It's getting harder for the market to rally … and no, I'm not talking about the threat of recession.

The stock market disconnected from the underlying economy during the pandemic and probably long before that. What drives the major indices now is the flow of money ... and the bad news for bulls is that central banks around the world are shutting off the gushing free money taps.

And I'm not just talking about hiking benchmark interest rates, though that definitely shuts off the money taps on its own. According to liquidity specialists CrossBorder Capital, interest rate hikes have already sparked a liquidity collapse. Central bank liquidity is contracting from peak annual expansion rates of about 40% last year.

But interest rate hikes are only one kind of tightening. The U.S. Federal Reserve is now embarking on a program of "quantitative tightening," selling off assets on the Fed's books.

This is necessary to unwind the massive quantitative easing that ballooned the Fed's assets to $8.9 trillion from under $1 trillion before the global financial crisis of 2008.

To do this tightening, starting in June, the Fed began allowing up to $30 billion of Treasury securities and $17.5 billion of mortgage-backed securities to roll off the balance sheet each month. And the Fed is on track to increase this tightening to $95 billion a month, a split between $60 billion of Treasurys and $35 billion of agency mortgage-backed securities.

Monetary Money Destruction

In quantitative easing, the Fed buys all sorts of securities on a large scale. This increases the money supply because asset purchases by the Fed pass money from the Fed to the seller, which deposits that money in a commercial bank. This is new money.

In turn, the bank passes the payment back to the Fed, which credits the commercial bank's reserve account. This is how QE increases both banks' reserves and the money supply out of thin air.

Oh ... but there's more.

With the Fed buying everything, banks must buy other things. They buy blue-chip stocks and less-than-investment-grade bonds. This makes it easier for companies with lower credit grades to raise money through issuing debt.

Also, with the Fed buying everything, banks would be foolish not to originate mortgages, even if a buyer's finances are "sketchy." This kicks the real estate market into high gear, and makes people feel flush with both cash and "real wealth."

Quantitative tightening is the reverse of easing. It's money destruction. The problem is, with its tightening, the Fed is sucking liquidity out of the stock market, to the tune of $95 billion a month.

A Global-Sized Squeeze

Wait, it gets worse!

Our Fed isn't the only central bank that's tightening. And according to analysts, the G4 central banks — the U.S. Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England — will shrink their balance sheets by a whopping $4 TRILLION by the end of next year.

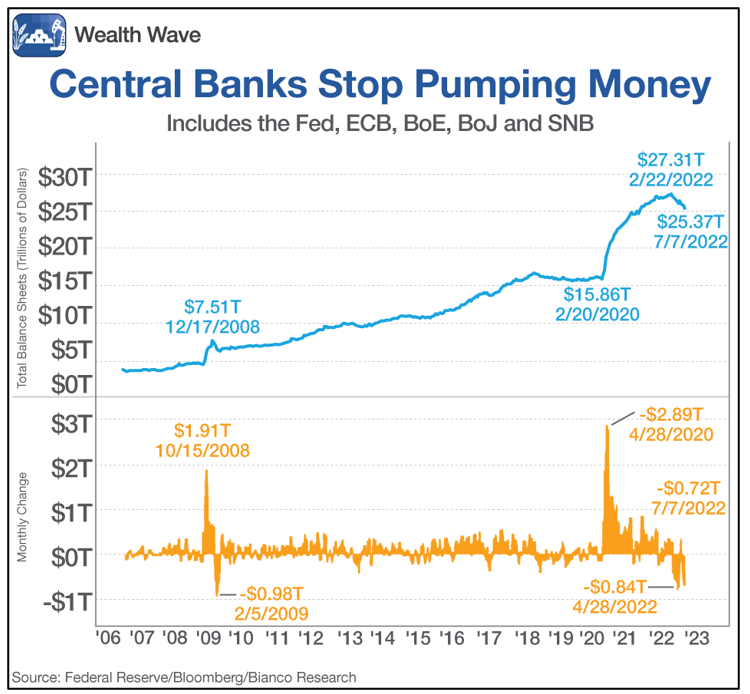

And the liquidity drain has already begun, as this next chart shows …

Will this take the wind out of the market's sails? I'd bet on it.

Guilhem Savry, who works in cross-asset solutions at Swiss asset manager Unigestion, told the Financial Times: "Liquidity is driven by central banks. Over the past 10 years there has been large liquidity in the U.S. and everywhere else, and now investors know it's finished. It's over."

This doesn't mean the broad market can't rally. Sure it can rally … but rallies will have less amplitude and length than when the Fed was flooding the market with money.

What to Consider Buying in a Liquidity Drought

If liquidity problems are going to get worse, not better, you want to avoid stocks that don't earn money. I'm talking about so-called "growth stocks." We'll see how much growth they have in them when liquidity runs dry.

What you should look to buy is "value stocks" — stocks that may not have a lot of growth but have plenty of cash flow. This allows them to pay earnings and more importantly, dividends.

Another thing to look to buy are private deals ... which are open at last.

On July 19, Dr. Martin Weiss will reveal an opportunity that's been off-limits to the public for nearly 100 years. Claim your free spot for this historic event and get first access to one amazing private deal!

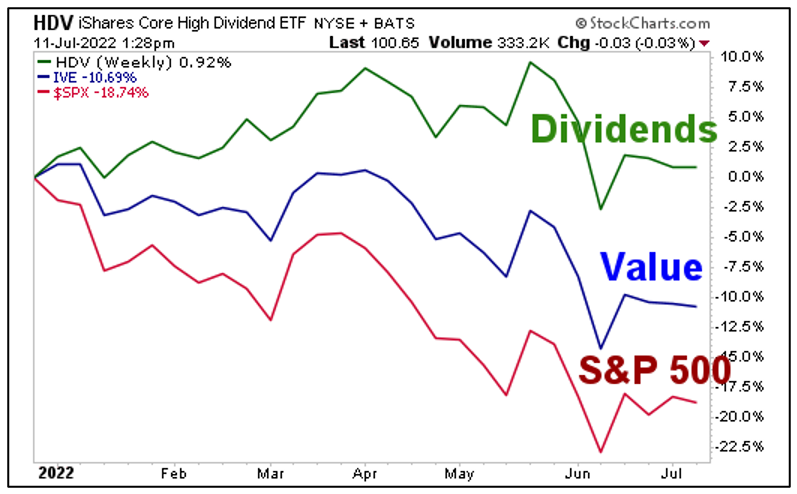

Here's a chart comparing the year-to-date performance of the SDPR S&P 500 ETF (SPY), the iShares S&P 500 Value ETF (IVE) and the iShares Core High Dividend ETF (HDV).

As of yesterday, the S&P 500 was down 18.74% for the year. Ugh! But the value stocks in the S&P 500, as tracked by the IVE, were down just 10.69% for the year. And high-dividend yielders put HDV slightly positive for the year.

As I said, the market could rally. I think in that case, value stocks will probably lead the way higher. And in a low-liquidity market — and liquidity is getting lower all the time — it should be the time for high-dividend stocks to shine.

ETFs are a great way to manage the risk in this wild market. Or you can drill down into these funds to find individual outperformers.

Either way, be aware of the growing risk that the liquidity drain presents for the stock market, always do your own due diligence and adjust your investments to make the most of it.

All the best,

Sean