Wall Street’s ‘Smart Money’ Bets Wrong on Inflation

The bigwigs at the Federal Reserve are downplaying inflation fears — and it’s working. Wall Street went from worrying about hotter inflation numbers to deciding, as Fed Chair Jerome Powell has said repeatedly, that inflation is “transitory.”

He’s not the only one: A Greek chorus of Fed governors is hitting the same tune.

For example, Fed Vice Chair Richard Clarida downplayed higher price pressures on Tuesday, saying the Fed could engineer a “soft landing” if prices continued to escalate.

As a result, Wall Street has spent the last week selling stocks that do well in inflation and buying others that would be hobbled by higher prices.

That is such a wrong bet …

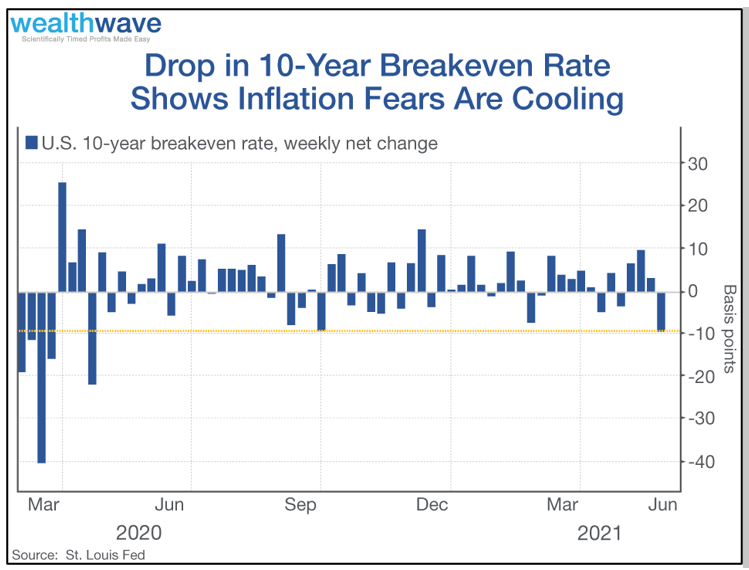

Anyway, how do we know that Wall Street no longer thinks inflation is a threat? Look no further than the 10-year breakeven rate.

The U.S. 10-year breakeven rate is the yield difference between the benchmark Treasury note and its inflation-protected counterpart.

Last week saw rates on U.S. 10-year breakevens fall by the most on a weekly basis since last year. This shows Wall Street no longer believes inflation is a threat.

Wall Street’s bond traders are supposed to be the smartest of the smart money. And the chart above shows they’re falling for this “cooling inflation” talk hook, line and sinker.

So why do I think they’re so wrong?

Because unlike Wall Street elites, I can see prices rising all around me.

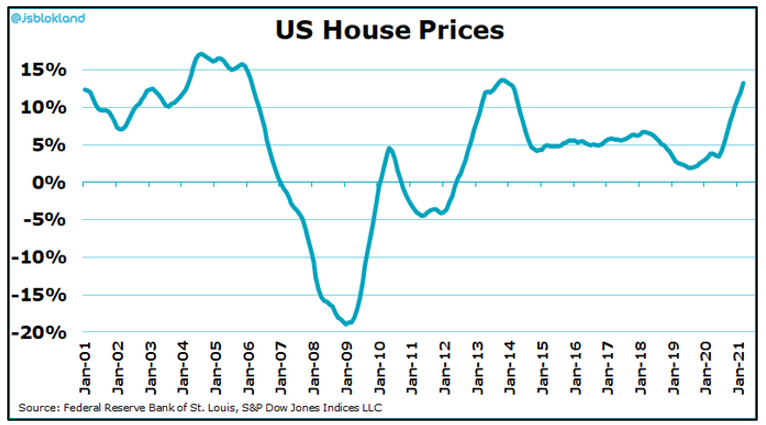

Not just at the grocery store and gas station … though the price raises at both of those places are getting painful … I’m talking about record prices for lumber, aluminum, copper and housing.

Heck, housing prices are up 13.3% compared to a year ago. That’s the biggest surge since 2005!

Even solar power prices are surging. That’s right! The cost of solar modules is up 18% since the start of the year after falling by 90% over the previous decade. Why? Because the price of polysilicon, used to make the modules, has more than quadrupled.

So, let’s take a look at the word “transitory.” The Fed says that these price rises will fade later this year. Really?

Here’s why they’re wrong.

Money for Working Folks, Not Wall Street

One of the big flaws of previous stimulus plans — under former Presidents Bush, Obama and Trump — was that they funneled most of the money to millionaires and billionaires through tax cuts.

The money was supposed to trickle down … but not much did. That’s one reason why the Obama stimulus, for example, was judged to only be partly effective.

The Biden administration passed a $1.9 trillion stimulus package that straight-out mailed $1,400 checks to working people. These are the kind of people who will spend every cent that comes in through the door. And you know what that is? Inflationary.

And Biden isn’t done: Roughly 39 million American families will begin receiving direct cash payments in July thanks to a child cash benefit created by the Democrats’ coronavirus relief bill.

On July 15, the IRS will start delivering a monthly payment of $300 per child under age six and $250 per child six or older for those who qualify. The monthly benefits will be deposited directly into most families’ bank accounts on the 15th of every month.

Do you think that money will sit in the bank or be spent? … I’d say it’s going to be spent, fueling inflation.

Wait, there’s more: Up to 13,000 farmers will see thousands of dollars in loan forgiveness starting this month. Roughly $4 billion worth. Do you think hard-pressed farmers won’t take on more debt and buy more stuff? They will, and that’s inflationary.

And then there are all the Americans cooped up at home last year who can finally step out the door. And they have cash burning a hole in their pockets.

It’s not just the United States. Around the world, people are going out and spending. As a result, one country after another is raising forecasts for gross domestic product (GDP).

They’re buying things made from copper, aluminum, steel and lumber. They’re going out to eat, sending the prices of wheat, corn, soy and more soaring.

Are people around the world suddenly supposed to stop spending in the fourth quarter? Or will economic activity feed more economic activity, as surplus dollars slosh around the system, accelerating prices?

Losing Its Grip

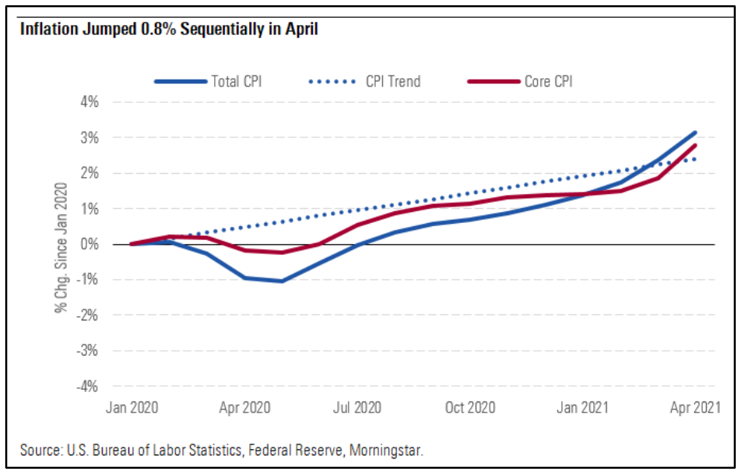

What’s more, the Fed has already lost its grip on inflation. The Fed is looking for inflation to run at 2%, though they won’t say for how long. Meanwhile, inflation has already run at above 3% for several months this year.

Just look at the most recent data. The Consumer Price Index (CPI) jumped 0.8% in April, following a large 0.6% increase in March. Core inflation increased even faster in April, up 0.9%. As a result, CPI is running HOTTER than it was before the pandemic.

Bottom line: Inflation is already here. I believe it will run hot for at least the next few years. And there is the potential for the guard rails to fail and prices to soar — to blast off overnight as the prices of hard assets float higher on an ocean of easy money.

Inflation is hard to predict, that’s for sure. But I’ll put on my Amazing Kreskin turban and say that whatever the Fed thinks is happening, they’re underestimating how hot inflation is … and overestimating their ability to control it.

How You Can Profit

In a series of three articles here, here and here, I gave you a bunch of picks on what should do well in an inflationary environment. These pulled back in the last couple weeks. That’s great. Considering the underlying inflationary trend, that means they’re on sale … and the picks in those articles are all still good ideas.

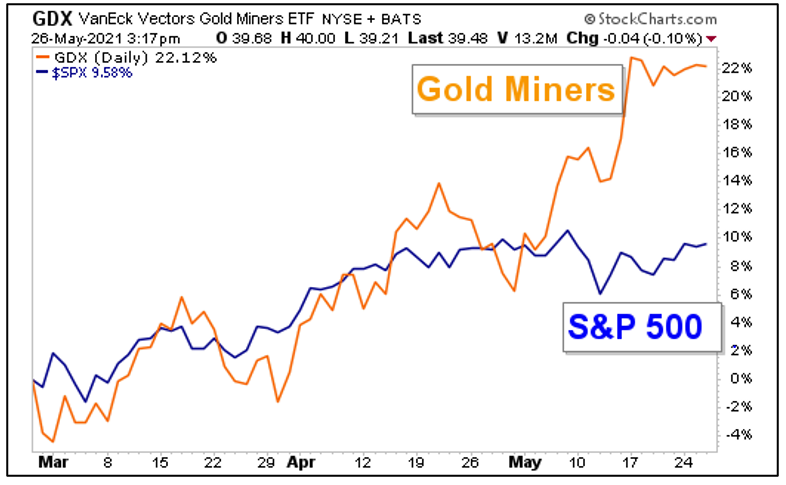

Let me give you one more: gold miners. Take a look at a performance chart of the VanEck Vectors Gold Miners ETF (NYSE: GDX) against the S&P 500 for the last three months. That’s a period that includes the most recent month in which Wall Street really began to worry about inflation.

You can see that once inflation worries were put on the front burner, gold miners took off compared to the S&P 500. Miners have flattened out more recently. I’d say the GDX is just taking a rest before the next big move.

Bottom line: The Fed is losing control of inflation. Wall Street is hearing what it wants to hear … ignoring hard facts right in front of its eyes.

The next move in prices could be huge. Prepare your portfolio … or you’ll wish you had.

All the best,

Sean