Here’s a fun fact: Sales of robots are surging.

With unemployment running at around 3.6% and continuing claims near a 50-week low, for many employers, it’s a case of “if you can’t hire ‘em … buy ‘em!”

In fact, sales of robots hit a record high in the first quarter of 2022, rising 28% year over year. That’s according to statistics from the Association for Advancing Automation.

So, yeah, I believe the robots are coming for your job.

I’m not saying resistance is futile. What I’m saying is smart investors would bet on the robots.

According to the International Federation of Robotics, the increase in robot density per 10,000 workers in North America jumped 28% in Q1 2022 compared to Q1 2021 — the highest rate of growth since records have been kept!

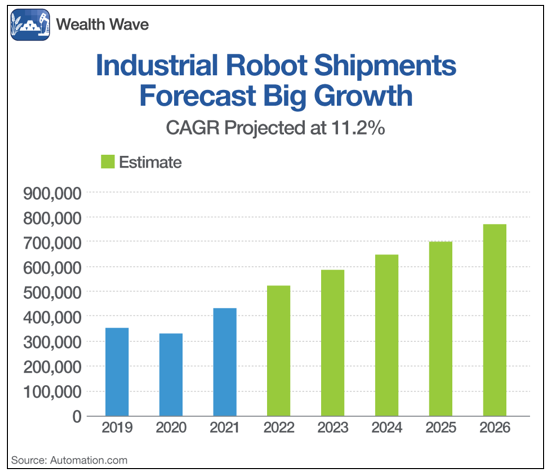

Here’s a chart of industrial robot sales, with a projection for this year through 2026:

Those are industrial robots — the dumb toasters that are taking our factory jobs. Sales of so-called smart robots — artificial intelligence systems capable of machine learning and decision-making that even work with humans — are rising even faster.

Kenneth Research just put out a new report saying that global smart robot sales will grow at a compound annual growth rate of 25.3% from 2019 to reach $21.35 billion by the year 2025.

So, what kind of jobs are robots taking?

Everything!

Factory jobs, sure. But also security, food and beverage industries, healthcare and more.

In fact, a survey this month showed 43% of American companies will use automation and robotics to address supply chain issues. So that’s probably going to give robot sales ANOTHER boost.

How Investors Can Look to Automate Gains

There are basically four robotic/artificial intelligence exchange-traded funds:

1. Global X Robotics & Artificial Intelligence ETF (BOTZ). BOTZ's expense ratio is 0.68%.

2. ROBO Global Robotics & Automation Index ETF (ROBO). ROBO’s expense ratio is 0.95%.

3. First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT). ROBT’s expense ratio is 0.65%.

4. iShares Robotics and Artificial Intelligence Multisector ETF (IRBO). IRBO has the lowest expense ratio of the four at 0.47%.

The expense ratio is basically the cost of owning the fund. It’s important, but not the most important thing.

Performance is more important, and you’ll find these funds have similar returns both long and short term. Performance is REALLY important.

But there is something I’m even more concerned with: liquidity, or average daily volume.

BOTZ is the most liquid, trading more than 684,000 shares per day. ROBO runs a distant second with an average volume of 96,100 shares per day.

But two on this list share a trait I’m not fond of: low volume. IRBO trades an average 56,000 shares per day. ROBT is even worse, trading just 28,440 shares a day on average.

Why is volume so important?

Because even more important than being able to get into something at a good price is being able to get out at a good price. And if a fund isn’t liquid, that really raises your odds of getting hosed.

For potentially better returns — and also higher risk — you can drill down into these funds and look for the best stocks in their top holdings.

The rise of the robots is a real trend, and a strong one at that. The robots are coming. You might as well profit from it.

No matter what you decide, always do your own due diligence.

One last thing …

For nearly 100 years, average investors were forbidden from investing in “Alpha Round” deals — the earliest pre-IPO funding that produces the biggest returns. But new laws have opened these deals to everyone.

This month, Weiss Ratings is diving into this exciting new frontier of the market. On Tuesday, July 19, join Dr. Martin Weiss for the Alpha Round Investing Summit to seize this historic opportunity and claim first access to a special Alpha Round deal with Weiss Ratings!

Click here to reserve your spot for free.

Best wishes,

Sean