Stocks were trying to rally at the beginning of this week before Tuesday’s ugly inflation report put the kibosh on bullish momentum.

Unfortunately for traders, the data all but assures that the U.S. central bank will respond by raising interest rates at least 75 basis points at its policy meeting next week.

The inflation data was a shock to the system for investors who were hoping to see consumer prices fall slightly. Gas prices have steadily declined since they peaked above $5-per-gallon in mid-June, but it wasn’t enough to offset increases in consumer staples.

The market is spooked that the Fed is content with letting the economy, real estate and stocks tumble as it fights inflation. Many believe the Fed is OK with the country falling into a recession, because that would curb demand that’s pressuring prices.

Chairman Jerome Powell has beaten the drum about consumers potentially feeling “some pain” as the Fed raises rates and sucks liquidity out of the market.

Macroeconomic conditions with higher rates, less liquidity and lower demand are pointing to a greater likelihood of a recession. Look no further than the housing market.

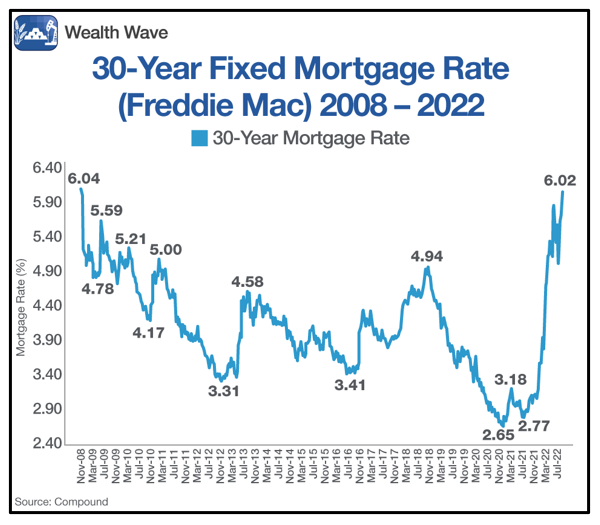

Mortgage Demand Woes

The real estate market is cooling down thanks to higher interest rates crushing borrowing power. Monthly payments soar as rates go up, and homebuyers’ funds don’t go as far as they did when rates were lower.

This week, the average 30-year fixed mortgage rate topped 6% for the first time since 2008. That’s more double the year-ago figure of 2.86%. Application volume fell 1.2% over the prior week.

The demand for refinancing is grinding to a halt, too. Refinancing applications dropped 4% this week, cratering to 83% below where they stood a year ago.

Declining mortgage demand points to potential future weakness in homes sales moving forward, which are already down 29.6% year over year. The housing market takes an extended period to react to macroeconomic changes, so the effects won’t be felt all at once.

Recessionary Outperformance

As the Fed continues tightening economic policy, it’s important to look at the sectors that do best when the economy contracts.

During recessions, corporations generally look to maximize productivity and cut costs wherever possible. Meanwhile, consumers prioritize the necessities in their budgets.

The following chart shows the historical performance of each stock market sector from 1989–2019 during economic expansions and recessions:

Consumer staples and healthcare stocks lapped the field because their demand is mostly inelastic. When households are forced to tighten their belts, they only cut back on healthcare products and necessities as a last resort.

Even during periods of high inflation, consumer staples companies are able to pass their additional costs onto buyers.

Historically, consumer staples stocks perform the best during recessions, so gaining exposure to the sector could help lower the risk in investors’ portfolios as uncertainty mounts.

1 ETF for Investors to Consider

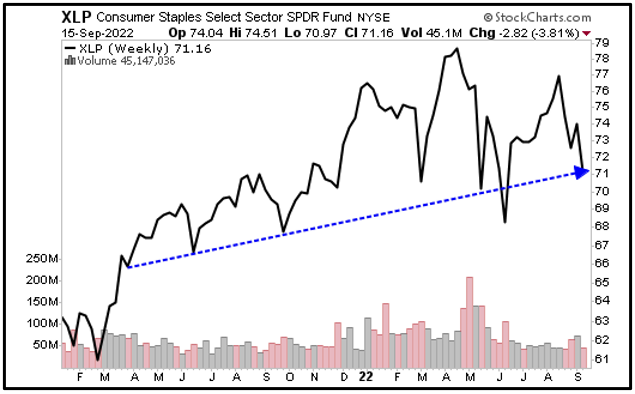

One exchange-traded fund to consider is the Consumer Staples Select Sector SPDR Fund (XLP), whichmirrors the performance of the S&P 500’s consumer staples sector. The fund offers exposure to domestic companies in the food and beverage, tobacco, household product and personal product industries.

XLP’s top three holdings are Procter & Gamble (PG), Coca-Cola (KO) and PepsiCo (PEP), which make up over 36% of the fund. It trades with plenty of liquidity, averaging 11.5 million shares of daily trading volume.

The fund’s expense ratio is a minimal 0.1%, and its dividend yields 2.5% at recent prices. That’s enough to cover its fees by 25 times!

XLP’s weekly chart illustrates how the fund has mostly managed to extend its uptrend despite the increasing market turmoil:

XLP could bounce higher off its positive trendline, and the recent market-wide selloff could offer an opportunity to enter the best names at a discount.

If you’d like my tailored picks in this sector, considering joining members of my trading service, Wealth Megatrends. They’re currently sitting on multiple double-digit open gains while being paid generous dividends in nearly all positions. Click here to find out more.

Make sure to conduct your own due diligence before buying anything, but a recession could create an environment where essential goods providers succeed.

All the best,

Sean