It sure looks like the Fed and market are cheering for a recession.

Stocks were bright green this weekas the case for a slowing economy gathered momentum.

On Wednesday, the Fed raised interest rates another 75 basis points to 2.25%-2.5%. That's the swiftest two-month central bank action since the '90s!

However, the market was optimistic after Fed Chair Jerome Powell said he would look at the data when re-evaluating the central bank's aggressive tightening. That data came in Thursday, and it points to greater recessionary risks.

The market is looking for the Fed to change course at some point.

Higher interest rates make funding growth more difficult, while the removal of $47.5 billion — soon to be $95 billion — per month in liquidity lowers the availability of credit.

If the tightening eases, stocks will face less resistance.

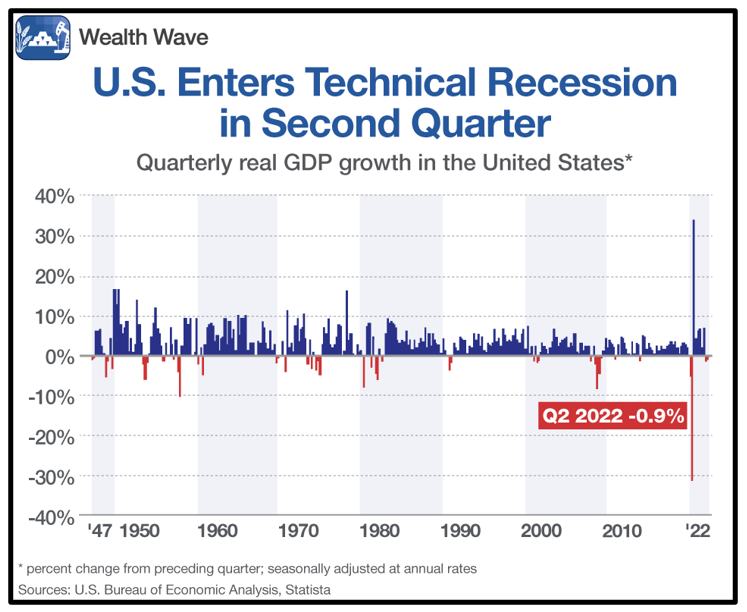

On Thursday, we got gross domestic product data for Q2.

The economy shrank at a 0.9% annual rate after contracting 1.6% in Q1. Two consecutive quarters of contraction meets the popular definition of recession, according to the Harvard Business School.

To be sure, that does not meet the official definition of recession as defined by the National Bureau of Economic Research. And the NBER is actually in charge of calling recessions.

But for Wall Street, it doesn't matter if we're "officially" in recession. The feeling on the Street is that if we're not already in a recession, we'll be in one soon, and that it'll bring an end to Fed Rate hikes.

The market has been drunk on stimulus since the pandemic began, and investors don't seem to mind that it could take a recession to bring it back. Powell's statements only add fuel to the fire.

Traders may like what they see for now, but a slowing economy heightens risks for the labor market and corporate earnings.

Greater Uncertainty, Greater Volatility

Growing recessionary risks are a warning signal for investors to be more vigilant. I've beaten the drum about one of my favorite forms of protection from weakening economic conditions because it's tried and tested.

I'm talking about dividend stocks.

The companies with stable cash flows that pay you to own them. In times of high inflation, they're even better.

And they're working for members of my Wealth Megatrends service. Members are currently sitting on open gains of 9.78%, 9.73% and 13.61% while routinely being paid generous dividends.

That's the kind of performance and payouts you like to see in an unstable and bearish market.

Some companies take bigger hits because future cash flows are heavily discounted, but dividend stocks make their payments upfront. They ride the wave up with the broader market, but they also provide downside cushioning with their quarterly payouts.

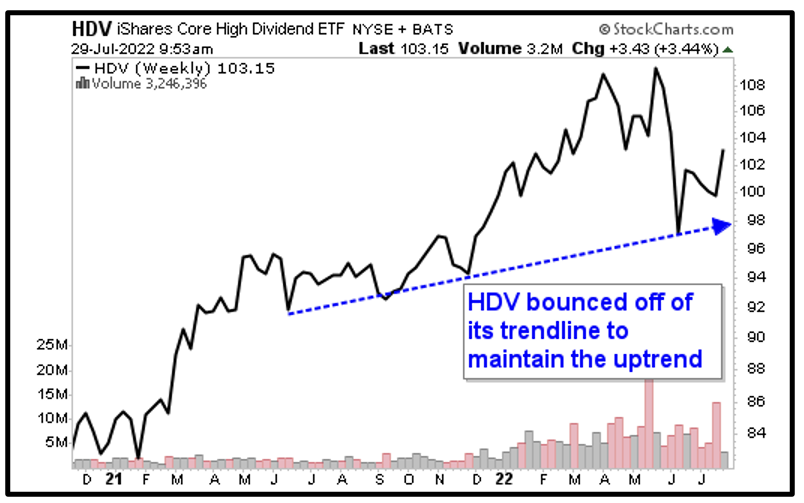

For high-dividend exposure, you can look into the iShares Core High Dividend ETF (HDV). The fund aims to track an index of U.S. stocks paying relatively high dividends and it currently pays 3.6% annually.

HDV's top three holdings by weighting are Exxon Mobil (XOM), Johnson & Johnson (JNJ) and AbbVie (ABBV). The fund trades with solid average daily volume of over 1.7 million shares, and it holds over $12.6 billion in net assets under management. Its expense ratio is extremely low at 0.08%.

Looking at HDV's weekly chart, we see it's rebounded with the broader market and maintained its positive trend:

HDV has significantly outperformed the S&P 500 year to date with its 3% gain compared to the latter's 13% loss. I expect it to continue showing strength as economic conditions get murkier.

If you'd like my tailored picks for high-yielding dividend-payers, consider joining members of Wealth Megatrends by clicking here.

Always conduct your own due diligence before buying something, but when conditions get more uncertain, it can help to add dividend-paying stability to your portfolio.

All the best,

Sean