President Trump slapped tariffs on foreign-made steel and aluminum. But if you think we’ve seen the end of the tariffs, think again. There’s a whole new laundry list of tariffs coming. And there are stocks you should sell IMMEDIATELY!

Trump’s new tariffs take aim at America’s No. 2 trading partner, China.

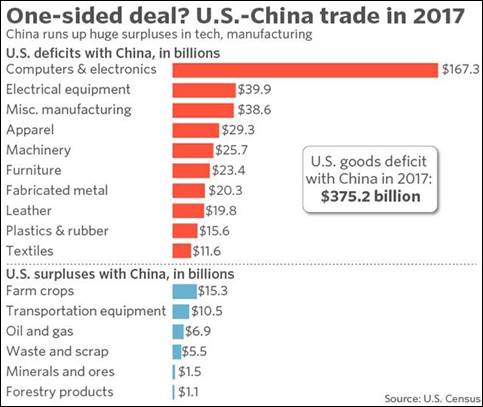

The U.S. runs a $566 billion annual trade deficit. And $375 billion of that is with one country, China. Here’s a chart I snagged from MarketWatch that illustrates the problem.

And if this is a trade war, you should know that China fired first.

It’s not just the massive intellectual property theft that China carries out. The office of The U.S. Trade Representative (USTR) is already investigating China under Section 301 of the Trade Act of 1974. This is due to China’s wholesale pirating and transfer of U.S. intellectual property.

China steals America’s best ideas through unfair technology licensing rules, forced “joint ventures” for U.S. companies that want to sell in China, and purchases of U.S. technology firms with state funding. And then there’s plain ol’ theft, cyber and otherwise.

But that wasn’t enough. China wants more. So, it proclaimed a “Made in China 2025” industrial development program. This $300 billion plan aims to make China self-sufficient in everything from planes to computer chips to artificial intelligence to agricultural machinery and more.

Many people think “Made in China 2025” takes aim at industries where U.S. companies have an edge — and sell lots of goods to China.

And one of those people is White House trade advisor Peter Navarro.

Navarro told Bloomberg TV: “China in my view brazenly has released this China 2025 plan and basically told the rest of the world, ‘We’re going to dominate every single emerging industry of the future and therefore your economies aren’t going to have any future.’ ”

So, this week, if the rumors are true, President Trump will roll out $60 billion on annual imports from China.

The U.S. Trade Representative’s office needs to unveil the list of products by Friday. There will then be a 60-day comment period, during which changes can be made. Then, the new tariffs will go into effect.

The question that should be on many American investors’ minds is, “how will China respond?”

On Sunday, China made its response to higher U.S. tariffs on imports of aluminum and steel. For its part, Beijing hiked tariffs by up to 25% on 128 U.S. products including frozen pork, as well as wine and certain fruits and nuts.

Frozen pork indeed. We must wonder if, in its next tariff response, China goes “whole-hog” on U.S. companies doing big business selling to China.

Here are five S&P 500 companies I see as vulnerable. Why? Because a big part of their total sales come from China.

Company

Ticker

Annual Revenue

% of sales to China

Skyworks Solutions

Nasdaq: SWKS

$3.7 billion

82.7%

Qualcomm

Nasdaq: QCOM

$22.3 billion

65.4%

Broadcom

Nasdaq: AVGO

$17.6 billion

53.7%

Micron Technology

Nasdaq: MU

$20.3 billion

51.1%

Texas Instruments

Nasdaq: TXN

$15 billion

44.1%

One can’t predict the future. But it’s likely that if China wants to hit back, these companies will be in the firing line.

For now, it’s time to duck and cover. Trade wars are unpredictable. The old saying goes, “there are no winners in a trade war.” We’ll see if President Trump can disprove that as he has other pieces of conventional wisdom.

In many cases, the U.S. no longer produces goods that it now buys from China. Consumer electronics are a prime example. So, what does this mean for, say, Best Buy (NYSE: BBY)? Or Amazon (Nasdaq: AMZN)?

It means there could be more collateral damage in a worsening trade war. So be prepared for it.

We also know that the whole “war” could fade into history with President Trump’s next tweet. So, be prepared for that, too.

All the best,

Sean