There is a supply/demand squeeze going in uranium right now. The funny thing is, it’s not being reflected in the latest action in the spot market for the energy metal.

Why? Maybe some fund is rotating out of uranium to chase bubble-icious Nasdaq stocks. But that’s incredibly short-sighted.

I last talked about uranium in July. Since then, the squeeze is getting tighter and tighter. The profit potential in select uranium stocks is enormous.

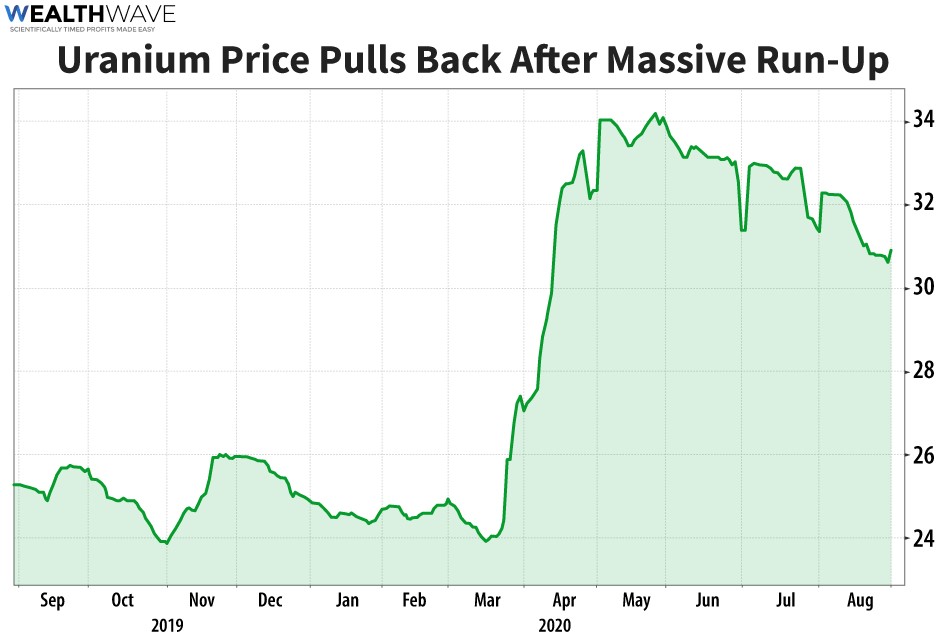

Let me show you what I mean. We’ll start with the fact that the price of uranium has been drifting lower after surging earlier this year.

Uranium spot prices spiked 35% from February to April 2020. After cresting at $34 per pound in May, the spot uranium price has drifted down to a little over $30. That’s not going to make anybody rich.

So, what do I mean by a supply squeeze? Well, the coronavirus pandemic has forced mine closures all around the world — gold mines, copper mines, even uranium mines. All the way from Canada to Kazakhstan to Africa and Australia.

This removed a lot of supply from the market. According to industry watcher TradeTech, the mine closures due to the pandemic have cut about 14 million pounds — that is 6,350 metric tons — from mine supply so far in 2020.

What’s more, industry watchers now say there could be a supply shortfall running into 2022.

Further down the road, forecasts differ. But Kristoffer Inton, a Morningstar analyst, forecasts that global uranium demand will grow roughly 40% by 2025.

Where will the supply come from?

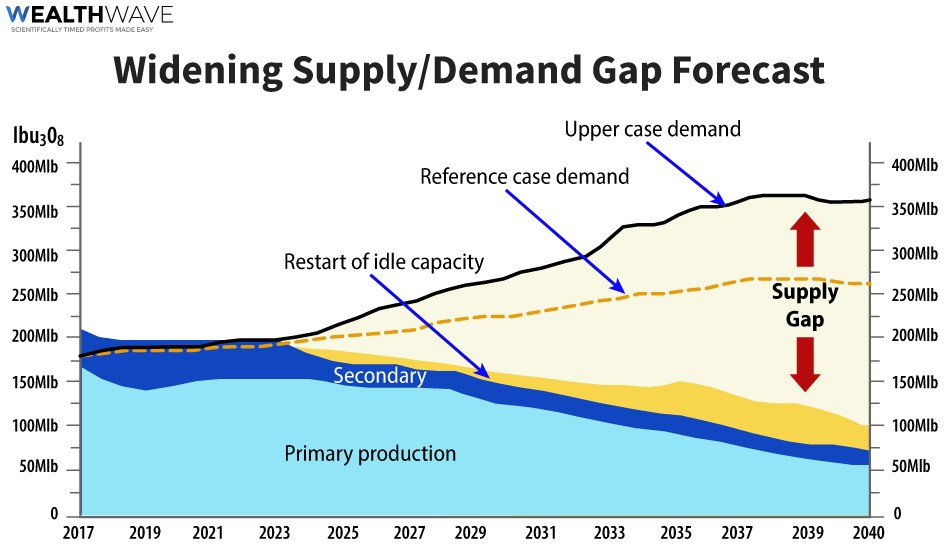

Here’s a chart of the potential uranium supply-demand gap, from the World Nuclear Association, via uranium explorer and developer Deep Yellow Limited (OTCQX: DYLLF, Unrated).

A forecast isn’t written in stone. It can change. One thing I’d point out though is that forecast is from September 2019, BEFORE mines shut down this year due to COVID-19.

And in the latest development, KazAtomProm — the national uranium company of Kazakhstan — shut down its mines for months to stop the spread of the coronavirus. Now, KazAtomProm says it plans to buy uranium in the spot market to maintain its stockpiles at about six to seven months of annual production. That’s according to an interview with CEO Galymzhan Pirmatov.

By my back-of-the-envelope calculation, that’s probably about 3,000 metric tons. Kazakhstan normally produces about 40% of the world’s uranium. That’s kind of a big deal.

The looming supply squeeze hasn’t caused the price of uranium to ignite … yet. But many say it’s only a matter of time. Worldwide, there are 48 new nuclear plants under construction, mostly in Asia. These are more than enough to make up for plants being phased out across Europe.

Especially when you factor in that power companies that use uranium have been “under buying” uranium — that is, not locking in enough long-term contracts to cover their consumption.

Instead, they’ve been scooping up uranium on the spot market. That works fine, until we see a crimp in supply. According to uranium company Paladin Energy (OTC Pink: PALAF, Unrated), utilities are “under buying” to the tune of 90 million pounds a year.

I figure that will manifest in the market sooner rather than later. Some utility will go to buy “spare” uranium and find the cupboard is empty.

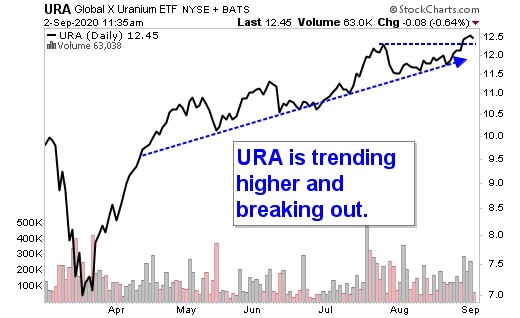

Meanwhile, the Global X Uranium ETF (NYSE: URA, Rated D) is certainly acting like someone anticipates higher prices.

This fund of stocks leveraged to the uranium price has trended higher since the March sell-off, and now it’s breaking out.

The URA is a fine way to play this rally in uranium stocks. But the better way is to buy uranium miners, developers and explorers with incredible leverage. The gains in those stocks could be enormous.

All the best,

Sean