 pounds.

Then think about all that copper needed for windfarms ... solar ... battery storage ... and charging stations.

The White House plans to build 500,000 public EV chargers coast to coast by 2030 ... which will require a LOT of copper.

And the recently passed $1 trillion infrastructure program is going to require a lot more.

Goldman estimates copper demand will significantly increase by up to 8.7 million metric tons by 2030.

The world used about 24.4 million metric tons of copper last year. So, the expectation is for demand to increase by about 35% through 2030. Wow!

Regarding supply, Goldman says ...

“The market is facing a supply crunch that could boost the price by more than 60% in four years.”

On March 4, Mining.com reported that copper warehouses are emptied out. In fact, global copper stockpiles are at their lowest level since 2005.

And one big copper project after another has been delayed.

For example, Rio Tinto (RIO)’s massive Oyu Tolgoi project in Mongolia ran afoul of “interesting geology” and government frustrations ...

While HudBay Minerals (HBM)’s big Rosemont copper mine near Tucson ran into stiff opposition over water concerns.

This is the kind of environment where moves in copper could be explosive!

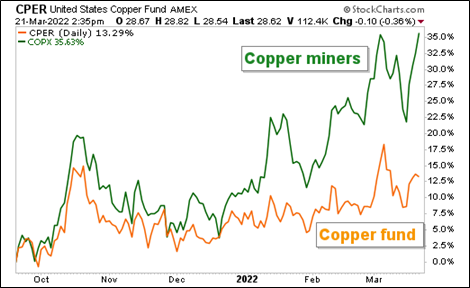

That’s why you might want to consider the United States Copper Index Fund (CPER).

It tracks a basket of copper futures and has an expense ratio of 1.08%.

Better yet, since copper miners are leveraged to the underlying metal, you could do even better with the Global X Copper Miners ETF (COPX).

It tracks a basket of 39 stocks exposed to copper and has an expense ratio of 0.65%.

Here’s a performance chart of the two funds …

You can see they’re both headed higher, and COPX is outperforming. That’s because stocks are leveraged to the underlying metal.

In fact, I said on Sept. 28 that the crisis in China’s real-estate mega-company Evergrande represented a great buying opportunity in COPX.

If you bought then, you’d be up over 30%. But I believe this is just the beginning.

Shares look attractive on the next dip. Always remember to do your own due diligence.

All the best,

Sean